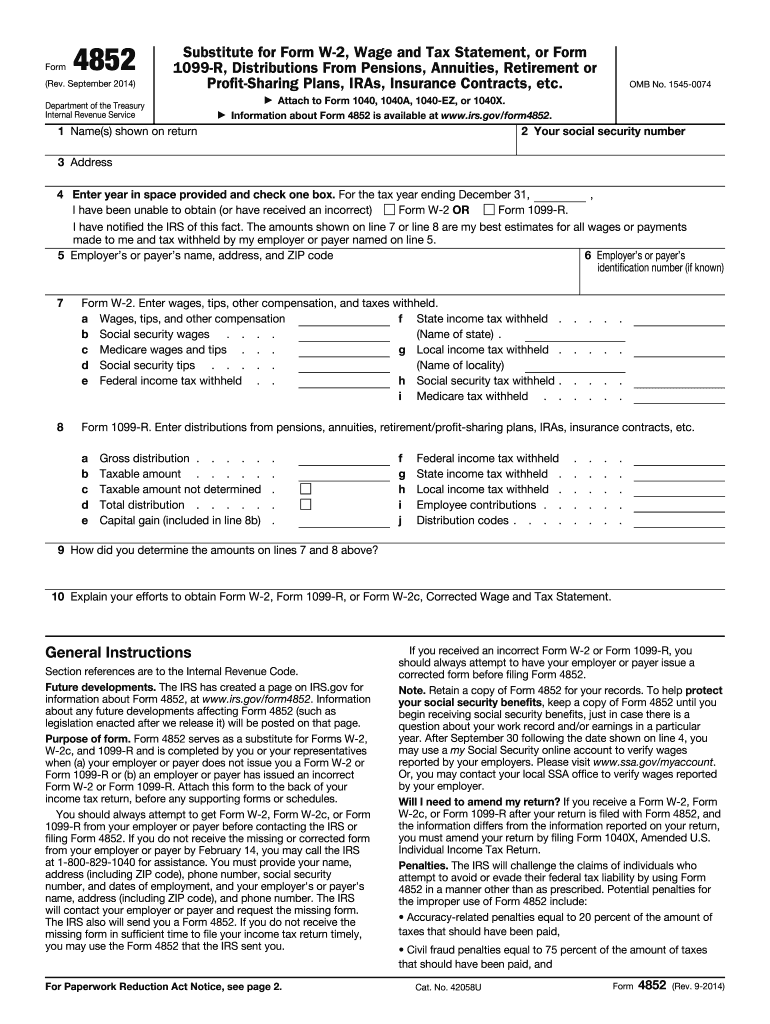

Definition and Purpose of Form 4

Form 4852, known as a substitute for Form W-2 and Form 1099-R, is crucial when taxpayers are unable to obtain these forms from their employers or if the forms received contain inaccurate information. It allows taxpayers to approximate their wages and tax withholdings, which can be critical during tax filings. The form ensures that individuals can accurately report their earnings and withheld taxes when filing their income tax returns using forms like the 1040. Understanding its purpose highlights its importance in maintaining compliance with federal tax obligations.

How to Use Form 4

Using Form 4852 involves several steps to ensure accurate and complete submission. Taxpayers must estimate their wages and taxes withheld. The form requires detailed information on employer efforts and any correspondence regarding the attempt to obtain official forms. It is necessary to attach Form 4852 to the taxpayer's income tax return, providing the IRS with a clear understanding of the estimated amounts reported. Understanding how to use this form ensures accurate reporting, preventing potential issues with tax filings.

Steps to Complete Form 4

Completing Form 4852 involves meticulous attention to detail. Here is a step-by-step process:

- Personal Information: Fill in necessary personal details like name, Social Security Number, and address.

- Employer Information: Provide your employer’s name, address, and Tax Identification Number (if known).

- Wages and Withholdings: Estimate wages earned and taxes withheld using pay stubs or other financial records.

- Efforts to Obtain Forms: Document all attempts to secure missing or corrected forms through written records and communication logs.

- Sign and Attach: Sign the form and attach it to your federal income tax return.

Ensure accuracy in each step to avoid discrepancies with the IRS.

Key Elements and Sections of Form 4

Form 4852 contains several critical components:

- Employee Information Section: Includes fields for taxpayer identification.

- Employer Information Section: Captures details necessary to identify the employer.

- Wage and Tax Estimation Section: Requires estimates using available financial data.

- Effort Documentation Section: Provides a space for taxpayers to outline steps taken to obtain appropriate tax documents.

These elements together ensure the form serves its purpose effectively by collecting all relevant data required by the IRS.

Legal Use and Compliance for Form 4

Form 4852 serves a legal function by officially recognizing income and tax withholdings when documentation from an employer is missing or inaccurate. It must be completed truthfully and accurately, under the penalties of perjury, as it replaces standard tax documents. Compliance with the legal requirements of the form includes retaining copies for personal records and presenting comprehensive documentation of all relevant communications when necessary. Misuse of the form can lead to penalties or legal issues, emphasizing the need for honest completion.

Required Documents for Accurate Completion of Form 4

To accurately complete Form 4852, gather the following documents:

- Previous Pay Stubs: Estimate wages and withheld taxes.

- End-of-Year Payroll Summary: Organize annual income.

- Written Employer Correspondence: Document interactions related to obtaining missing tax forms.

- Previous Year’s Tax Return: Serve as a reference for consistent reporting.

These documents ensure that reported amounts are as accurate as possible, reflecting correct financial situations.

IRS Guidelines for Filing Form 4

The IRS provides specific guidelines for the completion and submission of Form 4852. Taxpayers should not file Form 4852 electronically; it must be attached to a paper tax return. When estimating earnings and withholdings, accuracy is crucial to reflect the closest approximation. The IRS emphasizes the importance of detailed records demonstrating attempts to obtain the correct W-2 or 1099-R forms. Following these guidelines helps maintain compliance and reduces the risk of filing errors.

Examples and Scenarios for Using Form 4

Form 4852 is particularly beneficial in the following scenarios:

- Incomplete or Incorrect Forms From Employer: Employees receive forms with errors that the employer is unwilling or unable to correct.

- Non-receipt of Form Due to Employer Shutdown: A company closes or changes ownership, preventing the issuance of correct forms.

- Disputes Over Wages and Withholdings: Employees and employers disagree on reported income or withholdings.

These examples illustrate situations when using Form 4852 is necessary to ensure accurate tax filing, circumventing potential roadblocks in acquiring standard forms.