Definition and Meaning of the W-113K HRA Form

The W-113K HRA form is utilized primarily in the context of Human Resource Administration (HRA) within New York City. This form is essential for verifying employment status and income for applicants seeking public assistance, including food stamps and other benefits. The form collects pertinent information about employment, wages, and hours worked, which are integral to determining eligibility for various support programs administered by HRA.

This document specifically aids in establishing a recipient's financial status, assessing their needs based on current income levels. It ensures that individuals and families receive the appropriate support aligned with their economic situation, allowing for more effective resource allocation by public assistance programs. The W-113K form has been designed to streamline the documentation process and minimize the administrative burden on both applicants and city agencies.

How to Use the W-113K HRA Form

To effectively utilize the W-113K HRA form, individuals must accurately complete all required fields to avoid delays in processing their applications. Here are the steps to follow:

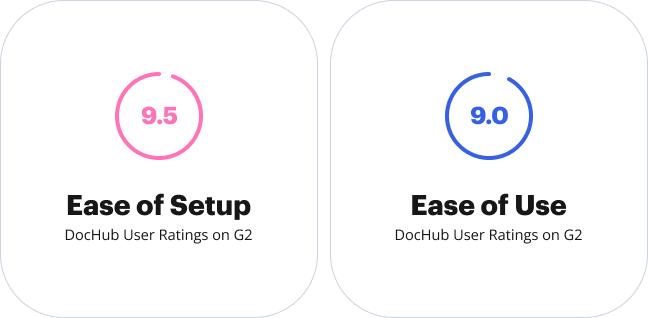

- Download the Form: Access the W-113K form from the official HRA website or the DocHub platform, where it may be available for online completion and submission.

- Gather Necessary Documentation: Collect all supporting documents that will substantiate the information provided on the form. This may include pay stubs, tax returns, or other proof of income and employment status.

- Complete the Form: Fill in all required sections, paying close attention to detail to ensure accurate information is reported. It’s vital to follow the instructions specified on the form for any calculations or declarations.

- Review Before Submission: Double-check the completed form for errors or omissions. Inaccuracies can lead to delays or denial of assistance.

- Submit the Form: The completed W-113K can be submitted online, by mail, or in person at designated HRA locations.

Completing the W-113K form thoroughly is crucial for ensuring a prompt assessment of eligibility for benefits, thereby improving access to necessary resources.

Required Documents for the W-113K HRA Form

When completing the W-113K form, applicants need to provide several key documents to validate their employment and income claims. The required documents typically include:

- Recent Pay Stubs: These demonstrate current earnings and should cover at least the last four weeks of employment.

- Tax Returns: Providing income tax returns may be necessary, especially if the applicant is self-employed or has variable income.

- Proof of Employment: This could be an employment verification letter or a contract that outlines expected hours and salary.

- Identification: A government-issued ID may be required to confirm identity, especially for public assistance applications.

Organizing these documents before filling out the form streamlines the verification process and helps prevent any delays.

Key Elements of the W-113K HRA Form

The W-113K form contains essential elements that are critical for accurate completion and processing. Understanding these elements can help applicants provide the necessary information effectively:

- Applicant Information: Personal details such as name, address, and contact information must be included.

- Employment Details: This section requires comprehensive information about the employer, job title, and duration of employment.

- Income Information: Applicants must disclose all income sources, including wages, bonuses, overtime, and any additional financial support being received.

- Hours of Work: Indicating the number of hours worked weekly helps the HRA assess the applicant's eligibility based on current employment status.

- Certification Statement: This section typically requires the applicant's signature, signifying that the information provided is accurate to the best of their knowledge.

Each of these elements plays a role in the assessment of eligibility for public assistance and helps ensure that applicants receive the support they need.

Important Terms Related to the W-113K HRA Form

Familiarity with certain terms associated with the W-113K form can enhance understanding and improve the application process. These terms include:

- Public Assistance: Government programs designed to support individuals and families who are economically disadvantaged.

- Eligibility Criteria: Specific requirements that individuals must meet to qualify for assistance, such as income limits and residency status.

- Verification of Employment: The process by which the HRA confirms the employment status and income of an applicant through submitted documentation.

- HRA Benefits: Financial assistance and support services provided by the Human Resources Administration to eligible individuals and families.

Understanding these terms is essential for applicants navigating the public assistance system and completing forms such as the W-113K form.

Who Typically Uses the W-113K HRA Form

The W-113K HRA form is primarily used by a variety of individuals seeking public assistance within New York City. Typical users include:

- Low-Income Families: Individuals needing financial assistance for basic necessities such as housing, food, and healthcare.

- Individual Applicants: Those who may be unemployed or underemployed and are seeking benefits to support their living expenses.

- Caregivers: Individuals taking care of dependents who may require additional financial support.

- Students: Young adults or students struggling to meet their living costs while pursuing education.

Recognizing these user groups helps tailor outreach and assistance programs to meet the specific needs of varied clienteles seeking coverage.

Steps to Complete the W-113K HRA Form

Completing the W-113K HRA form involves a systematic approach to ensure accuracy and compliance. Here’s a step-by-step breakdown:

- Access the Form: Obtain a copy of the W-113K form from the HRA or relevant sources such as DocHub.

- Prepare Supporting Documents: Gather all necessary documentation that will substantiate the information needed on the form.

- Fill Out Personal Information: Enter details including your full name, address, and contact information.

- Detail Employment Information: Fill in your current employer's name, address, and contact, alongside job title and employment dates.

- Input Income Information: Specify all sources of income, providing monthly figures when appropriate.

- Document Hours Worked: State the average hours worked per week or month based on your employment situation.

- Read Certification Statement: Carefully read and understand the certification statement before signing.

- Submit Your Form: Choose your preferred method for submitting the form—whether online submission, mailing it, or delivering it in person.

By following these steps, applicants can ensure that they complete the W-113K form effectively while minimizing errors that could delay their benefits application process.