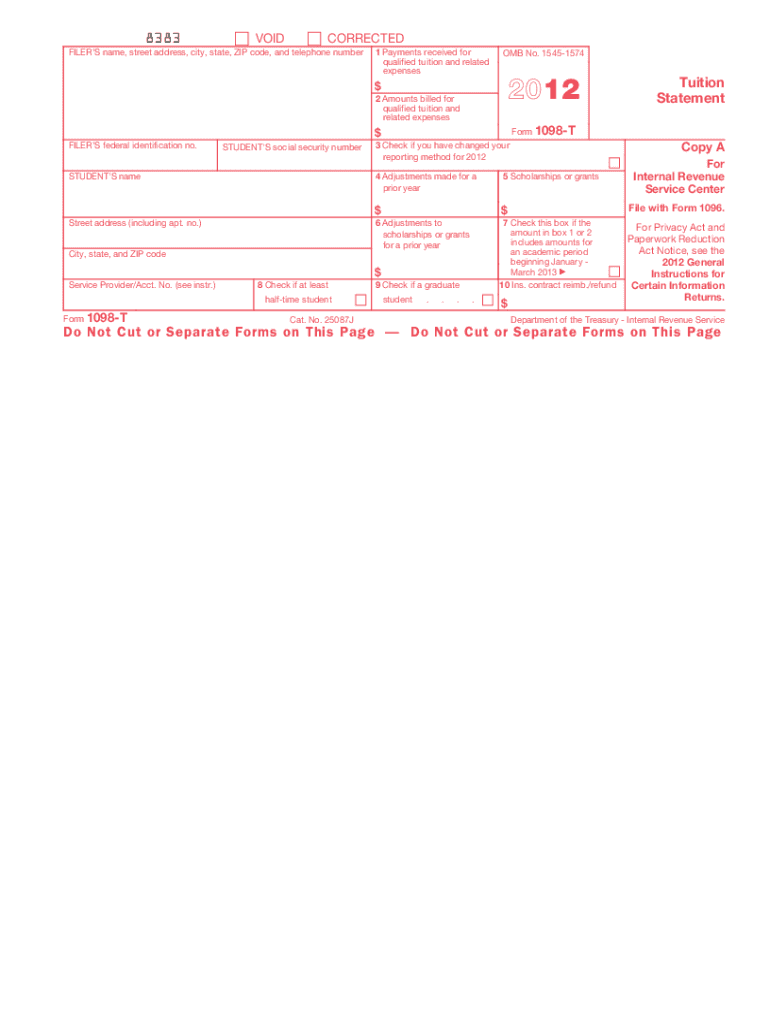

Definition and Purpose of the 2-T Form

The 2-T form is an Internal Revenue Service (IRS) document used by eligible educational institutions in the United States to report qualified tuition and related expenses paid by students. This form facilitates tax deductions or credits available to students and their families for higher education costs. Institutions are required to provide this form to students and the IRS to ensure transparency in financial reporting regarding tuition expenses.

Key purposes of the 2-T form include:

- Reporting qualified tuition and related expenses to the IRS.

- Providing students with necessary information to claim education-related tax credits, such as the American Opportunity and Lifetime Learning Credits.

- Reporting scholarships and grants that may reduce taxable income.

Understanding its significance is crucial for students aiming to maximize their education-related tax benefits.

Steps to Complete the 2-T Form

Completing the 2-T form involves several key steps to ensure accuracy and compliance. Here’s a structured approach:

-

Gather Required Information:

- Collect the student’s personal details, including name, Social Security number (SSN), and the institution's name and Employer Identification Number (EIN).

- Compile all relevant documentation regarding tuition payments and any financial aid received.

-

Fill Out the Form:

- Enter the student’s identifying information accurately.

- In Box 1, report the payments received for qualified tuition and related expenses during the calendar year.

- In Box 2, if applicable, enter amounts billed for qualified tuition. However, note that the 2012 version emphasizes Box 1 over Box 2.

-

Report Grants and Scholarships:

- In Box 5, report any scholarships or grants received by the student during the year which may offset the tuition paid.

-

Submitting the Form:

- Ensure all information is accurate to avoid penalties. Submit the form both to the IRS and provide a copy to the student by the designated deadline.

-

Maintain Records:

- Keep copies of the 1098-T form and supporting documents for your records for at least three years, as required for potential audits.

By following these steps, both educational institutions and students can ensure proper reporting and compliance regarding tuition expenses.

Who Typically Uses the 2-T Form?

The 2-T form is primarily used by the following individuals and organizations:

-

Eligible Educational Institutions:

- Colleges, universities, and vocational schools that provide higher education are required to issue the 1098-T form to their enrolled students who meet specific criteria.

-

Students and Their Families:

- Eligible students attending these institutions utilize the form to claim tax deductions or credits that can reduce their overall tax liability.

-

Tax Preparers:

- Tax professionals and preparers use the 1098-T form to prepare tax returns for clients who are students or parents paying for a student’s education.

-

Financial Aid Administrators:

- These professionals may rely on the information provided within the form to guide students regarding their financial aid packages and tax obligations related to educational costs.

Understanding who utilizes the 2-T form helps clarify its role in the broader context of educational finance and tax compliance.

Filing Deadlines and Important Dates for the 2-T Form

Filing deadlines for the 2-T form are crucial for compliance and to ensure students can take advantage of available tax credits. The deadlines include:

-

January 31, 2013: By this date, institutions must provide copies of the 1098-T form to students. This early notification allows students to prepare their tax returns in a timely manner.

-

February 28, 2013: Educational institutions must file the paper version of the 1098-T form with the IRS by this date.

-

April 1, 2013: If applicable, institutions filing electronically must submit the form to the IRS by this date. This option often allows for faster processing and error corrections.

Failing to meet these deadlines could result in penalties for the institution and missed opportunities for students to claim education-related tax benefits.

Important Terms Related to the 2-T Form

Understanding key terminology associated with the 2-T form can significantly aid in navigating the complexities of educational tax benefits. Here are essential terms:

-

Qualified Tuition and Related Expenses:

- These are costs associated with attending an eligible educational institution, including tuition and fees required for enrollment or attendance.

-

American Opportunity Credit:

- A tax credit that allows eligible students to claim up to two thousand five hundred dollars per eligible student for qualified education expenses.

-

Lifetime Learning Credit:

- This credit allows taxpayers to claim up to two thousand dollars per tax return for qualified tuition and related expenses for any post-secondary education.

-

Scholarships and Grants:

- Financial aid that does not need to be repaid, which can affect the total amount claimable under education tax credits.

By familiarizing oneself with these terms, students and filers can enhance their understanding of the benefits and compliance required when dealing with the 2-T form.