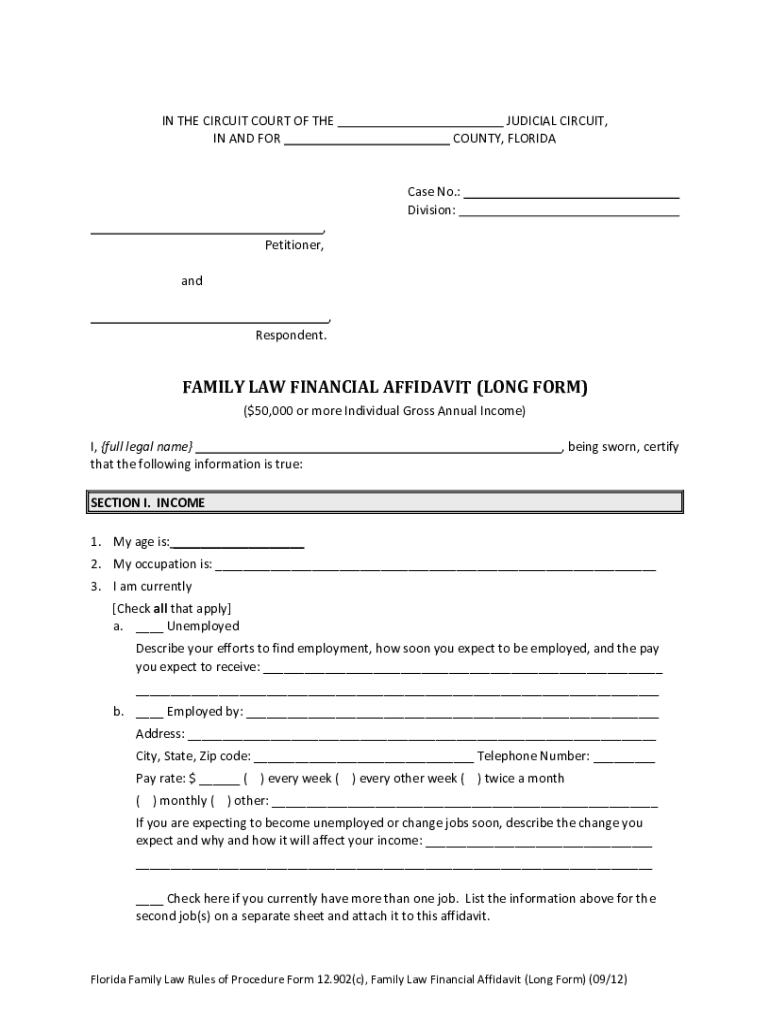

Definition and Meaning

The "2012 FL Form" refers to a specific legal or governmental form used in Florida for a certain purpose in 2012. This form was designed to capture information or provide a mechanism for reporting or application processes relevant to that year within the state. Understanding how this form functions within legal and administrative contexts is crucial for accurate usage.

Practical Implications

- Legal Documentation: Requires knowledge of the state laws and regulations applicable at the time.

- Specific Purposes: The form is typically designed to gather data for tax, legal, or administrative purposes, potentially involving financial disclosures or compliance verification.

Common Usage

- Used for applications, declarations, or reporting for individuals or businesses within Florida in 2012.

- Might have implications on legal obligations depending on the form's purpose for that year.

How to Use the 2012 FL Form

Understanding the utilization of the "2012 FL Form" is crucial for accomplishing its intended purpose effectively.

General Instructions

- Review Form Requirements: Ensure you understand the specific details required for each section, especially concerning personal information or financial data.

- Accurate Completion: Double-check entries for accuracy to avoid complications or legal repercussions.

- Submission Guidelines: Follow the appropriate channels for submission, which might vary depending on the agency governing the form.

Practical Example

- For tax forms, ensure all income is reported correctly and deductions are documented as per applicable law.

How to Obtain the 2012 FL Form

Accessing the "2012 FL Form" requires knowledge of the appropriate sources and processes.

Sources

- Government Websites: Many Florida government forms are accessible online via respective department websites.

- In-Person Retrieval: Local government offices or public libraries may offer paper versions.

Steps for Retrieval

- Visit the official state or departmental website.

- Utilize their search functions to locate the 2012 form.

- Download or request a paper form as needed.

Steps to Complete the 2012 FL Form

Completing the "2012 FL Form" involves specific steps that ensure all necessary information is captured correctly.

Process Overview

- Gather Required Information: Before starting, collect all necessary documents and personal information.

- Fill Out Form Accurately: Enter information exactly as it appears on official documents.

- Review for Completeness: Ensure all sections are filled. Double-check for any mandatory fields that must be completed.

Important Considerations

- Notarization: Some forms might require a notary's signature.

- Attachments: Ensure all supplemental documents are attached when submitting.

Who Typically Uses the 2012 FL Form

Identifying who uses the "2012 FL Form" helps clarify its target audience and purpose.

Common Users

- Individuals: Those who have specific legal or financial matters.

- Businesses: Entities required to file information to comply with state law.

Special Cases

- Professionals: Lawyers or accountants might assist clients in completing these forms due to complexity.

Important Terms Related to 2012 FL Form

Familiarity with specific terminology associated with the "2012 FL Form" is essential for proper execution.

Key Terms

- Notary Public: An official authorized to witness signatures on documents.

- Filing Requirements: Guidelines dictating how forms should be submitted and handled.

- Compliance: Adherence to the laws and regulations specific to the form.

Examples in Context

- Signature Requirement: Certain forms may have sections that require official witnessing.

Legal Use of the 2012 FL Form

The "2012 FL Form" must be used within a legal framework to ensure its validity and compliance with state regulations.

Ensuring Legality

- Accurate Information: Providing false information could lead to penalties or legal consequences.

- Timely Submission: Failure to submit within the prescribed timeframe can result in fines or other repercussions.

Case Scenarios

- Tax forms submitted late could incur penalties. Legal representation may be necessary if compliance issues arise.

Key Elements of the 2012 FL Form

Understanding the core components of the "2012 FL Form" enhances its proper completion and submission.

Main Components

- Personal Information: Includes name, address, and identification numbers.

- Financial Information: Details about income, deductions, or investments.

Critical Fields

- Ensure mandatory sections, such as those requiring a signature or financial declarations, are fully completed to avoid submission rejections.

Penalties for Non-Compliance

Failing to comply with regulations associated with the "2012 FL Form" can result in legal or financial penalties.

Consequences

- Fines: Monetary penalties for late submission or incorrect information.

- Legal Action: Potential for court appearances if serious violations occur.

Avoidance Strategies

- Timely submission and double-checking of all form fields can prevent common issues leading to penalties.