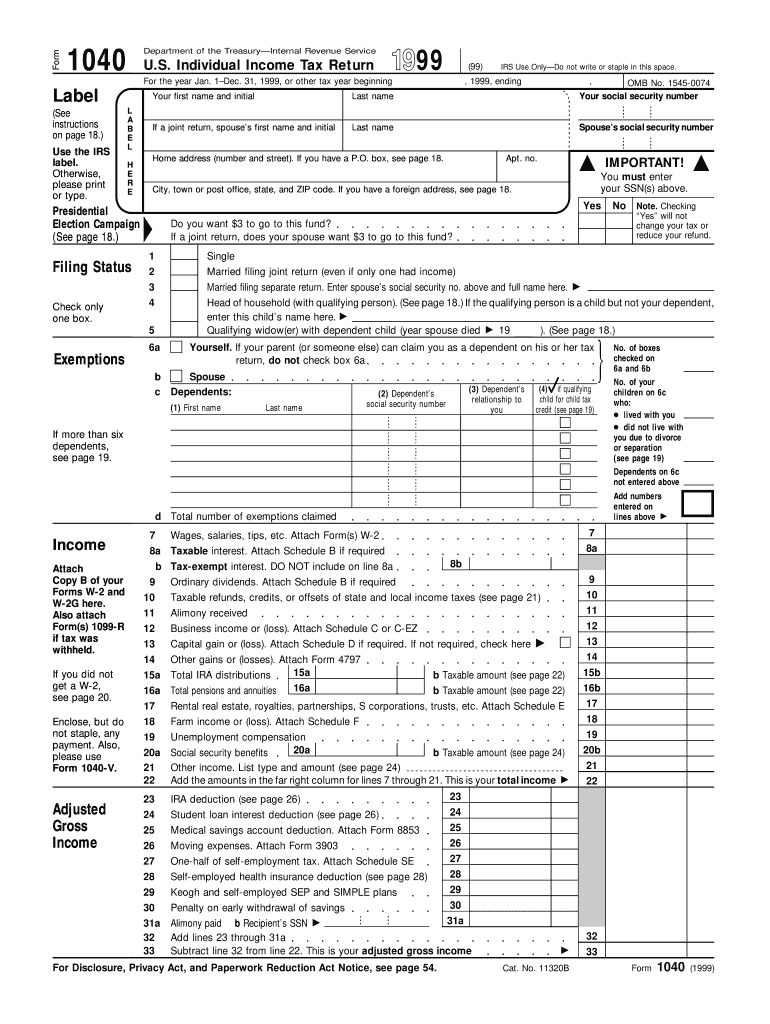

Definition and Purpose of the 1999 IRS Form

The 1999 IRS Form refers to the U.S. Individual Income Tax Return Form 1040 for the tax year 1999. This form is essential for taxpayers to report income, claim deductions, and calculate tax liability. Form 1040 allows individuals to document various income sources, including wages, dividends, and interest, ensuring that all taxable income is accounted for. The form also facilitates the claiming of tax credits and adjustments, enabling taxpayers to accurately determine whether they owe additional taxes or are eligible for a refund.

Key Components of Form 1040

- Personal Information: Name, Social Security number, and address.

- Filing Status: Single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Income Reporting: Detailed sections for wages, taxable interest, dividends, alimony, and business income.

- Adjustments to Income: Deductions for contributions to retirement accounts or student loan interest.

- Tax Credits: Options to claim credits such as the Child Tax Credit or the Earned Income Credit.

The comprehensive nature of Form 1040 ensures that taxpayers have an equitable means of fulfilling their tax obligations while allowing them to take advantage of available credits and deductions.

How to Use the 1999 IRS Form

Utilizing the 1999 IRS Form 1040 involves several steps to ensure accurate completion and compliance with federal tax regulations. Taxpayers need to gather necessary documentation and accurately fill out each section of the form.

Step-by-Step Guide to Using Form 1040

- Collect Documentation: Gather your W-2 forms, 1099s, and documentation of any deductions or credits you plan to claim.

- Determine Filing Status: Select your appropriate filing status based on your marital situation and household arrangement.

