Definition & Meaning

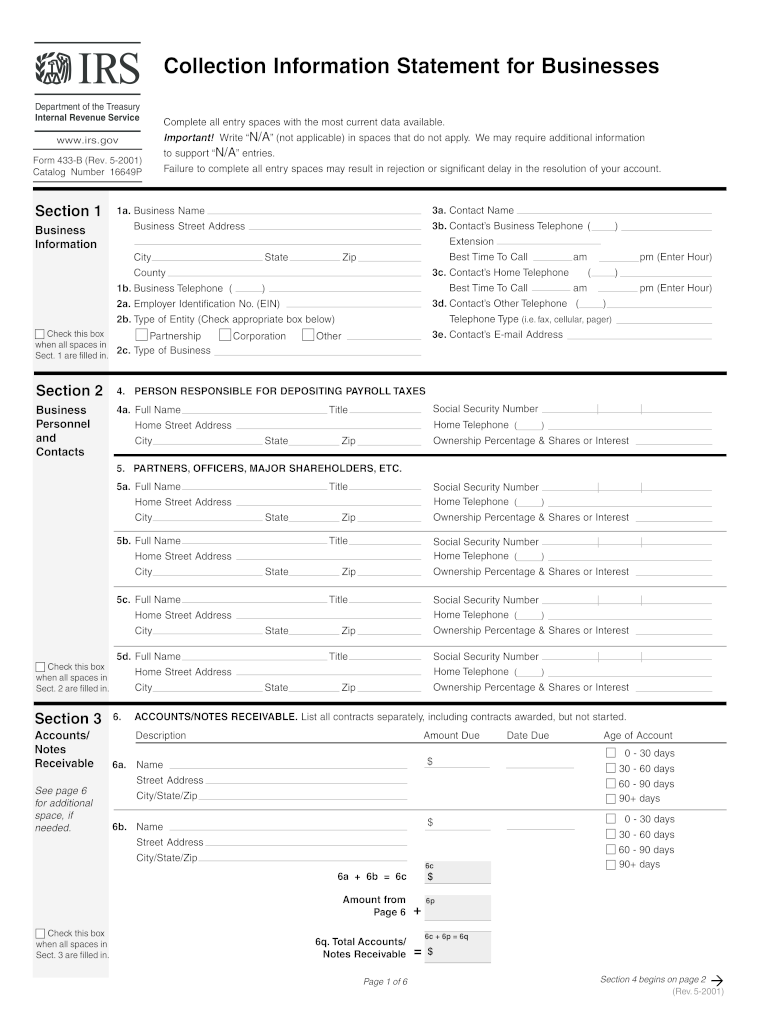

IRS Form 433-B is a critical document used by businesses to provide the IRS with detailed financial information, specifically detailing business income and expenses, assets, liabilities, and other financial obligations. This form, particularly the 2001 version, is integral in assessing a business’s current ability to pay tax liabilities. As a "Collection Information Statement for Businesses," its primary purpose is to assist in the resolution of tax issues by offering a thorough snapshot of the business's financial standing. Using this form is essential for businesses facing collection actions, allowing them to negotiate payment plans or other resolutions with the IRS.

Steps to Complete IRS Form 433-B 2001

Completing IRS Form 433-B efficiently requires careful attention to detail. Here's a step-by-step guide to help navigate the process:

-

Gather Required Documents:

- Financial statements

- Bank statements

- Inventory valuations

- Accounts receivable details

-

Fill Out Business Information:

- Enter the business name, address, Employer Identification Number (EIN), and type of business entity.

- This section establishes the identity and type of business.

-

Detailed Reporting of Business Assets:

- List all assets including real estate, equipment, and vehicles.

- Provide current market value and any associated debts or liens.

-

Revenue and Expense Analysis:

- Calculate monthly income derived from various sources.

- Detail all expenses, making sure to include payroll, rent, and utilities.

-

List of Creditors:

- Provide names and contact details for all business creditors.

- Include amounts owed and payment terms.

-

Verification and Submission:

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Important Terms Related to IRS Form 433-B 2001

Understanding key terms associated with IRS Form 433-B can enhance clarity and accuracy:

- Accounts Receivable: Money owed to the business by its customers.

- Liabilities: Financial obligations the business must pay.

- EIN (Employer Identification Number): A unique identifier for a business entity used by the IRS.

- Assets: All valuable property owned by the business, including cash, real estate, and inventory.

Legal Use of IRS Form 433-B 2001

IRS Form 433-B must be used in compliance with U.S. tax laws. This form serves as a legally binding document, meaning all information provided should be accurate and truthful. Any discrepancies or fraudulent entries can result in penalties or legal action by the IRS. The form is typically used to propose installment agreements or offers in compromise when a business cannot pay its full tax debt upfront.

Key Elements of IRS Form 433-B 2001

- Business Identification: Ensures that the IRS can clearly identify the business submitting the form.

- Financial Disclosures: Detailed reporting of both income and expenditures.

- Asset Declarations: Comprehensive listing of all business assets and their valuations.

- Debt Documentation: Clear identification of obligations and creditors.

Who Typically Uses IRS Form 433-B 2001

Businesses facing financial difficulties in meeting their tax liabilities typically utilize IRS Form 433-B. This includes various business entities such as:

- Sole Proprietorships

- Partnerships

- LLCs (Limited Liability Companies)

- Corporations

These business types use Form 433-B to negotiate terms with the IRS to alleviate the burden of immediate tax payments.

IRS Guidelines

The IRS has outlined specific guidelines to ensure proper usage of Form 433-B. Depending on various factors like business size and tax obligations, the form should be used to report complete and accurate financial information. Additionally, businesses should adhere to IRS instructions to maintain compliance and ensure the integrity of negotiations.

Penalties for Non-Compliance

Failing to properly complete or submit Form 433-B can result in significant penalties. These may include fines, interest on unpaid taxes, or enforcement actions like liens and levies. Therefore, it is crucial for businesses to be thorough and accurate, ensuring all information reflects the true financial condition of the business.

Required Documents

When preparing to complete IRS Form 433-B, businesses should gather several key documents to provide the necessary information, including:

- Current Financial Statements

- Most Recent Tax Returns

- Details of All Assets and Liabilities

- Credit Reports

Having these documents ready ensures that all sections of the form are completed accurately and efficiently.