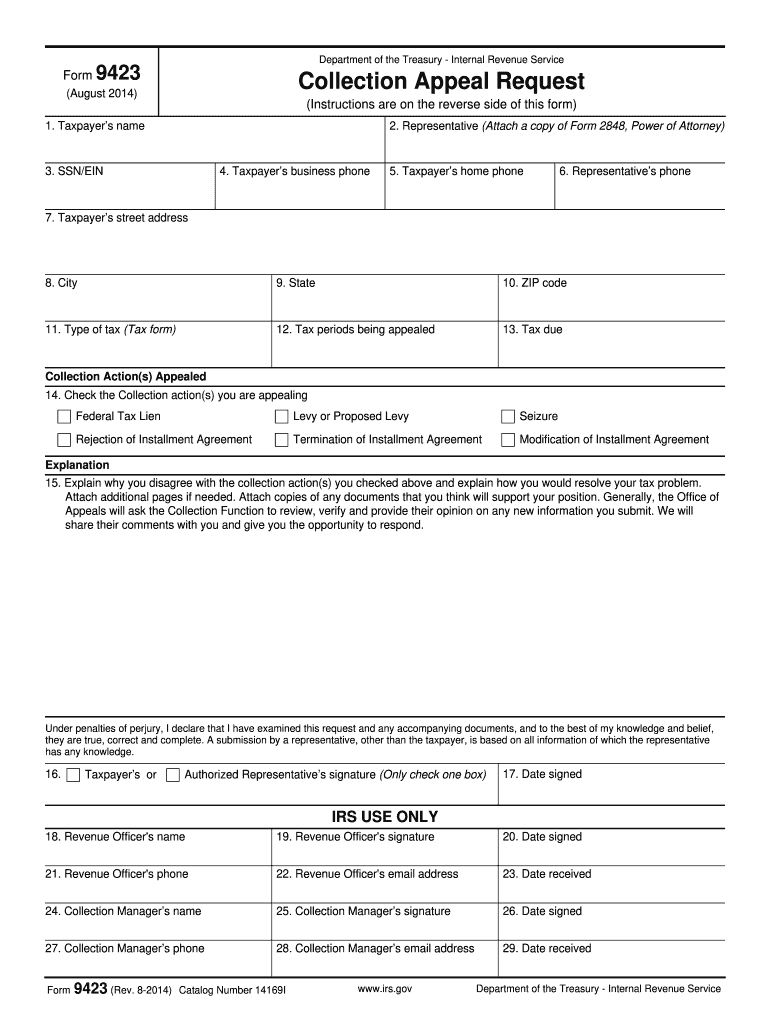

Definition and Purpose of Form 9423

Form 9423, known as the Collection Appeal Request, is an official document used by taxpayers to appeal various collection actions undertaken by the Internal Revenue Service (IRS). The primary purpose of this form is to give taxpayers an avenue to contest actions such as levies, liens, and decisions related to installment agreements. This form is crucial as it protects taxpayers' rights, giving them the opportunity for a review of the IRS's collection actions under the Internal Revenue Code.

Taxpayers preparing to submit Form 9423 should clearly understand what actions they wish to appeal. The form requires detailed information about the taxpayer and the specific issues being contested. This may include the type of collection action being reviewed, the reasons for the appeal, and any supporting documentation that strengthens the case.

Submitting Form 9423 effectively pauses the collection activities while the appeal is processed, allowing taxpayers relief from immediate demands for payment. It ensures that taxpayers are not subjected to undue pressure during the review process. Furthermore, if the IRS determines that the collection efforts were improper, they can adjust the account accordingly, possibly eliminating or reducing the taxpayer’s debt.

How to Obtain Form 9423

Obtaining Form 9423 can be accomplished through several methods. Taxpayers can visit the IRS website and download the form directly from there. The form is available in PDF format, making it easy to access and print for completion. Additionally, taxpayers can request a physical copy by calling the IRS directly.

- IRS Website: The most efficient method is to download the form as it ensures you have the latest version.

- Phone Request: Calling the IRS helpline can facilitate receiving a physical copy, but this method may require waiting time.

- Tax Preparation Services: Some tax professionals and enrollment agents may offer access to this form as part of their services, including assistance in filling it out correctly.

Ensure that you always use the most current version of Form 9423 to avoid issues related to filing outdated forms.

Steps to Complete Form 9423

Completing Form 9423 involves careful attention to detail to ensure that all required information is accurately provided. Here’s a step-by-step guide to aid in the completion of the form:

- Identify the Collection Actions: Clearly state the actions you are appealing. This may include levies, liens, or specific decisions regarding payment options.

- Provide Taxpayer Information: Fill out the personal information segment, including your name, address, Social Security number, and any applicable Employer Identification Numbers (EIN).

- Detail the Appeal Reasons: In this section, explain why you believe the collection action is incorrect or unjust. Providing specific reasons and any relevant past communications with the IRS can be essential.

- Gather Supporting Documentation: Include copies of any documents that support your appeal, such as prior correspondence from the IRS, payment records, or financial statements outlining your ability to pay taxes.

- Sign and Date the Form: Ensure that you sign and date the form before submission. An unsigned or undated form may be deemed invalid and rejected by the IRS.

Keep a copy of the completed form and all attachments for your records. This documentation is vital should further communications or actions arise from the IRS.

Important Terms Related to Form 9423

Understanding specific terminology is critical when dealing with Form 9423 and the broader context of IRS collection actions. Here are key terms associated with this form:

- Levy: A legal seizure of property to satisfy a tax debt.

- Lien: A legal claim against assets to secure payment of tax obligations.

- Installment Agreement: An arrangement that allows taxpayers to pay their tax debt over time rather than in a single payment.

- Appeal Rights: Legal rights enabling taxpayers to dispute IRS decisions impacting their tax obligations.

- Notice of Intent to Levy: A formal written notice to taxpayers informing them of the IRS's intention to seize their property.

Familiarizing yourself with these terms not only aids in the completion of Form 9423 but also empowers you to navigate the complexities of IRS collection processes more effectively.

Legal Use of Form 9423

The legal framework surrounding Form 9423 is grounded in the taxpayer’s rights to appeal IRS actions. According to the IRS’s Taxpayer Bill of Rights and relevant internal regulations, Form 9423 should be utilized appropriately to ensure fair treatment of taxpayers. Key legal aspects include:

- Timeliness: The form must be submitted within a certain period after receiving a notice from the IRS regarding collection actions. Specific deadlines depend on the action being appealed.

- Grounds for Appeal: Taxpayers should present legitimate grounds for their appeal. This could include demonstrating that the collection action was incorrect or that it imposes an undue financial hardship.

- Protection Against Retaliation: Submitting an appeal using Form 9423 should not result in penalties or further collection efforts while the appeal is under review, safeguarding the taxpayer from additional stress during the process.

Understanding these legal contexts is essential for anyone navigating tax disputes, ensuring that their rights are upheld throughout the appeals process.