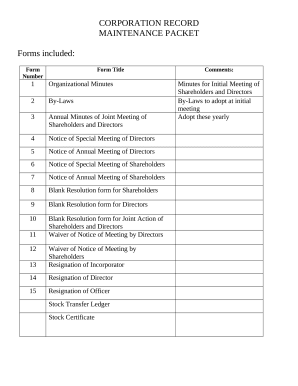

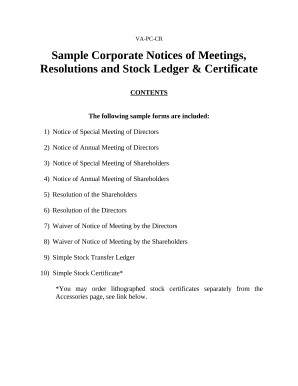

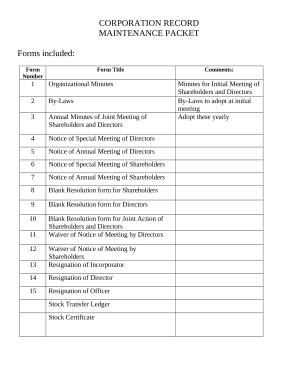

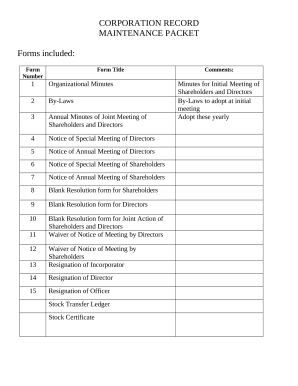

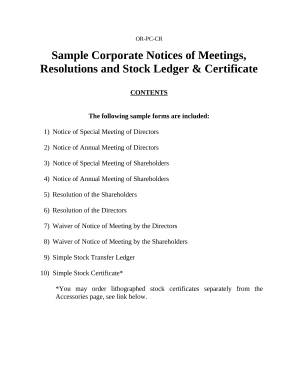

Boost your form management using our Corporation Record Keeping collection with ready-made templates that meet your needs. Access the form, alter it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively with your forms.

The best way to use our Corporation Record Keeping:

Examine all of the possibilities for your online file management with the Corporation Record Keeping. Get a totally free DocHub account right now!