Definition and Meaning of the c105 2 Form

The c105 2 form, officially known as the “Workers' Compensation Insurance Coverage Certification,” serves a crucial purpose for businesses operating in New York state. It is a mandatory form that verifies that an employer has obtained appropriate workers' compensation insurance coverage as required by New York state law. This form essentially provides evidence that an employer is compliant with legal requirements to protect employees injured on the job. Without this coverage, employers may face fines and legal actions.

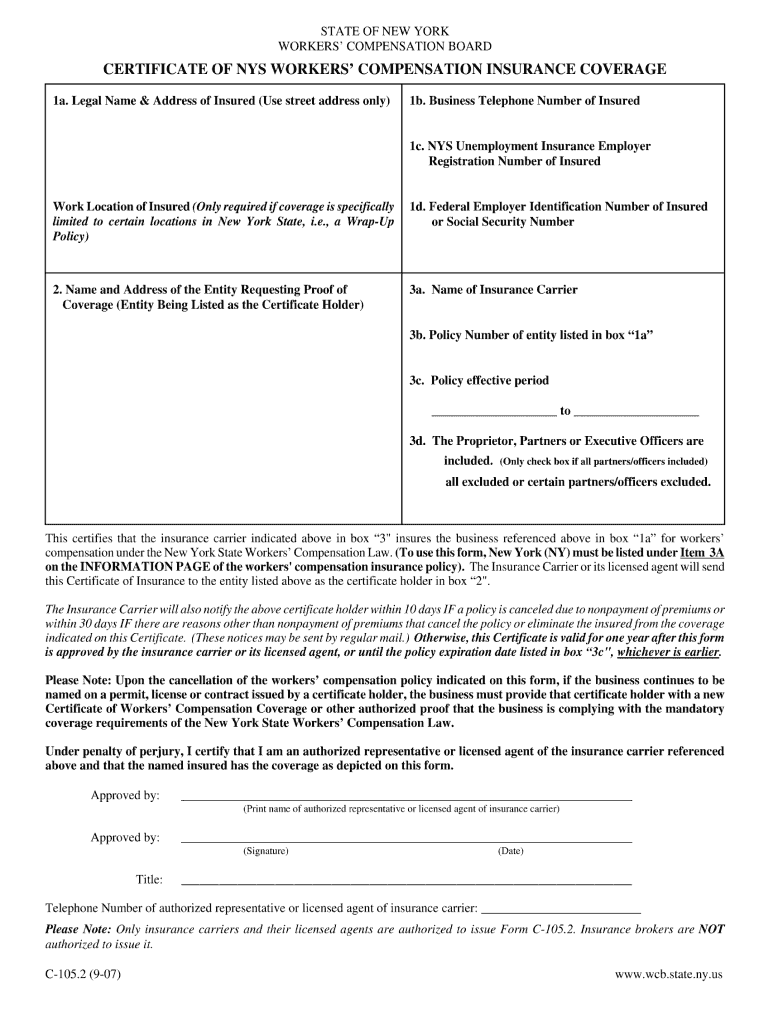

The c105 2 form includes key information such as the legal name and address of the insured business, the insurance carrier information, and the policy number. These details are crucial for ensuring that businesses can fulfill their obligations to employees and meet state regulations. The form is pertinent not just for compliance but also for the overall safety and well-being of workers, demonstrating the employer’s commitment to a secure workplace environment.

How to Use the c105 2 Form

To effectively utilize the c105 2 form, it is essential to understand its key functions in the business context. Businesses typically need to present this form when applying for permits, licenses, or other regulatory requirements, as it confirms their compliance with state insurance laws.

-

Completion Process: When filling out the c105 2 form, ensure that all required fields are completed. This includes information about the employer, the insurance provider, and policy details. Missing information could result in delays or rejections.

-

Submission Locations: The completed c105 2 form should be submitted to the relevant agencies, such as state departments or local municipalities, depending on where the business operates. It's crucial to keep copies for your records.

Employing this form correctly contributes to operational legitimacy and protects the business from potential liabilities associated with employee injuries.

Steps to Complete the c105 2

Completing the c105 2 form requires a systematic approach to ensure accuracy and compliance. Here are the fundamental steps to consider:

-

Gather Required Information: Collect necessary details, including your business's legal name, address, and contact number. You will also need information from your workers' compensation insurance provider: the insurer's name, policy number, and coverage dates.

-

Complete the Form: Fill out the form neatly. Each field must be addressed to avoid processing issues. Pay special attention to the accuracy of the policy number and insurance company details.

-

Review for Completeness: Ensure there are no missing fields and that all information provided is accurate. This can significantly reduce the likelihood of receiving a notice for correction.

-

Submit: Once the form is complete, submit it to the relevant agency, such as your local government or department of labor. Ensure submission is done before any deadlines to keep your business compliant.

-

Maintain Records: Keep a copy of the submitted form and any confirmation received after submission for your records. This is important for future reference or potential audits.

Following these steps helps businesses avoid non-compliance penalties and demonstrates fiscal responsibility regarding workers' safety.

Important Terms Related to the c105 2 Form

Understanding the key terms associated with the c105 2 form can provide clarity on its structure and importance. Below are critical terms:

-

Workers' Compensation: A form of insurance providing wage replacement and medical benefits to employees injured in the course of employment, protecting them from financial hardship.

-

Insurance Carrier: The company providing insurance coverage for the employer, responsible for processing claims and ensuring compliance with state regulations.

-

Coverage Certificate: A document that confirms the existence of a workers' compensation insurance policy, typically required for legal and operational purposes.

-

Employer Liability: The legal responsibility of employers to safeguard their workers’ well-being, which includes providing necessary insurance coverage.

Understanding these terms helps individuals and businesses navigate the regulatory landscape effectively when dealing with workers' compensation matters.

Who Typically Uses the c105 2 Form

The c105 2 form is crucial for various entities, particularly those engaged in business activities within New York state. Key users include:

-

Employers: Any business with employees is required to complete and file this form to demonstrate compliance with state workers' compensation insurance laws.

-

Contracting Businesses: Companies seeking contracts or permits often need to submit proof of insurance coverage. The c105 2 form serves as verification.

-

Government Agencies: Local and state agencies may request this form during audits, inspections, or as part of the application for certain licenses, aiming to ensure compliance.

-

Insurance Professionals: Agents and brokers may assist clients in completing the c105 2 to ensure that all regulatory requirements are satisfied for proper insurance coverage.

Understanding the primary users of the c105 2 form can enhance compliance and streamline interactions with regulatory entities, fostering a safer working environment.