Definition and Importance of ACH Letter to Vendors

An ACH letter to vendors is a formal document used to authorize the transfer of funds electronically through the Automated Clearing House (ACH) network. This letter signifies the vendor's agreement to receive payments via electronic methods, which provides advantages such as improved security and faster transaction processing compared to traditional paper checks. The ACH network is a highly efficient means for businesses and government entities to process payments and deposits, effectively reducing the risks of check fraud and the handling of physical cash.

Using ACH payments can significantly streamline the accounting processes for businesses. With automatic transfers, cash flow management becomes more predictable, as invoices are settled on a predetermined timeline. Additionally, such payments eliminate the need for constant communication regarding payment issues, as both parties have clarity on the payment schedule. Therefore, having a clear understanding of the ACH letter and its significance is vital for effective vendor management.

Key Elements of an ACH Letter to Vendors

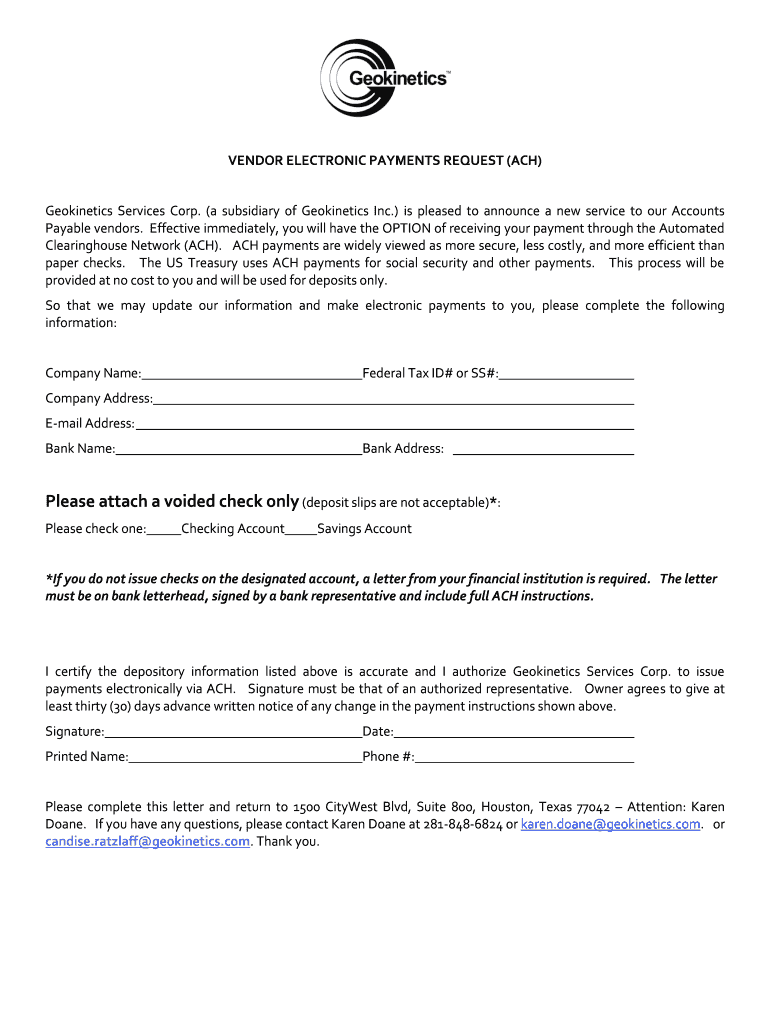

An effective ACH letter should include several critical components to ensure both clarity and legal compliance. Here are the elements that should be featured:

- Vendor Information: Include the vendor's name, address, and contact details, ensuring that the letter is specific to the recipient.

- Authorization Statement: A clear statement granting permission for ACH transactions to be initiated from the vendor's account.

- Banking Information: The vendor must provide their bank name, account number, and the routing number to facilitate electronic payments.

- Signature Line: A section for the vendor's authorized representative to sign, indicating their agreement with the terms specified in the letter.

- Effective Date: The date when the authorization becomes active, which helps in compliance tracking.

Each of these elements plays a vital role in ensuring that not only is the payment process more streamlined, but also that there is a thorough record of the agreed-upon terms.

Steps to Complete the ACH Letter to Vendors

Creating an ACH letter involves several straightforward steps, ensuring the document is accurate, detailed, and legally binding. Below is a step-by-step guide for drafting an ACH letter to vendors:

-

Collect Required Information:

- Gather necessary vendor details including name, address, and contact information.

- Obtain the vendor's bank account and routing numbers.

-

Draft the Letter:

- Create a clear and concise format that includes your company's letterhead.

- Begin with a formal salutation, addressing the vendor directly.

-

Include Essential Details:

- State the purpose of the letter and include an authorization statement allowing electronic payments.

- List the bank details accurately.

-

Review and Sign:

- Ensure all the information included is correct and reflects your intent.

- Require the vendor's authorized representative to sign the document.

-

Distribute Copies:

- Provide copies of the signed ACH letter to all relevant parties, both the vendor and your finance department.

Following these steps ensures that both parties have clarity on the payment method and that the process adheres to banking practices.

Examples of Using an ACH Letter to Vendors

To better understand the application of an ACH letter, consider the following scenarios:

-

Scenario 1: A company may implement ACH payments to streamline their accounts payable process. They issue ACH letters to all recurring vendors, enabling direct deposit payments on specific dates.

-

Scenario 2: A vendor may change their banking information and would thus send an updated ACH letter reflecting the new banking details. This ensures ongoing payments are routed correctly to avoid service disruptions.

These scenarios illustrate the practical benefits and applications of the ACH letter within real-time business transactions.

Legal Use and Compliance with ACH Letters

Legally, the ACH letter to vendors serves as an authorization document that complies with the Electronic Fund Transfer Act (EFTA) and must be handled with due diligence. The signed authorization grants payment rights to the payer while ensuring protection for both parties involved:

- Privacy Compliance: Ensure that the vendor's banking information is protected and used solely for payment processing purposes.

- Record Keeping: Maintain copies of all ACH letters in case of disputes or audits concerning payment processing.

Following these legal guidelines ensures that organizations are compliant with regulations and reduces potential risks that may arise from incorrect or unauthorized payments.