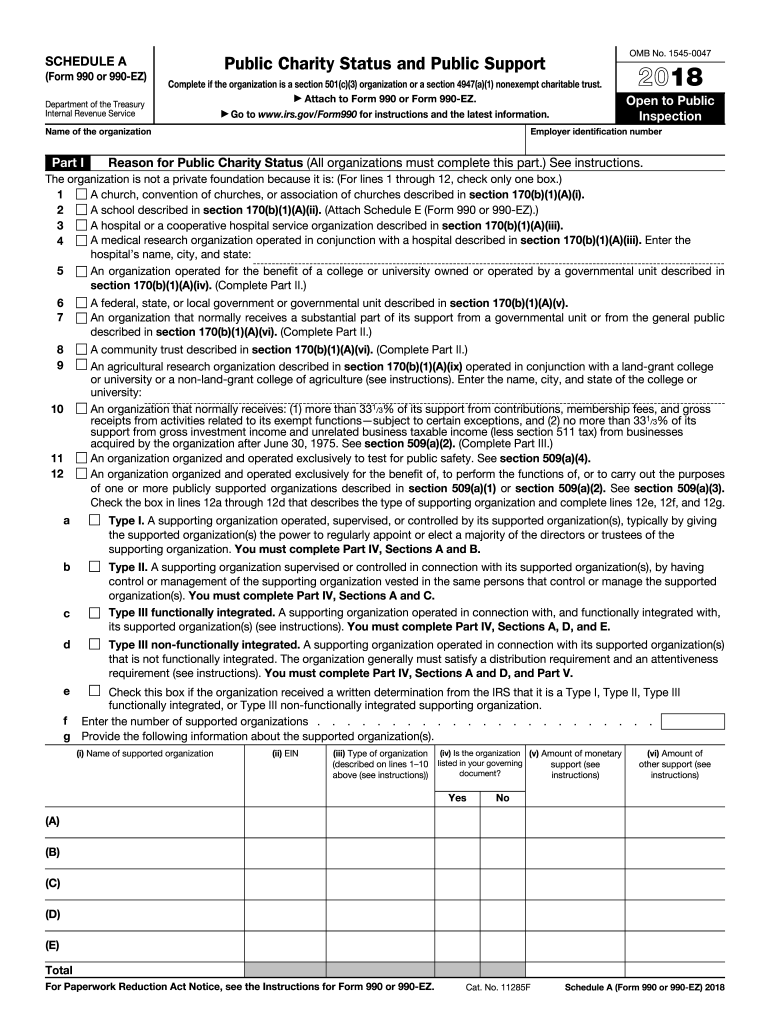

Definition & Purpose of Form 990 Schedule A

Form 990 Schedule A is primarily used by organizations recognized as 501(c)(3) public charities or nonexempt charitable trusts, according to IRS regulations. This schedule is a critical component of Form 990 or 990-EZ, which nonprofit organizations file annually to report their financial information to the IRS. Schedule A specifically assists in determining an organization's public charity status and comprehensively discloses various aspects of its support structure. The form includes several sections detailing public support, total support, and information about any supporting organizations. By completing Schedule A accurately, organizations provide the IRS with necessary data to confirm their adherence to public charity qualifications, which impacts their tax-exempt status.

Key Elements of the 2018 Form 990 Schedule A

The structure of Schedule A is segmented to capture essential information about a nonprofit’s operational status:

- Public Support: Calculate and report contributions from public and governmental sources.

- Total Support: Include revenue from all sources, helping to determine the organization’s dependency on public support.

- Supporting Organizations: Identify and describe any affiliated supporting organizations, which further underscores the nature of public charity status.

- Compliance Details: Outline adherence to IRS regulations to maintain tax-exemption eligibility.

Steps to Complete Form 990 Schedule A

While filling out Schedule A, organizations must ensure accuracy in reporting:

- Gather Financial Records: Collect documentation of revenue and donations received over the reporting period.

- Calculate Public Support Percentage: Use the form instructions to determine the percentage of public support received, crucial for maintaining public charity status.

- List Supporting Organizations: Clearly identify any organizations that provide additional support or functionally connect to the charity.

- Complete All Sections: Address every applicable part of the form to provide a complete picture to the IRS.

- Review for Accuracy: Double-check entries against financial records to prevent errors that could affect compliance.

How to Obtain the 2018 Form 990 Schedule A

Organizations can access the 2018 Form 990 Schedule A through various methods:

- IRS Website: The form can be downloaded directly from the official IRS website.

- Tax Preparation Software: Many tax software packages include this form as a part of their suite, often accompanied by fill-in features and guidance.

- Professional Advisors: Contact accounting professionals experienced in nonprofit tax filings. They often provide this form as a part of their services.

Filing Deadlines & Important Dates

Schedule A, as a part of Form 990 or 990-EZ, follows the same filing timelines:

- Annual Deadline: Generally, the form is due on the 15th day of the fifth month after the organization's accounting period ends.

- Extension Availability: Organizations can apply for an automatic six-month extension using Form 8868 if more time is needed.

Eligibility Criteria for Using Schedule A

To determine if using Schedule A is necessary:

- 501(c)(3) Status: Organizations must be recognized as 501(c)(3) public charities or nonexempt charitable trusts.

- Gross Income Reporting: For nonprofits surpassing certain income thresholds, Schedule A becomes a requirement to detail support sources.

- Supporting Organizations Involvement: Organizations with ties to supporting entities need to file Schedule A for transparency and compliance purposes.

Important Terms Related to Form 990 Schedule A

Understanding specific terms aids in proper completion:

- Public Charities: These are nonprofits that receive a significant portion of their revenue from public donations and governmental support.

- 501(c)(3): Refers to tax-exempt status granted to organizations for their charitable purposes.

- Public Support Percentage: A numerical value that reflects how much of an organization's income comes from public sources, crucial for maintaining tax-exemption.

Penalties for Non-Compliance

Failing to file Schedule A, or filing incomplete or incorrect information, can result in significant penalties:

- Fines: Monetary penalties can be imposed by the IRS for late or inaccurate filings.

- Loss of Tax-Exempt Status: Organizations risk losing their 501(c)(3) designation, which affects both tax exemptions and public trust.

- Increased Scrutiny: Non-compliance might lead to more frequent or detailed audits by the IRS, increasing administrative burdens.

IRS Guidelines for Form 990 Schedule A

Organizations must adhere to IRS guidelines for compliance:

- Accurate Reporting: Ensure all financial and organizational data reported is accurate and verifiable with supporting documents.

- Detailed Disclosure: Provide comprehensive information about public and total support, ensuring clarity and transparency.

- Timely Filing: Submit all forms within stipulated deadlines to avoid penalties and maintain good standing with the IRS.

These comprehensive details give organizations the clarity needed to correctly prepare and submit Form 990 Schedule A, maintaining compliance and protecting their tax-exempt status.