Understanding the RF1 Excel Format 2021

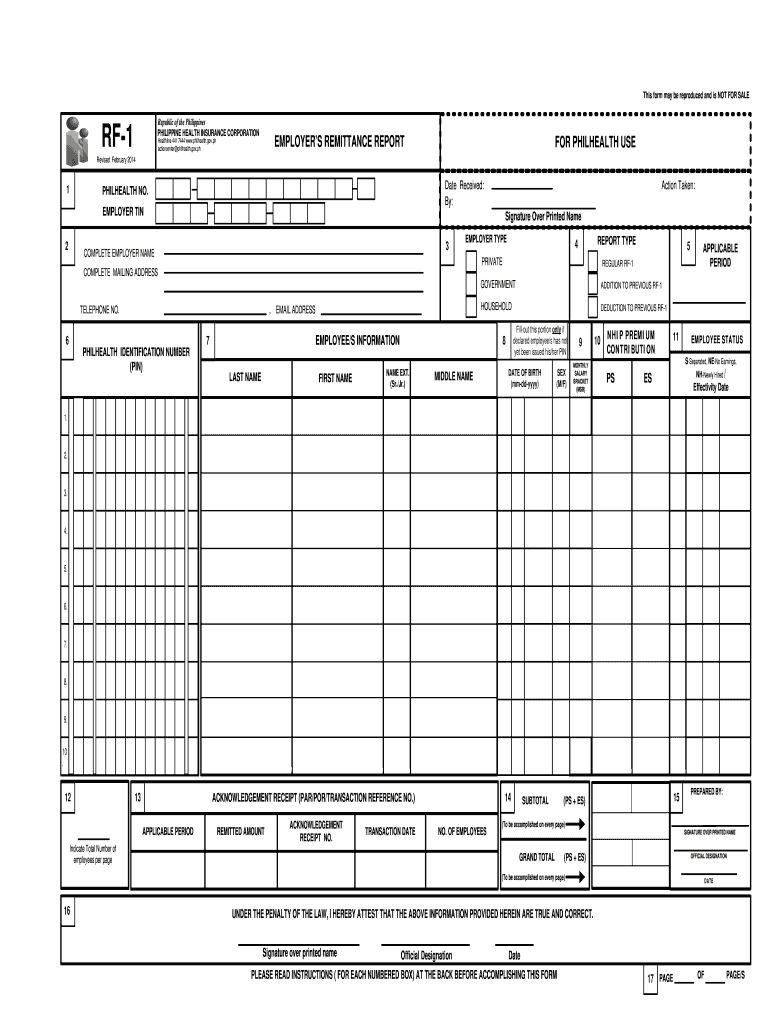

The RF1 Excel format 2021, commonly associated with the Philippine Health Insurance Corporation (PhilHealth), is designed for employers to report health insurance contributions for their employees effectively. This format streamlines the reporting process, ensuring accuracy and compliance with the requirements set forth by PhilHealth.

Key Features of the RF1 Excel Format

- Structured Data Entry: The RF1 form simplifies data input through a structured layout. Each section corresponds to specific employee details and contributions, which assists in minimizing errors during entry.

- Compatibility: The format is compatible with widely used spreadsheet software, allowing employers to edit, save, and share the form efficiently.

- Automated Calculations: Included formulas enable automatic calculation of premium contributions, reducing the risk of manual miscalculations.

Sections Included in the RF1 Form

The RF1 Excel format is divided into several critical sections, each serving a specific purpose:

- Employer Information: Details about the employer, including business name, address, and contact information.

- Employee Details: Sections for listing employee names, PhilHealth ID numbers, and monthly salary figures.

- Premium Contributions: Calculations of contributions based on the employee's salary bracket, ensuring compliance with current regulations.

Steps to Complete the RF1 Excel Format

- Download the Form: Obtain the RF1 Excel format 2021 from the official PhilHealth website or authorized sources.

- Enter Employer Information: Fill out the required employer details accurately.

- Input Employee Data: List each employee’s information in the designated fields, ensuring that all details are correct.

- Review Contribution Calculations: Confirm that all premium contributions are accurately computed based on the latest salary brackets provided by PhilHealth.

- Submit the Form: Once completed, the form can be submitted electronically or printed for manual submission, depending on your company’s reporting preferences.

Compliance and Penalties for Non-Submission

Employers are required to submit the RF1 form within a specified timeframe following payment. Late submissions can result in penalties, including fines or other repercussions as dictated by PhilHealth regulations. Understanding these deadlines is crucial for compliance.

Variants and Alternatives to the RF1 Form

Over the years, various versions of the RF1 form have been introduced, including RF1 formats from 2014 and 2016. Each version reflects updates in regulations, reporting requirements, and data collection methodologies. It’s essential for employers to use the correct version to ensure compliance.

Legal Considerations Related to the RF1 Form

The use of the RF1 Excel format 2021 is governed by national health insurance laws and reporting requirements established by PhilHealth. Employers must adhere to these legal standards to avoid compliance issues. Additionally, unauthorized alterations to the form can result in legal repercussions.

Practical Examples of Using the RF1 Form

Consider a small business employing ten staff members. By utilizing the RF1 Excel format 2021, the business can easily compile employee data and calculate total contributions due. For instance, an employee earning a salary of $800 would have a different contribution than one earning $1,200, highlighting the need for accurate data entry.

Digital vs. Paper Format: Choosing the Right Option

While the RF1 form can be printed for manual submission, using the digital Excel format allows for easier edits and calculations. Employers are encouraged to emphasize digital submissions where possible to enhance efficiency and reduce physical paperwork.

Resources for Downloading the RF1 Excel Format

Employers looking to acquire the RF1 Excel format 2021 should ensure they are downloading from verified and official sources, such as the PhilHealth website. This guarantees the form is up-to-date and compliant with current reporting standards.