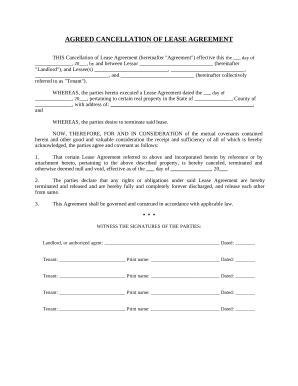

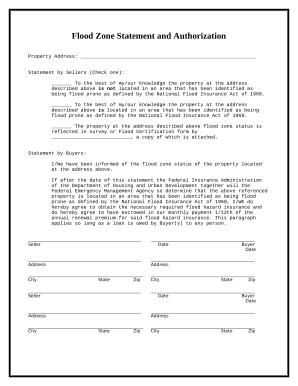

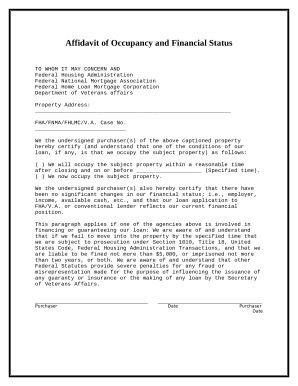

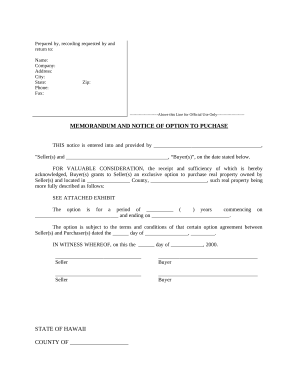

Your workflows always benefit when you can get all the forms and documents you may need at your fingertips. DocHub provides a vast array of form templates to alleviate your day-to-day pains. Get a hold of Hawaii Property Legal Forms category and easily discover your form.

Start working with Hawaii Property Legal Forms in several clicks:

Enjoy easy file managing with DocHub. Check out our Hawaii Property Legal Forms collection and get your form right now!