Start by creating a free DocHub account using any offered sign-up method. Simply log in if you already have one.

Try out the complete suite of DocHub's advanced features by signing up for a free 30-day trial of the Pro plan and proceed to craft your Equation personal finance Balance Sheet Template.

In your dashboard, choose the New Document button > scroll down and choose to Create Blank Document. You’ll be taken to the editor.

Utilize the Page Controls icon marked by the arrow to toggle between different page views and layouts for more flexibility.

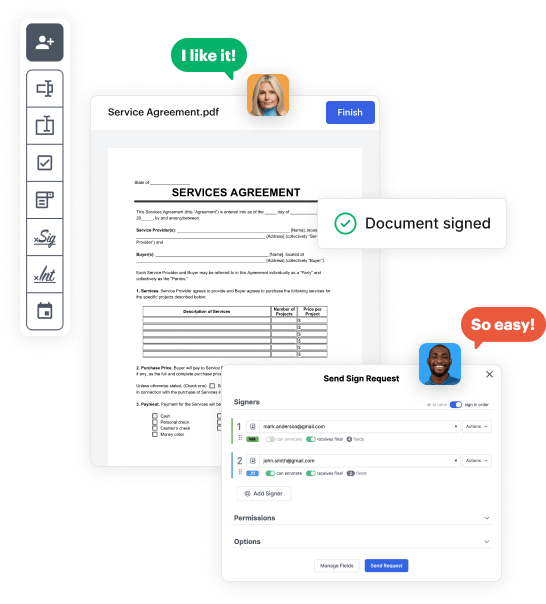

Navigate through the top toolbar to place document fields. Add and arrange text boxes, the signature block (if applicable), insert images, etc.

Organize the fields you added based on your chosen layout. Modify each field's size, font, and alignment to make sure the form is easy to use and neat-looking.

Save the completed copy in DocHub or in platforms like Google Drive or Dropbox, or craft a new Equation personal finance Balance Sheet Template. Distribute your form via email or get a public link to reach more people.