Definition and Meaning of the T4 Fillable

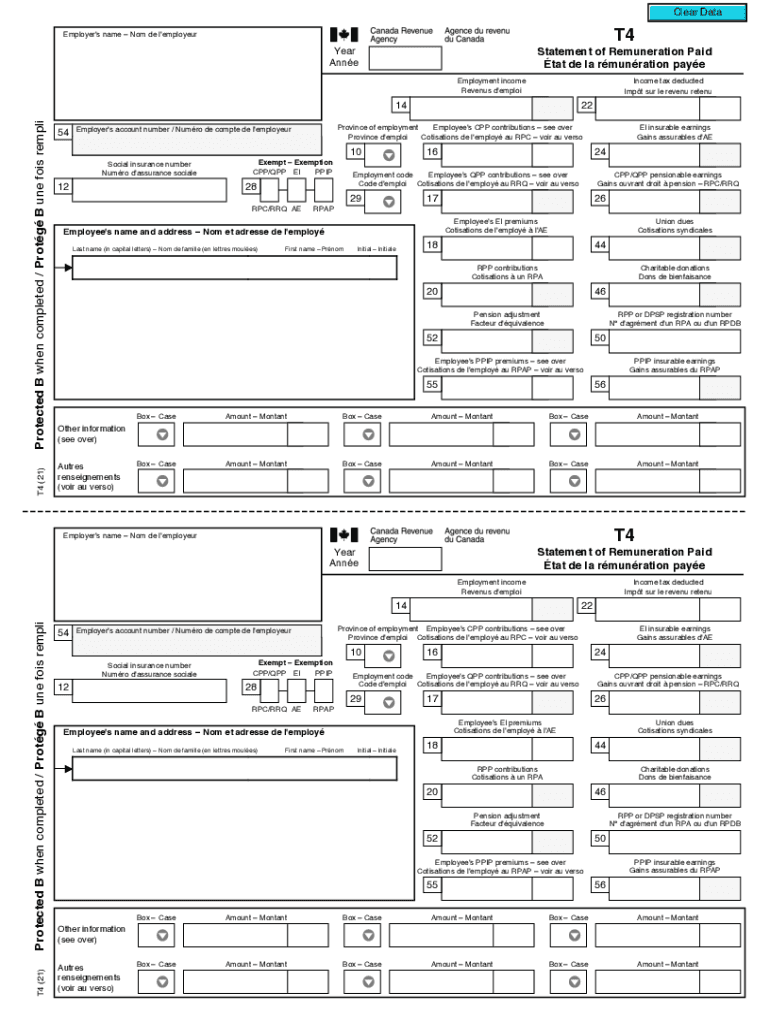

The T4 fillable form, officially known as the T4 Statement of Remuneration Paid, is a crucial document in Canada. It is utilized for reporting income earned by employees throughout the year. The T4 slip details the total earnings, deductions, and taxable benefits that an employer has provided to each employee. It is a mandatory form for employers to disclose employee income and remittances to the Canada Revenue Agency (CRA). The form is electronically fillable, streamlining the process of inputting and submitting necessary data, thus reducing the likelihood of errors when compared to traditional paper forms.

In essence, the T4 fillable serves multiple purposes, including:

- Facilitating accurate income reporting for tax purposes.

- Providing a structured format for deductibles and taxable benefits.

- Allowing for easy adjustments or updates if corrections are needed.

Steps to Obtain the T4 Fillable

Obtaining the T4 fillable form is straightforward for employers and employees alike. Here are the essential steps involved:

-

Visit the CRA Website: Navigate to the official CRA website where you can find various tax forms, including the T4 fillable form.

-

Select the Appropriate Form: Ensure that you are choosing the correct version of the T4 slip for the relevant tax year, such as the 2023 T4 fillable or previous years’ forms.

-

Download or Open the Form: You can directly open the T4 fillable PDF in your browser or download it to your local drive.

-

Open with a Compatible PDF Editor: Ensure you have software that can handle fillable forms, like Adobe Reader or any compatible PDF editor.

-

Input Required Information: Complete the form by entering your income details, deductions, and other necessary information.

-

Review and Save: After filling, review the entries for accuracy, then save the edited document for submission.

-

Submit to CRA: The final step is to submit the completed T4 slip electronically through the CRA’s E-filing system or via mail.

These steps highlight how simple it is to obtain and fill out the T4 form electronically.

Steps to Complete the T4 Fillable Form

Completing the T4 fillable form requires attention to detail to ensure compliance with regulations. Here are detailed steps for efficiently filling out the form:

-

Employee Information: Begin by entering the employee's personal details, such as their name, address, and social insurance number (SIN).

-

Employer Information: Fill in the employer's name and address at the top of the form. Provide the employer's business number (BN) issued by the CRA.

-

Income Details: In the relevant boxes, report the total employment income, including regular wages, bonuses, and any other compensatory payments.

-

Deductions and Tax Amounts: Specify any deductions such as Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and tax withheld. These amounts are crucial for accurate tax reporting.

-

Benefits and Allowances: Include taxable benefits provided to the employee, such as gifts or allowances, which must also be reported for tax purposes.

-

Review Each Section: Double-check all entries to verify the accuracy of the information, as errors can lead to complications or penalties.

-

Submit: Once completed and confirmed, save it in the specified format for electronic filing or prepare it for mailing.

These comprehensive steps guide employers through the intricacies of filling out the T4 fillable to ensure all necessary financial information is accurately reported to the CRA.

Importance of Using the T4 Fillable Form

The T4 fillable form is essential for several reasons, particularly for employees and employers navigating the tax landscape in Canada. Here are the critical reasons why utilizing the T4 fillable form is important:

-

Accurate Record-Keeping: The form helps in maintaining precise records of employee earnings and deductions throughout the year, which is vital for both financial management and tax compliance.

-

Ease of Submission: The fillable nature of the T4 form allows for straightforward data entry and reduces the possibility of paper waste. It also eases the filing with the CRA as electronic submissions can often be processed faster.

-

Streamlined Communication: Both employers and employees can access the necessary information quickly, facilitating better communication regarding tax obligations.

-

Error Reduction: The fillable format often includes built-in checks to reduce common mistakes, as opposed to manually filling out a paper form.

-

Adaptability and Updates: Employers can easily make updates or corrections to employee records when using a digital fillable form, thus ensuring compliance and avoiding potential penalties related to incorrect filings.

The T4 fillable form serves as a cornerstone for proper tax reporting and compliance in Canada, ensuring that both employees and employers fulfill their responsibilities accurately.

Examples of Using the T4 Fillable Form

Practical examples illustrate how the T4 fillable form is employed in real-world scenarios. Here are several common cases:

-

Annual Income Reporting: Employers use the T4 form annually to report the total earnings of their employees, detailing specific amounts for income, allowable deductions, and benefits that need to be reported for tax assessment.

-

Freelance or Contract Work: A company may utilize the T4 fillable to report payments made to freelancers or contractors who meet the criteria for employment income, ensuring that all parties comply with income disclosure requirements.

-

Year-End Tax Preparation: Employees use the T4 slip during year-end tax preparation. When filing their individual income tax returns, they reference the amounts listed on the T4 form to compute tax obligations accurately.

-

Employment Verification: The T4 slip can also serve as proof of income when employees apply for loans or mortgages, as it summarizes their earnings and deductions from the previous tax year.

These examples demonstrate real-world applications of the T4 fillable form, highlighting its role in income reporting, tax filing, and verification.