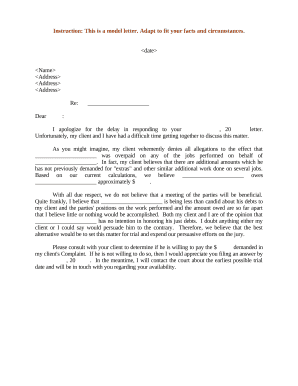

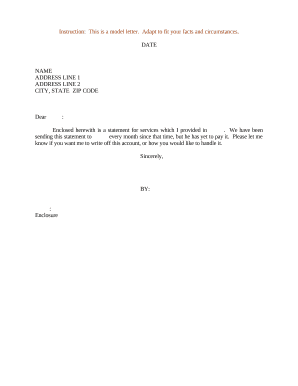

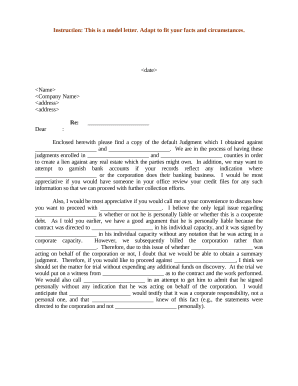

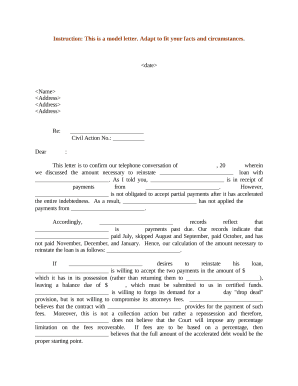

Accelerate your file managing with the Debt Recovery Letters online library with ready-made templates that meet your requirements. Get your document, alter it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

How to use our Debt Recovery Letters:

Explore all the opportunities for your online document management with the Debt Recovery Letters. Get your free free DocHub profile right now!