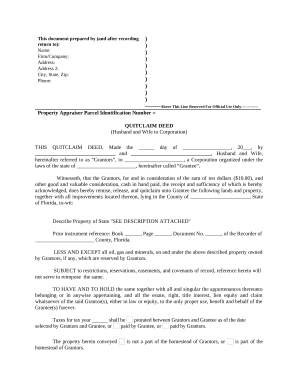

Improve your file managing with the Florida Real Estate Transfer Forms collection with ready-made form templates that suit your requirements. Get the form template, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the forms.

The best way to manage our Florida Real Estate Transfer Forms:

Discover all of the possibilities for your online document management with the Florida Real Estate Transfer Forms. Get your free free DocHub profile right now!