Definition and Purpose of Form 8868

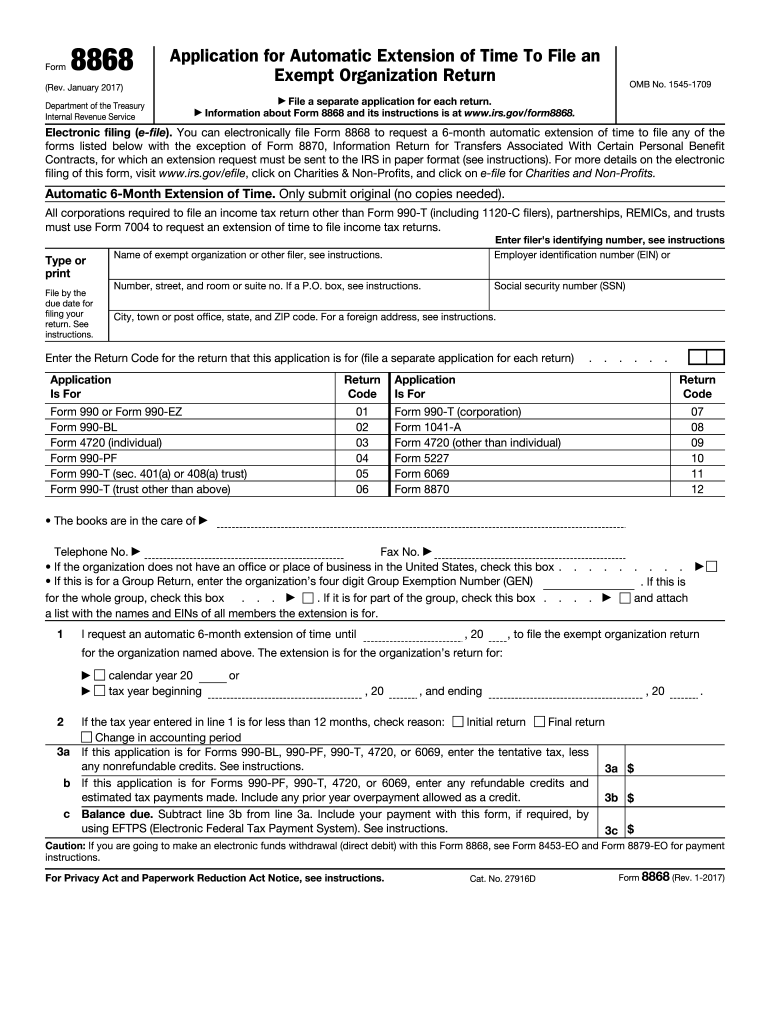

Form 8868 is utilized by certain exempt organizations to apply for an automatic six-month extension to file their federal tax returns. Specifically, this form is relevant for nonprofits and other tax-exempt entities that may need additional time to prepare their filings. The extension granted by Form 8868 applies to returns that are due on or after the effective date of the form and extends the deadline to file without incurring late-filing penalties.

The form serves as an essential tool for organizations that need to ensure compliance with IRS regulations, allowing them to maintain their tax-exempt status. When filing this form, organizations must also pay close attention to specific deadlines associated with their typical return forms, as the extension applies only to specific types of returns, such as Form 990 and Form 990-EZ.

How to Use Form 8868 Effectively

To use Form 8868 correctly, organizations must understand the specific requirements and processes involved in its submission. The following steps outline how to utilize this form most effectively:

-

Determine Eligibility: Ensure that your organization qualifies as exempt under IRS guidelines. This includes nonprofits and certain other designated groups.

-

Identify Applicable Tax Returns: Recognize which returns this extension applies to. Form 8868 is most commonly associated with Form 990 series returns.

-

Complete the Form: Fill out the required information, including the organization’s name, address, and Employer Identification Number (EIN). It’s essential to be thorough and accurate to avoid processing delays.

-

Submit On Time: Ensure that Form 8868 is submitted by the original due date of the return it relates to. This is crucial to prevent any penalties for late filing.

-

Notify the IRS if Necessary: If you are unable to meet the extension deadline, you may need to communicate with the IRS regarding your situation.

