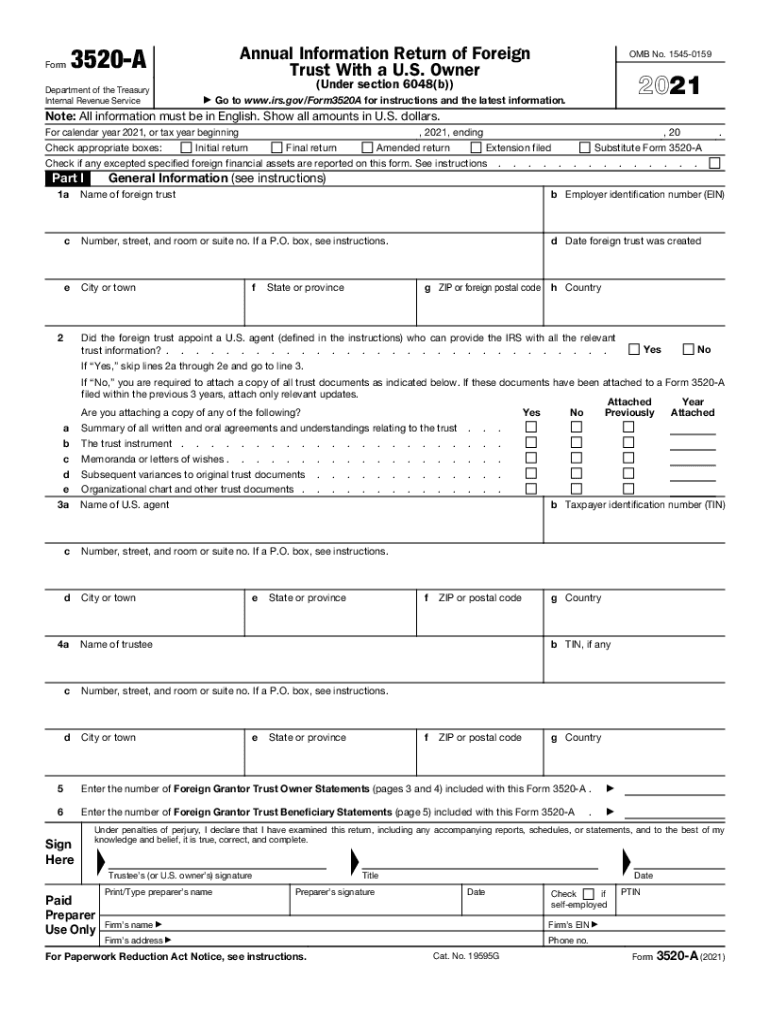

Definition and Meaning of Form 3520-A

Form 3520-A is known as the Annual Information Return of Foreign Trust with a U.S. Owner, mandated by the Internal Revenue Service (IRS). This form is required for U.S. owners of foreign trusts to report information pertaining to the trust's activities, income, and distributions for each tax year. Specifically, it collects crucial data on the trust’s income and expenses, any distributions made to U.S. beneficiaries, and other significant financial statements. The filing of this form is essential for maintaining compliance with U.S. tax laws, particularly under Internal Revenue Code Section 6048.

Understanding the nuances of Form 3520-A is vital for individuals who are U.S. beneficiaries of foreign trusts. Failure to file this form can lead to substantial penalties, and it is imperative to provide accurate and complete information. The IRS utilizes this form to monitor compliance with tax regulations related to offshore investments and structures.

Steps to Complete Form 3520-A

Completing Form 3520-A involves a structured approach. Here are the detailed steps:

-

Gather Required Information:

- Collect all necessary documents related to the foreign trust, including financial statements, records of distributions, and details on the trust's income and expenses.

- Identify the U.S. owner and any beneficiaries to ensure accurate reporting.

-

Understand the Form Sections:

- Familiarize yourself with the specific sections of Form 3520-A, which include information about the trust, the U.S. owner, annual income, and distributions made during the year.

- Each section has specific instructions, so it’s important to refer to the guidelines for how to fill them out.

-

Complete Each Section Accurately:

- Fill out the form meticulously, ensuring that all numerical entries are accurate and correspond to the supporting documentation.

- Provide the necessary details about the trust's financial activities, including any income earned and expenses incurred throughout the year.

-

Review and Validate:

- Carefully review the completed form for accuracy and completeness, ensuring every required field is filled out.

- Consider seeking advice or review from a tax professional specializing in international tax law to ensure compliance.

-

Submit the Form:

- Once you are confident in the accuracy of the information, submit the form to the IRS. Determine the appropriate filing method based on the latest IRS guidance: this may include electronic filing or mailing the form to the designated address.

Filing Deadlines and Important Dates for Form 3520-A

Adhering to specific deadlines for Form 3520-A is crucial for compliance with IRS regulations. The form is generally due on the 15th day of the third month following the close of the trust’s tax year. For example, if a trust’s tax year ends on December 31, the form should be filed by March 15 of the following year.

Important considerations include:

- Extensions: For those needing more time, a six-month extension can be requested under certain circumstances. However, this extension must be filed timely to avoid penalties.

- Penalties for Late Filing: The IRS enforces strict penalties for late submissions or failures to file Form 3520-A. These can include significant monetary fines, emphasizing the importance of timely and accurate filing.

- Annual Requirement: It is important to note that Form 3520-A must be filed annually, reflecting the ongoing reporting obligations for U.S. owners of foreign trusts.

Key Elements of Form 3520-A

Understanding the key elements of Form 3520-A is essential for effective completion and compliance. The form comprises several critical components:

- Trust Identification Information: Details regarding the name, address, and identification number of the foreign trust must be included.

- U.S. Owner Information: This section requires the disclosure of the U.S. owner’s name, address, and taxpayer identification number (TIN).

- Annual Financial Information: This encompasses the trust’s income, expenditures, distributions made to U.S. beneficiaries, and a comprehensive statement of assets.

- Additional Reporting Requirements: Depending on the trust's activities, there may be supplementary schedules or statements required to provide complete transparency about the trust's financial dealings.

Filling out these sections accurately ensures proper disclosure and compliance with IRS regulations, thus minimizing the risk of penalties.

Examples of Using Form 3520-A

Real-life scenarios illustrate the practical application of Form 3520-A. These examples highlight its importance in various circumstances:

- Example 1: A U.S. citizen inherits a foreign trust from a relative living abroad. The inheritance requires that the beneficiary file Form 3520-A yearly to report any distributions received and the trust's ongoing income.

- Example 2: An American expatriate establishes a trust in a foreign jurisdiction while residing overseas. As the U.S. owner of the trust, the expatriate is obligated to submit Form 3520-A annually to report the trust's financial activities, ensuring compliance with both U.S. and foreign tax laws.

- Example 3: A U.S. citizen who owns a business in a foreign country sets up a trust to manage business profits. The owner must file Form 3520-A, detailing income earned by the trust and any distributions made to beneficiaries.

These examples underscore the critical role of Form 3520-A in ensuring transparency, compliance, and adherence to U.S. tax obligations related to foreign trusts.