Definition and Purpose of Form 3520-A

Form 3520-A, officially known as the "Annual Information Return of Foreign Trust With a U.S. Owner," serves as a reporting requirement mandated by the IRS. The form is used to furnish information about a foreign trust and its U.S. owner(s), including general information about the trust, its income, and the financial standings. The primary purpose is to ensure compliance with U.S. tax regulations concerning foreign trusts, thereby enhancing transparency and accountability.

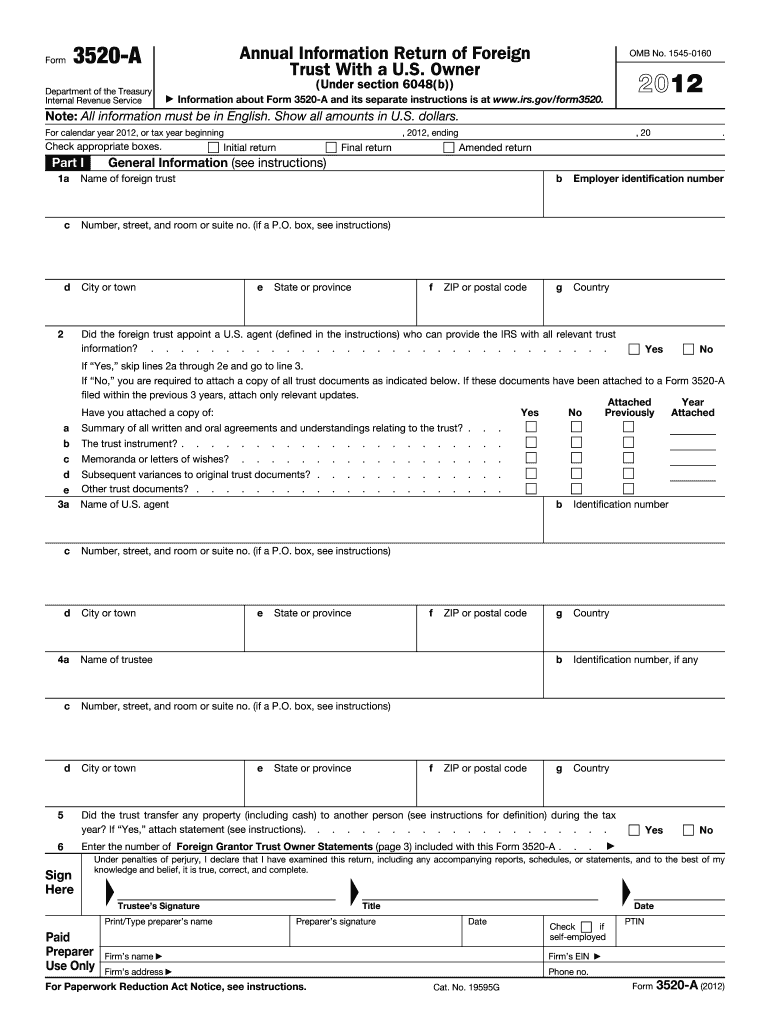

Steps to Complete Form 3520-A

Completing Form 3520-A involves several steps that require meticulous attention to detail. The process begins by gathering pertinent information related to the foreign trust and its financial activities.

-

Collect Required Information: Ensure you have comprehensive data about the trust, including its income, expenses, beneficiaries, and balance sheet.

-

Complete Part I - General Information: Fill out section detailing the trust establishment, its foreign status, and identification of U.S. owners.

-

Provide Financial Details: Include income statements and expense reports in Part II, and balance sheet figures in Part III.

-

Include Owner Statements: The form requires statements for U.S. owners, detailing their proportionate share of the trust’s income and other financial details.

-

Review and Double-Check: Verify accuracy across all sections, ensure all information aligns with financial documentation.

-

Signature and Submission: Have the form signed by the foreign trustee or an authorized signatory before submission to the IRS.

Obtaining Form 3520-A

Form 3520-A can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be printed and filled out or completed using software that supports PDF editing. Ensure that you have the latest version of the form and accompanying instructions, as the IRS subjects these forms to annual updates.

Importance of Filing Form 3520-A

Filing Form 3520-A is critical for compliance with U.S. tax laws concerning foreign trusts. Non-compliance can result in substantial penalties. The form helps the IRS monitor the activities of foreign trusts, thereby preventing tax evasion and ensuring that U.S. owners declare their global income accurately. Accurate reporting can mitigate potential legal and financial consequences for U.S. owners of foreign trusts.

Who Typically Uses Form 3520-A

Form 3520-A is typically used by foreign trusts with at least one U.S. owner. This includes any foreign trust created or organized outside of the United States that has U.S. taxpayers as beneficiaries or holders of any ownership stake. This form is also relevant for trustees managing these trusts, ensuring they meet their obligations for information reporting and disclosure.

Key Elements of Form 3520-A

- General Information about the Trust: Captures foundational data about the trust, including its identification and foreign status.

- Income and Expenses: Details the trust’s income generation activities, expenses, and transactions conducted during the tax year.

- Balance Sheet Details: Provides an overview of the trust’s financial position, including assets, liabilities, and equity at the end of the tax year.

- Statements for U.S. Owners: Necessitates detailed breakdowns of income and distribution statements pertinent to U.S. owners of the trust.

IRS Guidelines on Form 3520-A

The IRS provides comprehensive guidelines for filing Form 3520-A. These guidelines include stipulations about when the form must be filed, how to handle extensions, and detailed instructions on filling out each section of the form. It is crucial to adhere to these guidelines strictly to avoid errors and potential penalties. These guidelines are updated regularly, ensuring alignment with current tax laws and international treaties.

Filing Deadlines and Important Dates

The due date for Form 3520-A is the 15th day of the third month after the end of the trust's tax year. For calendar year taxpayers, this typically falls around March 15. Extensions can be requested using Form 7004, but it is vital to file for an extension before the original due date to avoid penalties. Accurate awareness and adherence to these deadlines are crucial to maintain compliance.

Penalties for Non-Compliance

Failing to file Form 3520-A or providing inaccurate information can lead to significant penalties. The IRS may impose penalties for late filing, non-filing, or inaccuracy, with fines potentially reaching thousands of dollars. The imposition of penalties emphasizes the importance of precise and timely filing, reinforcing adherence to U.S. tax obligations regarding foreign trusts.

Digital vs. Paper Version of Form 3520-A

The form is available in both digital and paper formats. The digital version allows for electronic completion and submission, offering convenience and reducing errors through built-in checks. However, some may prefer the traditional paper format. Both versions require the same level of detail and accuracy, and the choice of format should align with the filer’s comfort and capacity for digital transactions.