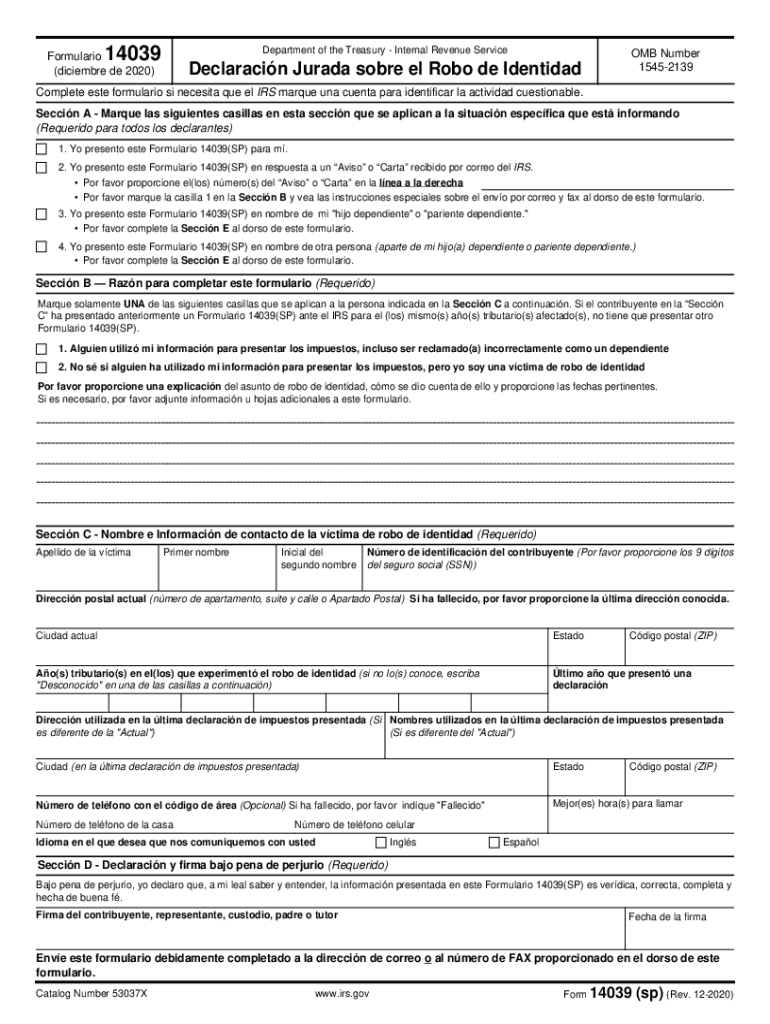

Definition and Purpose of IRS Form 14039

IRS Form 14039 is a declaration form intended for individuals who suspect that they have been victims of identity theft, particularly in relation to their tax filings. This form allows taxpayers to notify the Internal Revenue Service (IRS) that their personal information may have been misused for tax-related purposes, which is crucial for protecting themselves from further fraudulent activity. By submitting this form, taxpayers can initiate a process to secure their tax records and ensure that their personal information is accurately represented in the IRS's systems.

The form consists of different sections that help the IRS identify the victim and understand the circumstances surrounding the identity theft. Key components include:

- Victim Identification: Sections for entering the victim's name, social security number, and contact details.

- Identity Theft Circumstances: A space for detailing how the victim's information was compromised, such as through stolen documents, mail interception, or phishing scams.

- Submission Instructions: Guidance on how to send the form to the IRS to ensure it is processed effectively.

Understanding IRS Form 14039 is essential for individuals who wish to safeguard their tax status and prevent potential consequences of tax-related identity theft.

Steps to Complete IRS Form 14039

Filling out IRS Form 14039 accurately is critical to alerting the IRS about potential identity theft. The process involves several steps to ensure all necessary information is accurately provided.

-

Download the Form: Obtain the latest version of IRS Form 14039 from the IRS website or reliable sources. Ensure that you have the most recent version.

-

Fill Out Personal Information:

- Enter your full name, current address, and Social Security number.

- Include a daytime phone number for easier communication with the IRS.

-

Describe the Identity Theft:

- Provide detailed information about how you suspect your personal information was compromised.

- Examples may include receiving unexpected tax documents, notices from the IRS, or missing tax refunds.

-

Signature: After reviewing the information for accuracy, sign and date the form. A signature validates the authenticity of your claim.

-

Submit the Form:

- Send the completed form to the IRS by the specified method, which can include mail or online options based on current IRS guidelines.

When completed accurately, IRS Form 14039 serves as a formal notification to the IRS, helping to initiate the identity theft resolution process.

Who Typically Uses IRS Form 14039

IRS Form 14039 is most commonly used by individuals who have discovered that they are victims of identity theft, especially regarding their tax filings. The following groups may find this form relevant:

- Taxpayers Receiving Unfamiliar IRS Correspondence: Individuals who receive tax documents or notices from the IRS regarding tax returns they did not file or are unaware of.

- Victims of Fraud: Those who have had their personal information stolen through methods such as phishing, hacking, or social engineering.

- Individuals Noticing Discrepancies: Taxpayers who notice unusual activity on their tax accounts, such as unexpected refunds or audits.

This form is vital for anyone needing to formally report identity theft to the IRS, enabling them to safeguard their tax identities and recover from fraudulent activities.

Filing Methods for Form 14039

Completing and submitting IRS Form 14039 can be done through various methods to cater to different preferences and circumstances. Each method has specific guidelines to ensure proper filing.

Online Submission

- e-File: If applicable, some taxpayers can file Form 14039 through their tax preparation software, especially if the software supports identity theft case submissions directly to the IRS.

Mail Submission

- Paper Submission: For those who prefer traditional methods or if online filing is not available, the form can be printed and mailed to the IRS address specified in the instructions. It is essential to send it via a trackable service to confirm receipt.

In-Person Options

- Local IRS Office: Individuals may also choose to visit their local IRS office for assistance. This can be particularly helpful for those needing additional support.

Using the correct submission method is crucial for ensuring that the IRS receives your identity theft declaration promptly and effectively.

Important Terms Related to IRS Form 14039

Understanding the terminology associated with IRS Form 14039 can help clarify its purpose and usage. Here are some key terms:

- Identity Theft: This refers to the unauthorized use of someone else's personal information, typically for financial gain, such as filing fraudulent tax returns.

- Victim: The individual whose personal information has been compromised.

- IRS Identity Protection Specialized Unit: A dedicated unit within the IRS that assists victims of identity theft in resolving their cases.

- Form Submission: The process of sending IRS Form 14039 to the IRS, which can be done online, in person, or via mail.

Familiarity with these terms can enhance comprehension of the identity theft reporting process and the actions necessary to protect oneself from tax-related fraud.

Required Documents for Filing IRS Form 14039

When filing IRS Form 14039, supporting documentation plays a critical role in effectively reporting identity theft. While the form itself collects essential information, the following documents may be required or beneficial:

- Government-issued Identification: A copy of your driver's license, state identification, or passport may be necessary to verify your identity.

- Proof of Identity Theft: Any documents that substantiate your claim, such as fraudulent notices from the IRS or correspondence indicating suspicious activity.

- Tax Returns: Copies of the last few years of your tax returns might help the IRS assess the validity of your claim.

Having these documents ready can streamline the process and maximize the efficiency of the IRS's response to the identity theft report.