Thus, the form becomes a crucial aspect of tax compliance, preventing potential issues from late filings.

Steps to Complete Form 8868

Completing Form 8868 involves several detailed steps that organizations must follow to ensure correctness and compliance. Here’s how to proceed:

-

Gather Required Information: Before filling out Form 8868, collect all necessary documents, including the current year’s financial statements and relevant organizational information.

-

Fill in Basic Information:

- Organization's legal name.

- EIN (Employer Identification Number).

- Mailing address.

-

Indicate the Type of Return: Specify the type of return for which the extension is being requested. This is critical, as the IRS guidelines differ based on the return type.

-

Choose the Extension Period: Indicate whether you are requesting a 3-month or 6-month extension. Most organizations opt for the full six-month extension, particularly when they anticipate needing additional time.

-

Sign and Date the Form: Ensure that the authorized representative of the organization signs and dates the form to validate the request.

-

File the Form: See the submission methods available for your organization, whether electronically or by mailing the physical form.

Following these instructions carefully will streamline the filing process and mitigate any complications.

Important Deadlines Related to Form 8868

Timely filing of Form 8868 is essential to avoid penalties. Here are the crucial deadlines organizations should keep in mind:

-

Original Due Date: Form 8868 must be filed by the original due date of the tax return for which an extension is being sought. For instance, if a Form 990 return is due on May 15, Form 8868 should be submitted by that date.

-

Extended Deadline: If Form 8868 is approved, the extended deadline will provide organizations with an additional six months, pushing the due date to November 15 for a May 15 original deadline.

-

Filing Requirements: It is imperative to both file Form 8868 and submit the appropriate tax return by the extended deadline to avoid excess penalties associated with late filings.

Be mindful that strict adherence to these deadlines is fundamental for maintaining good standing with the IRS.

Legal Use of Form 8868

Understanding the legal implications of filing Form 8868 is crucial for organizations. This form must be submitted in compliance with IRS regulations, and failure to follow proper procedures can lead to penalties and jeopardize the organization's tax-exempt status.

-

Compliant Extension: Form 8868 is compliant under the requirements of the Internal Revenue Code, ensuring that organizations maintain their regulatory obligations while providing flexibility for tax return preparation.

-

Penalties for Non-Compliance: If an organization fails to submit Form 8868 or its associated tax return by the stipulated deadlines, it may incur penalties, including fines that accumulate daily after the due date.

-

Documentation: It is critical to keep a copy of the filed Form 8868 and any corresponding communications with the IRS to document compliance and extend legal protections.

Organizations must follow legal protocols surrounding Form 8868 to mitigate risks related to tax compliance.

Examples of Filing Form 8868

Practical scenarios can help clarify how Form 8868 might be used effectively in real-world situations.

-

Scenario 1: Last-Minute Preparations: An educational nonprofit realizes it requires additional time to finalize its financial statements for Form 990. By filing Form 8868 before the original due date, they receive an automatic extension to prepare their documents meticulously.

-

Scenario 2: Change in Leadership: An organization undergoing changes in leadership may find that deadlines cannot be met due to management transitions. By filing Form 8868, they can ensure continued compliance while organizing their documentation under new leadership.

-

Scenario 3: Merging Organizations: When two charitable organizations merge, the newly formed entity may need detailed time to reconcile financial records. By utilizing Form 8868, they secure an extension, allowing ample time for accurate filings, post-merger.

These scenarios illustrate various situations in which Form 8868 can provide the necessary buffer period for compliance.

Key Elements of Form 8868

The key components and information required for completing Form 8868 are crucial to understand. Organizations should be aware of the following elements:

-

Organization Information: Accurate details, including legal name, EIN, and address, are essential.

-

Return Type Specification: Clarity on the specific type of return that is being extended is crucial for correct processing.

-

Requested Extension Period: Explicitly state whether the request is for a shorter or longer extension period.

-

Signature and Authorization: An authorized representative must sign Form 8868 to validate the request, reinforcing the organization’s commitment to compliance.

Understanding these elements ensures that the completion of the form is done correctly, minimizing potential errors.