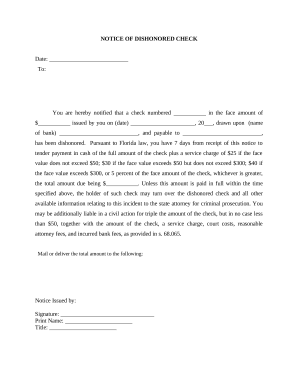

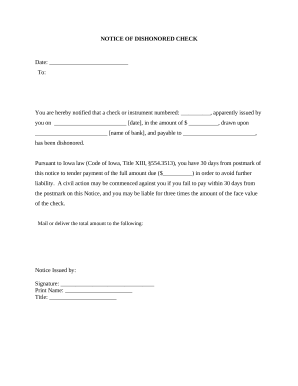

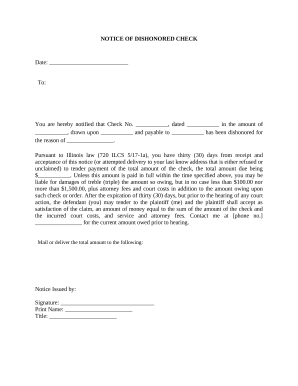

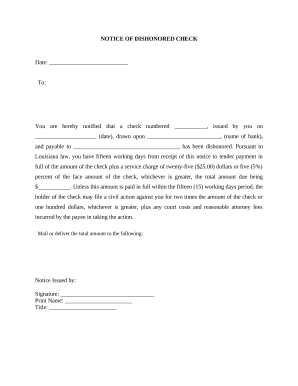

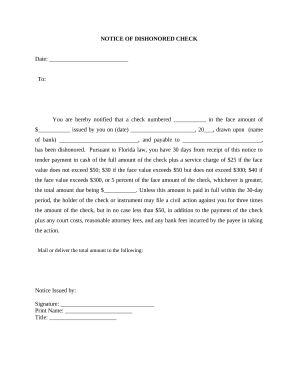

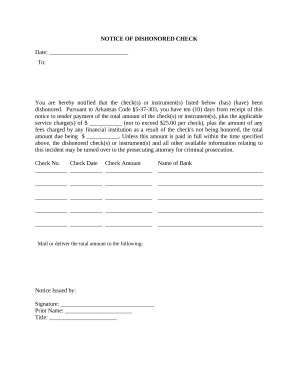

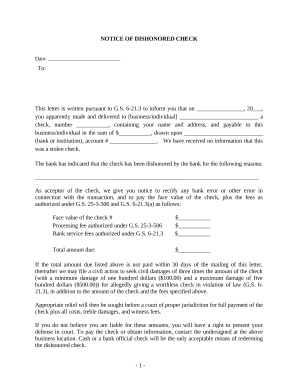

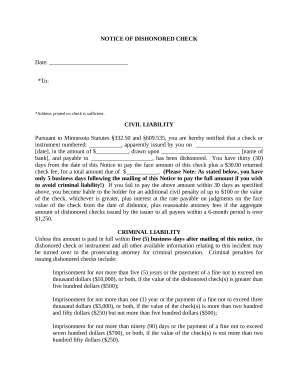

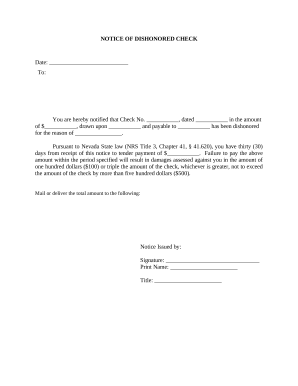

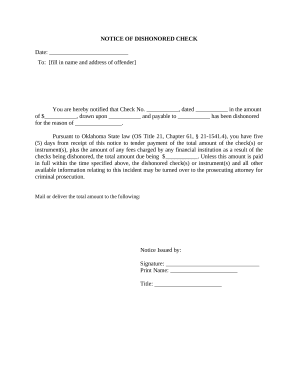

Speed up your file administration with the Bad Check Notices online library with ready-made document templates that meet your requirements. Get the document template, change it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your forms.

The best way to use our Bad Check Notices:

Explore all the possibilities for your online document management with our Bad Check Notices. Get a totally free DocHub account right now!