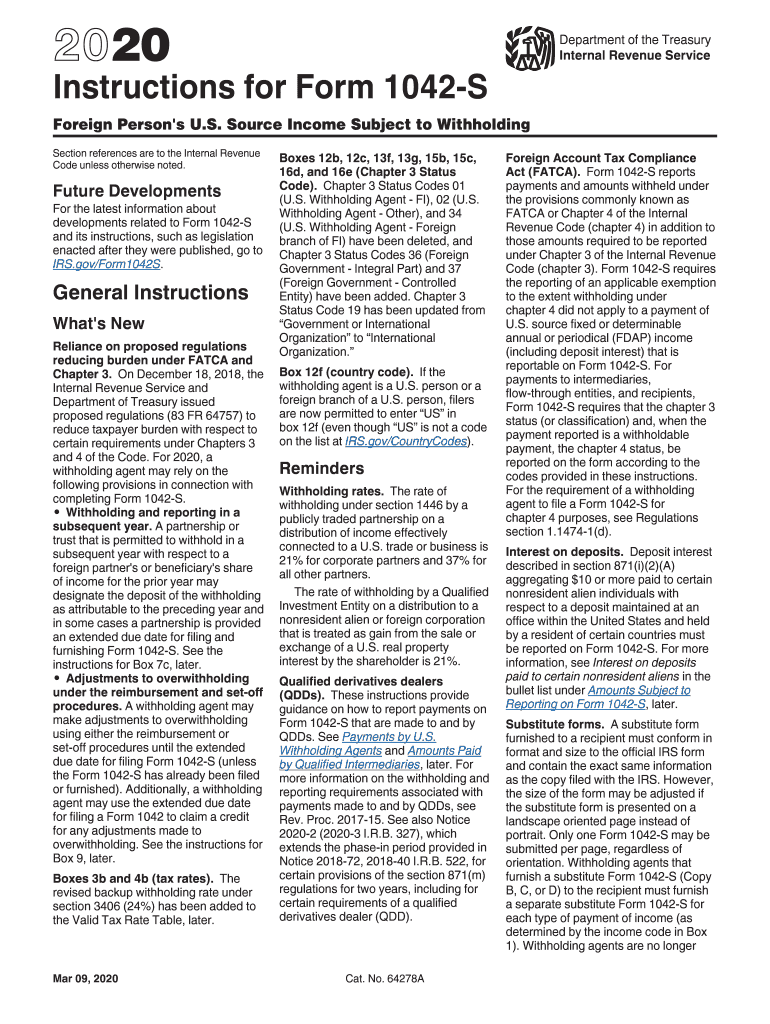

Definition and Purpose of IRS Form 1042-S

IRS Form 1042-S is a tax form used to report income that is sourced in the United States and paid to foreign persons. This includes individuals, corporations, or partnerships that are not considered U.S. residents for tax purposes. The form details income that is subject to withholding tax under U.S. tax regulations. The primary focus of this form is to report payments such as interest, dividends, rents, salaries, and other forms of compensation that require withholding tax.

Key aspects of Form 1042-S include:

- Withholding Requirements: Payors of U.S. source income must withhold tax on payments made to foreign persons. The required withholding tax rates can vary depending on the type of income and tax treaties in place.

- Reporting Obligations: Filing this form is essential for compliance with IRS regulations and enables the IRS to monitor income distributions to foreign persons.

- Recipient Information: Each form must include critical information about the foreign recipient, such as their name, address, and taxpayer identification number.

Understanding the role and necessity of Form 1042-S is crucial for both payors and recipients in managing U.S. tax obligations properly.

Steps to Complete IRS Form 1042-S

Completing Form 1042-S requires attention to detail and a clear understanding of the fields provided on the form. Follow these steps for accurate completion:

- Obtain the Form: Access the form from the IRS website or tax preparation software.

- Fill in Payor Information: Enter your name, address, and Employer Identification Number (EIN).

- Recipient Details: Provide the payee's information, including:

- Name

- Address

- Country of residence

- Tax identification number, if applicable

- Payment Amount: Report the total amount of U.S. source income paid to the recipient. This section may also require you to state the portion of the income designated as tax-exempt, if applicable.

- Withholding Tax: Indicate the amount withheld for U.S. taxes, which typically corresponds to the income type and the tax treaty rate.

- Classification Code: Use the codes provided in the form instructions to categorize the type of payment and the recipient’s status, as this affects withholding rates.

- Sign and Date the Form: Affirm that the information provided is accurate to the best of your knowledge.

Each step is essential, as inaccuracies can lead to penalties or incorrect tax outcomes for both payors and recipients.

Important Terms Related to IRS Form 1042-S

Familiarity with key terms related to Form 1042-S is essential for effective tax reporting. Here are some terms commonly associated with this form:

- Withholding Agent: The individual or entity responsible for managing the withholding taxes and ensuring that Form 1042-S is correctly filed.

- Tax Treaty: Agreements between the U.S. and other countries that might reduce the withholding tax rate on certain types of income for foreign entities.

- FIRPTA: The Foreign Investment in Real Property Tax Act, which can influence tax treatment and reporting for foreign investors in U.S. properties.

- Exempt Organization: Entities that may be exempt from U.S. withholding, such as certain foreign governments or international organizations.

Understanding these terms ensures clarity and accuracy when interacting with Form 1042-S and U.S. tax law.

Filing Deadlines and Important Dates for IRS Form 1042-S

Timelines associated with Form 1042-S filing are critical to avoid penalties. Key dates include:

- February 28: By this date, the Form 1042-S must be filed with the IRS if submitted on paper.

- March 15: If filing electronically, the deadline extends to this date.

- Recipient Copies: Payors must furnish copies of Form 1042-S to recipients by March 15, ensuring they have the necessary documents for their tax records.

Being aware of these deadlines helps taxpayers maintain compliance with the IRS and avoid unnecessary penalties.

Penalties for Non-Compliance with IRS Form 1042-S

Failing to properly file Form 1042-S or submitting inaccurate information can result in significant penalties. These include:

- Failure to File Penalties: Penalties imposed for not filing Form 1042-S by the due date, which can accumulate depending on how late the form is submitted.

- Inaccurate Information: If incorrect data is reported—such as wrong payment amounts or missing recipient identification—the IRS may also impose fines.

- Effective Dates: Penalties can vary based on when the form was submitted relative to the deadline, and ongoing failure to comply can lead to increased scrutiny from the IRS.

Being informed about potential penalties serves as a crucial motivator for timely and accurate reporting.