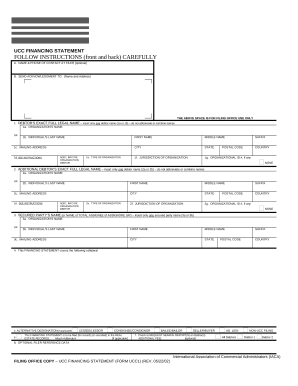

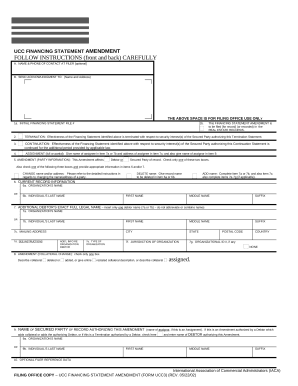

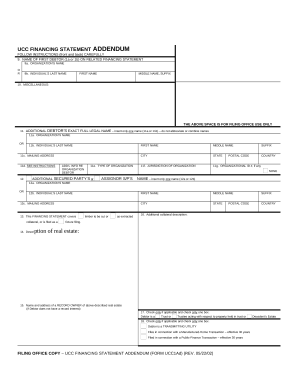

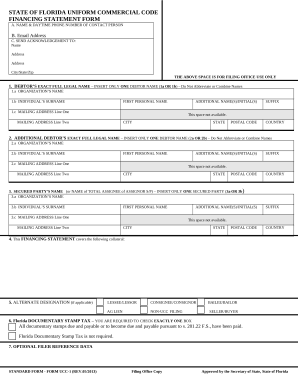

Boost your file administration with our Financing Legal Documents online library with ready-made document templates that suit your needs. Get the document template, change it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with your documents.

The best way to manage our Financing Legal Documents:

Examine all of the possibilities for your online file management with our Financing Legal Documents. Get a totally free DocHub profile today!