|

|

RS Documents | |

|---|---|---|

| Create Documents pre-filled with Salesforce data | ||

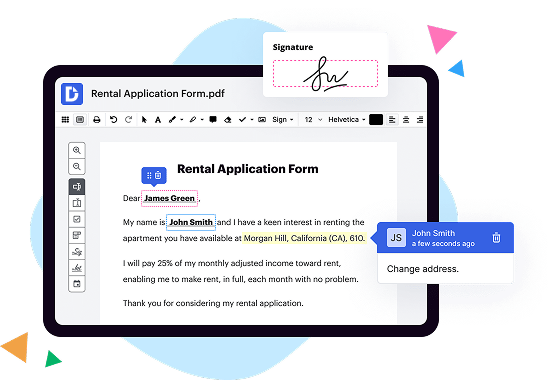

| Add Smart Fillable Fields | ||

| Type in PDF | ||

| Erase in PDF | ||

| Black out & Redact in PDF | ||

| Add Images & Tables in PDF | ||

| Draw Arrows & Lines in PDF | ||

| Add Watermarks, Videos & Company Logos | ||

| Paginate PDFs | ||

| Add Sticky Notes & Text Boxes | ||

| Search and Replace Text in PDF | ||

| Spellcheck in PDF | ||

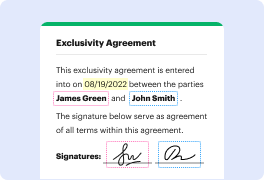

| Sign Online | ||

| Embedded Signing | ||

| Add a Signature on Mobile | ||

| Signature Workflows | ||

| Request Additional Documents | ||

| Signature Notifications | ||

| Track Sent Document | ||

| Unique Document ID | ||

| Host Fillable Forms | ||

| Extract Collected Data | ||

| Two-Factor Authentication | ||

| Four-digit PIN | ||

| Get DocHub for free |

The maximum transfer limit of funds through IMPS is Rs. 5 lakh. However, it may vary from bank to bank. while the minimum limit usually is Rs. 1. However, the limit may vary from bank to bank.

DocHub implements reasonable measures to comply with industry-leading standards, regulations, and certifications so you can securely edit, fill out, sign, and send documents and forms.