Definition and Purpose of Form 4136

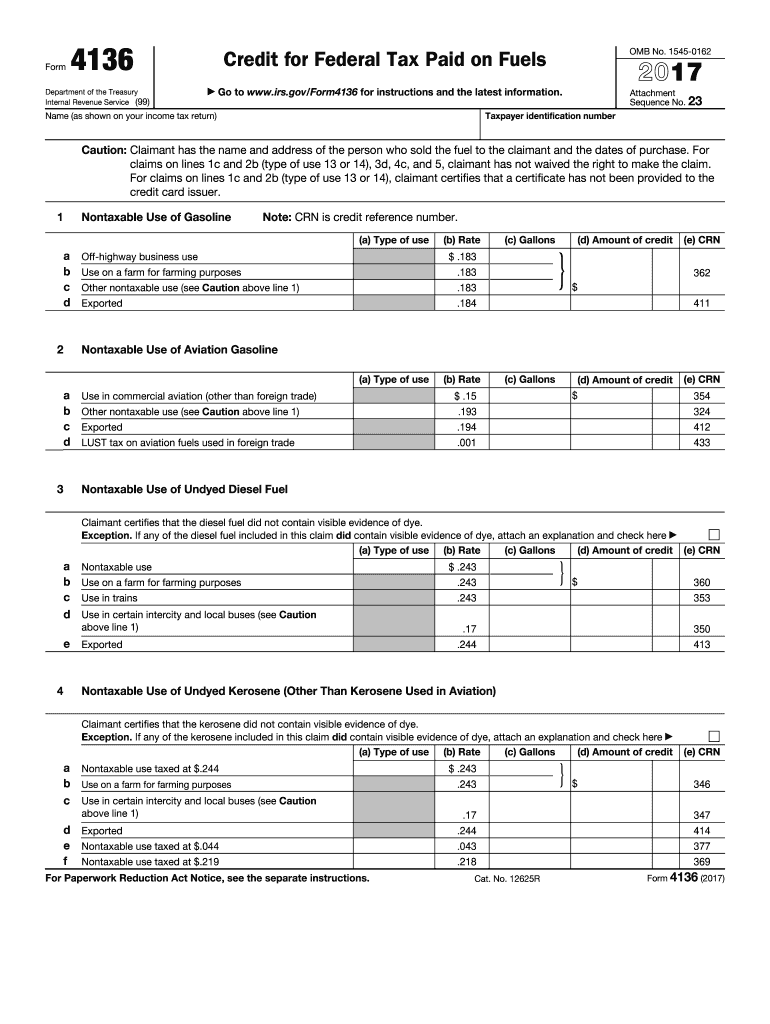

Form 4136, titled "Credit for Federal Tax Paid on Fuels," is used by taxpayers to claim credits for the excise tax paid on certain fuels. This form allows individuals and businesses to receive a refund for taxes paid on fuels used for nontaxable purposes, such as farming, nonprofit educational organizations, and certain government functions. The form is applicable for different types of fuel, including gasoline, aviation gasoline, undyed diesel fuel, and kerosene.

Primary Uses and Applications

- Nontaxable Fuel Activities: Taxpayers often engage in activities that necessitate fuel for non-commercial purposes. For example, farmers using diesel fuel for agricultural machinery or schools using buses for student transportation.

- Fuel Types Covered: The form covers various fuel types, emphasizing distinguishing between taxable and nontaxable uses to ensure accurate credit application.

Steps to Complete Form 4136

Completing Form 4136 accurately involves a structured approach to reporting fuel usage and calculating potential credits.

Detailed Completion Instructions

- Gather Necessary Information: Collect all relevant documents that show the purchase and usage of fuels, including receipts and logs.

- Identify Fuel Usage: Categorize all fuel usage into taxable and nontaxable, ensuring nontaxable usage aligns with IRS guidelines.

- Calculate Credits: Using the outlined rates in the form instructions, determine the credit amount for each type of fuel.

- Complete Required Sections: Fill each section of the form thoroughly, ensuring all information is accurate and complete.

- Review and Attach Documentation: Double-check entered information and attach any required supporting documents, such as purchase receipts or logs.

Who Typically Uses Form 4136

Varied groups and individuals commonly use this form to reclaim excise taxes paid on fuels.

Typical Users

- Farmers: Utilizing diesel and gasoline for non-highway agricultural equipment.

- Aviation Companies: Using aviation gasoline for exempt flights.

- Nonprofit Organizations: Utilizing fuels for exempt purposes under specific provisions.

IRS Guidelines and Legal Compliance

Following IRS guidelines ensures compliance when claiming fuel tax credits.

Key Compliance Requirements

- Correct Usage Documentation: Maintain detailed records of fuel usage and ensure it aligns with IRS guidelines for allowable nontaxable purposes.

- Accurate Rate Applications: Apply the correct rates per fuel type based on the IRS’s latest tables and regulations.

- Timely Filing: Adhere to IRS deadlines for filing the form to avoid penalties or disallowance of credit.

Penalties for Non-Compliance

Non-compliance with Form 4136 regulations can lead to significant penalties.

Common Penalties

- Disallowance of Credits: Filing inaccurate information or failing to meet documentation standards can result in denial of credits claimed.

- Monetary Penalties: Not meeting filing deadlines or intentionally misreporting fuel usage can incur fines.

Filing Deadlines and Important Dates

Adhering to specific deadlines ensures eligibility for credits and avoids unnecessary fines.

Critical Filing Periods

- Annual Filing Requirement: Form 4136 is typically filed annually with tax returns.

- Amended Returns: If necessary, amended returns must adhere to specific IRS deadlines to be valid.

Software Compatibility

Understanding software integration aids in streamlining form submission.

Compatible Software

- Tax Preparation Software: Popular options like TurboTax and QuickBooks facilitate electronic filing of Form 4136.

- IRS E-File System: Taxpayers can utilize the IRS e-file system for direct submissions, reducing processing time and enhancing accuracy.

Taxpayer Scenarios and Practical Examples

Examining real-world scenarios illustrates the form's practical applications.

Scenarios and Use Cases

- Small Business Owners: Utilizing fuels for non-commercial equipment may find significant tax savings through this form.

- Transportation Services: Operators using diesel for school transportation not aligned with regular commercial activities can claim credits.

By providing comprehensive coverage of Form 4136, this guide emphasizes the details needed for taxpayers to understand, complete, and comply with the requirements of claiming fuel tax credits, enhancing their document workflow efficiency.