Definition & Meaning of the 2008 Form 990

The 2008 Form 990 is a federal tax document required by the Internal Revenue Service (IRS) for organizations exempt from income tax under section 501(a) of the Internal Revenue Code. This form serves as an informational return that provides essential details about the organization’s financial activities, governance, and compliance with tax regulations. It is a critical tool for maintaining transparency between organizations and the IRS, as well as providing data for public disclosure.

Purpose of the Form

- Transparency: The form ensures that nonprofit organizations disclose their financial practices to the public, promoting accountability.

- Tax Compliance: Organizations use it to report income, expenditures, and financial status to avoid potential tax liabilities.

- Public Support Verification: Nonprofit organizations must demonstrate their public support for continued tax-exempt status.

Key Components

- Financial Statements: Includes revenues, expenses, assets, and liabilities.

- Program Accomplishments: Organizations must articulate their efforts and accomplishments in fulfilling their mission.

- Governing Body Information: Disclosures regarding the board of directors and key personnel are crucial to understand governance practices.

IRS Guidelines for Completing the 2008 Form 990

The IRS provides comprehensive guidelines for completing the 2008 Form 990. Adhering to these guidelines ensures accurate reporting and compliance.

Key Instructions

- Accurate Financial Reporting: Organizations must report all sources of income and categorize expenditures thoughtfully.

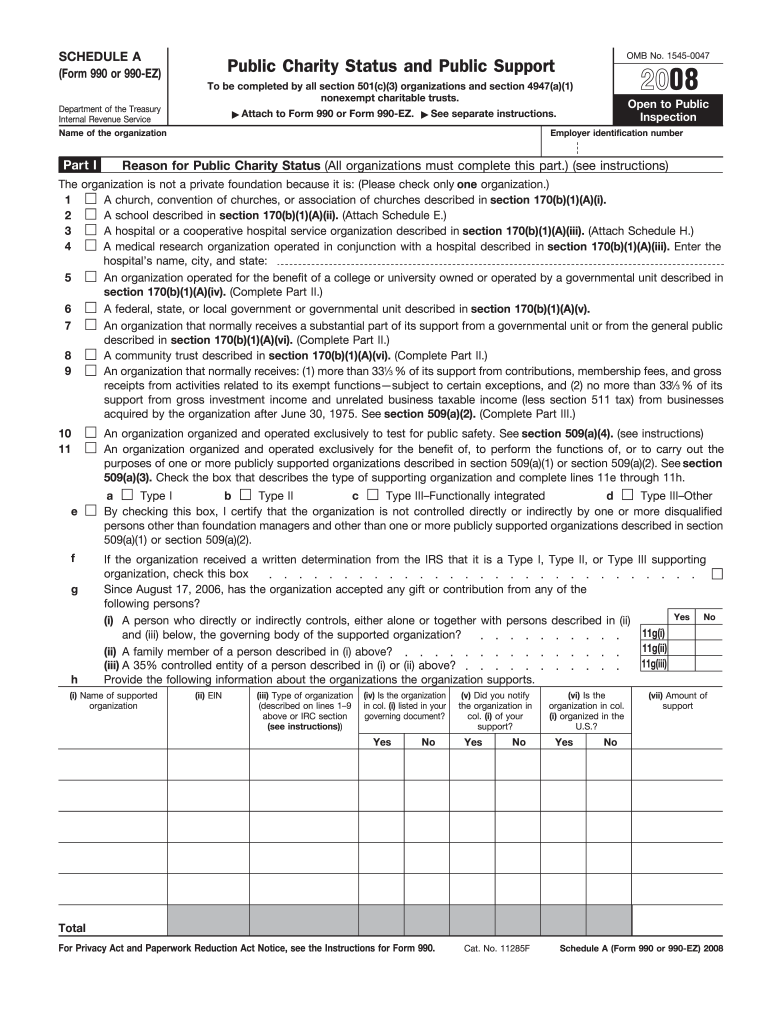

- Important Schedules: Some nonprofits will need to complete specific schedules that provide additional details pertinent to their operations, such as Schedule A for public charity status.

- Deadlines for Filing: The form is due on the 15th day of the 5th month after the end of the organization's tax year, with allowable extensions available.

Common Errors to Avoid

- Omissions: Failing to report all relevant income sources can lead to penalties.

- Inaccurate Data: Misclassifying expenses or revenues can complicate audits and lead to compliance issues.

- Late Submissions: Missing the deadline can incur significant penalties.

Steps to Complete the 2008 Form 990

Completing the 2008 Form 990 involves multiple steps that require careful attention to detail. Below are the essential steps organizations should follow for the successful completion of the form.

Preparation Steps

- Gather Financial Records: Collect financial statements, bank statements, and other pertinent documents.

- Identify Required Schedules: Determine which schedules must accompany the main form based on the organization’s circumstances.

- Review IRS Instructions: Familiarize yourself with IRS instructions specific to the 2008 Form 990.

Completion Steps

- Fill Out General Information: Enter the organization’s name, address, and Employer Identification Number (EIN).

- Report Revenue and Expenses: Provide a detailed account of the organization's income sources and expenditures.

- Document Programs and Achievements: Articulate how the organization’s activities align with its mission and contributions to the community.

- Review and Submit: Double-check all entries for accuracy before submitting the form electronically or via mail.

Filing Deadlines / Important Dates for the 2008 Form 990

Filing deadlines are crucial for compliance with the IRS regulations regarding the 2008 Form 990. Organizations must be diligent in meeting these dates to avoid penalties.

Key Dates

- Initial Due Date: The original due date for filing the 2008 Form 990 is May 15, 2009, for organizations operating on a calendar year basis.

- Extended Deadline: Organizations can extend the deadline by filing Form 8868, allowing up to six additional months, making the extended due date November 15, 2009.

- Annual Requirement: Nonprofits must file the form annually, and it is essential to keep track of yearly deadlines.

Important Terms Related to the 2008 Form 990

Familiarity with specific terminology related to the 2008 Form 990 enhances understanding and compliance. Key terms in this context include:

Essential Terminology

- 501(c)(3): A designation for organizations that are exempt from federal income tax and recognized as charitable.

- Public Charity: A type of nonprofit that typically receives a substantial portion of its support from the public or governmental units.

- Schedule A: An attachment to Form 990 for public charities to document their public support test and compliance.

- Unrelated Business Income: Income generated from activities not substantially related to an organization’s exempt purpose that may be subject to taxation.

Examples of Using the 2008 Form 990

Real-world scenarios illustrate how various organizations utilize the 2008 Form 990 for compliance and transparency.

Case Study Examples

- Local Nonprofit Organization: A local charitable organization uses Form 990 to report its fundraising efforts and educational programs, demonstrating its commitment to community development.

- Health Services Provider: A nonprofit health services provider files Form 990 to disclose financial information, ensuring stakeholders are aware of how donations are being utilized for community health initiatives.

- Cultural Arts Organization: An arts nonprofit reports significant grants received and expenses incurred for community art projects, highlighting the impact of public funding on local culture.

These examples showcase the diverse applications and importance of the 2008 Form 990 across different types of organizations, reinforcing accountability, transparency, and compliance in the nonprofit sector.