- Fill in Personal Information: Include your name, address, and Social Security number on the form.

- Report Income: Enter all income amounts accurately, ensuring you include all necessary sources as specified.

- Calculate Adjustments and Deductions: Make adjustments to your income as needed and apply any deductions you're eligible for.

- Determine Tax Owed or Refund Due: Calculate your total tax liability and figure out whether you owe money or are due a refund.

- Review Before Submission: Double-check all entries for accuracy and completeness to avoid errors that could result in fines or delayed refunds.

By following this structured approach, taxpayers can ensure they complete the Form 1040 accurately and efficiently.

Steps to Complete the 1999 IRS Form

Completing the 1999 IRS Form 1040 requires careful attention to detail and a clear understanding of the required information. Follow these steps to ensure a thorough and accurate filing process.

Detailed Instructions for Completing Form 1040

- Step 1: Personal Information: Provide complete information, including your full name and dependents, if applicable.

- Step 2: Choose Your Filing Status: Identify which filing status applies to you; this affects your tax rates and eligibility for certain deductions.

- Step 3: Input Your Income: Use accurate figures for all forms of income. For example:

- Wages from employment from your W-2.

- Interest and dividends from bank statements.

- Step 4: Deductions and Credit Claims: Identify potential deductions like medical expenses or student loan interest and apply for tax credits where eligible.

- Step 5: Calculate Taxes Owed: Utilize the provided tax tables or calculators to determine the amount of tax owed based on your taxable income.

- Step 6: Final Review: Provide a final read-through, checking for errors or missed entries, before submitting your form.

Completing the form accurately can help prevent penalties and expedite refund processing.

Important Dates for Filing the 1999 IRS Form

Understanding the filing deadlines associated with the 1999 IRS Form 1040 is critical to avoiding penalties and ensuring compliance with tax regulations.

Key Filing Deadlines for 1999 Form 1040

- Tax Filing Deadline: April 15, 2000. It's essential to submit your Form 1040 by this date to avoid late fees.

- Extension Request Deadline: If additional time is needed, taxpayers could file Form 4868 to request an automatic six-month extension.

- Payment Due Dates: Taxes owed must also be paid by April 15, 2000, regardless of any extension requests.

Being aware of these dates helps taxpayers manage their finances effectively and avoid complications with the IRS.

Who Typically Uses the 1999 IRS Form?

The 1999 IRS Form 1040 is commonly utilized by a wide array of taxpayers in the United States.

Common User Types of Form 1040

- Employees: Individuals receiving a salary or wages reported via W-2 forms.

- Self-Employed Individuals: Freelancers and business owners who report income and expenses.

- Families with Dependents: Parents claiming dependents and tax credits such as the Child Tax Credit.

- Retirees: Seniors receiving pensions, retirement distributions, or Social Security income.

Understanding the demographics of Form 1040 users can highlight the diverse needs and complexities involved in tax filing processes.

Legal Use of the 1999 IRS Form

The 1999 IRS Form 1040 serves as a legally recognized vehicle for American taxpayers to fulfill their tax obligations to the federal government.

Legal Compliance with Form 1040

- Official Document Submission: By filling out and submitting Form 1040, taxpayers affirm the accuracy of the information provided, which is legally binding.

- IRS Regulations: Form 1040 must be completed in accordance with the guidelines set by the Internal Revenue Service, ensuring compliance with federal tax laws.

- Auditable Records: The form contributes to the taxpayer's official financial records, which may be subject to IRS audits.

Legal adherence to the requirements of Form 1040 fosters transparency and responsibility among taxpayers.

IRS Guidelines for Using the 1999 Form

Following IRS guidelines for completing and submitting the 1999 IRS Form 1040 is vital for compliance and optimizing tax situations.

IRS Recommendations for Filing

- Accurate Reporting: Ensure all financial information is reported correctly to avoid discrepancies.

- Documentation Retention: Maintain copies of all submitted forms and supporting documentation for a minimum of three years, in case of audit.

- Utilization of Resources: Access IRS resources, such as publication guides specific to tax issues related to filing Form 1040.

Staying informed about IRS guidelines enables taxpayers to navigate the filing process with confidence.