Your workflows always benefit when you can obtain all of the forms and files you may need at your fingertips. DocHub gives a wide array of templates to relieve your day-to-day pains. Get a hold of Husband to Wife Property Transfer Forms category and quickly browse for your form.

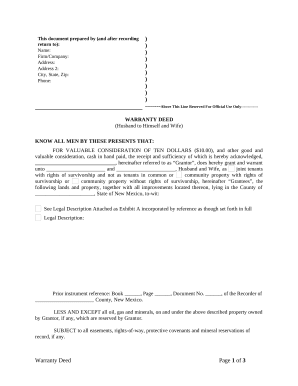

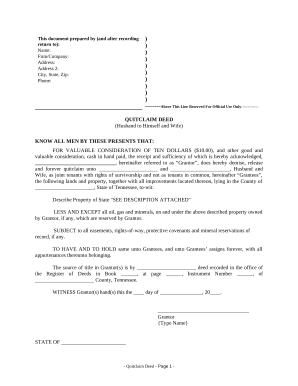

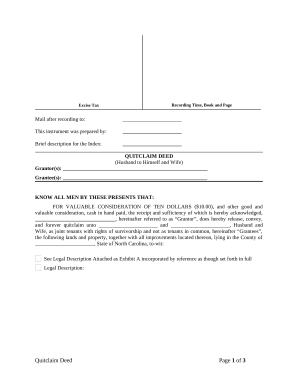

Begin working with Husband to Wife Property Transfer Forms in several clicks:

Enjoy fast and easy file management with DocHub. Check out our Husband to Wife Property Transfer Forms category and find your form today!