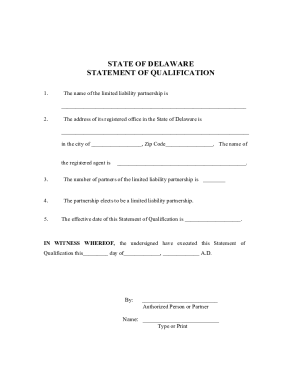

Personalize and handle Delaware secretary of state Business Forms in a few easy clicks. View and obtain document templates and easily edit them with DocHub adaptable editing tools.

Improve your file operations using our Delaware secretary of state Business Forms category with ready-made document templates that suit your needs. Access your document, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with the forms.

How to use our Delaware secretary of state Business Forms:

Discover all the possibilities for your online file management with our Delaware secretary of state Business Forms. Get a free free DocHub account right now!