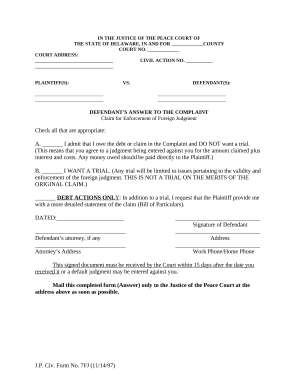

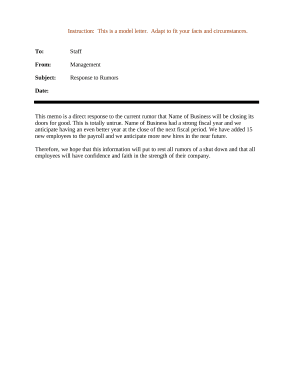

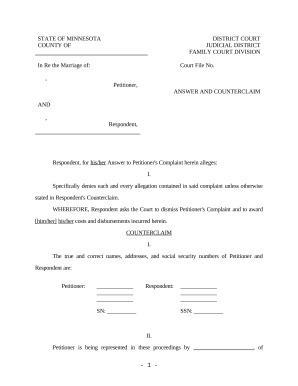

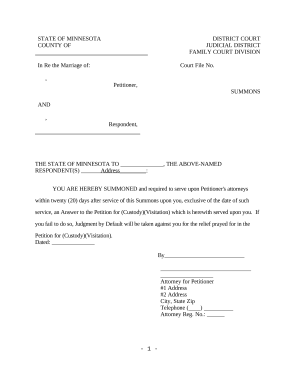

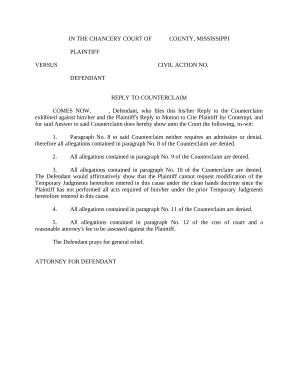

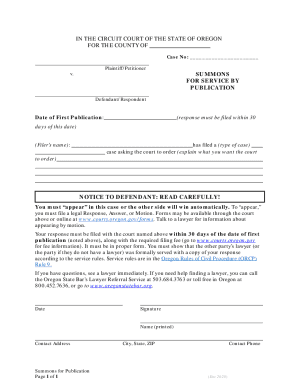

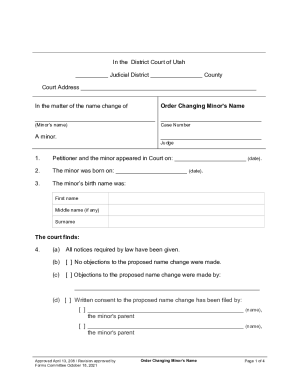

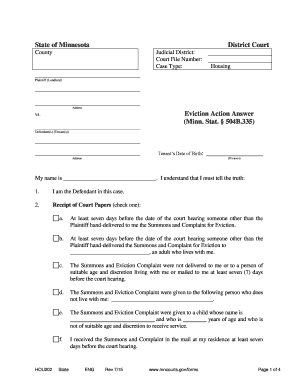

Browse different Legal reply to debt collection Complaint Forms and select the one that suits your needs. Adjust and complete your templates, send them with other team members, and safely store them within your DocHub account.

Boost your file managing using our Legal reply to debt collection Complaint Forms library with ready-made document templates that meet your requirements. Access the form, alter it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

The best way to manage our Legal reply to debt collection Complaint Forms:

Discover all of the possibilities for your online document management with our Legal reply to debt collection Complaint Forms. Get a totally free DocHub profile right now!