Definition and Significance of the 1601 C Excel Format

The 1601 C Excel format refers to the electronic version of the BIR (Bureau of Internal Revenue) Form No. 1601-C, which is used for the monthly remittance return of income taxes withheld on compensation in the Philippines. This form is vital for employers and withholding agents who are responsible for deducting income tax from their employees’ compensation. The Excel format allows users to efficiently input, calculate, and submit data, ensuring full compliance with tax regulations.

The significance of using the 1601 C Excel format lies in its ease of use and accuracy in tax computations. By utilizing an Excel file, users can take advantage of built-in functionalities, such as formulas and error-checking features, to ensure that all entries are correct before submission. This format is particularly beneficial for organizations that handle multiple employee records, as it simplifies data management and reporting.

How to Obtain the 1601 C Excel Format

Obtaining the 1601 C Excel format is straightforward. The form is typically available on the Bureau of Internal Revenue's official website, allowing users to quickly access the necessary documents. Here are the steps to obtain the form in Excel format:

- Visit the BIR's official website or designated platform.

- Navigate to the section dedicated to downloadable forms.

- Locate Form 1601-C and select the Excel format option.

- Download the Excel file to your device.

- Ensure that you save the file in a convenient location for easy access when needed.

This Excel file can be opened using software like Microsoft Excel or Google Sheets, allowing for easy editing and calculations.

Steps to Complete the 1601 C Excel Format

Completing the 1601 C Excel format involves several detailed steps to ensure accurate data entry. Below are the fundamental steps to guide you through the process:

- Open the Excel File: Launch the downloaded Excel file for Form 1601-C.

- Fill in Tax Period Details: Enter the relevant month and year for which you are reporting.

- Input Employee Information:

- For each employee, input the following:

- Name

- Tax Identification Number (TIN)

- Gross compensation

- Total withholding tax

- For each employee, input the following:

- Calculate Tax: Ensure the Excel file has formulas to calculate the withholding tax accurately based on the latest tax tables provided by the BIR.

- Review and Validate Data: Check for any inconsistencies or errors in the data input.

- Save Your Work: Regularly save the updated file to avoid any data loss.

- Export if Necessary: Depending on filing requirements, you may need to save the completed form in PDF format for submission purposes.

Completing the form accurately is crucial to avoid penalties associated with misreporting or late submissions.

Importance of Using the 1601 C Excel Format

Utilizing the 1601 C Excel format offers numerous advantages for employers and administrators. Notably, it simplifies complex data entry tasks and standardizes reporting processes. Here are some reasons why using this format is beneficial:

- Efficiency: Automated calculations save time, making it easier to manage multiple employees' data.

- Accuracy: The embedded formulas reduce the risk of human error in computations.

- Accessibility: Excel files can be shared across teams, ensuring that everyone involved has access to the most current information.

- State Compliance: Using the right format ensures compliance with governmental tax regulations, which is crucial for avoiding legal issues.

- Ease of Submission: The Excel format can generally be converted into required formats for different filing methods, including electronic filing.

These aspects make the 1601 C Excel format a preferred choice for organizations looking to fulfill their tax obligations efficiently.

Key Elements of the 1601 C Excel Format

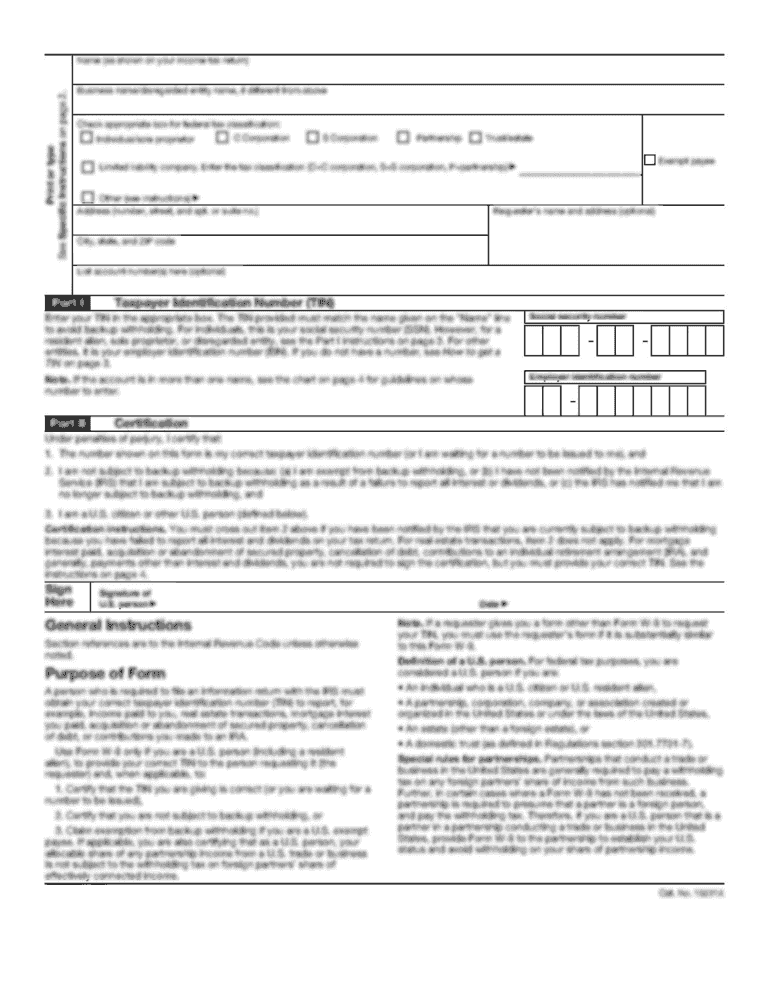

The 1601 C Excel format consists of several essential components that users must understand to complete the form accurately. The key elements include:

- Tax Identification Number (TIN): A unique identifier required for each employee to ensure correct tax tracking.

- Employee Details: Comprehensive information about each employee, including names and earnings.

- Gross Compensation: The total earnings of the employee before tax deductions.

- Tax Rate Application: The application of the correct withholding tax rates based on BIR guidelines, which vary according to income brackets.

- Final Computation Fields: These fields automatically calculate the total withholding tax due, ensuring the amounts filed are accurate and compliant.

Understanding and accurately populating these elements is vital for successful completion and submission of the form.

Common Use Cases for the 1601 C Excel Format

The 1601 C Excel format is widely used across various sectors and by different types of organizations. Here are common scenarios where this form is applicable:

- Corporations: Larger employers utilize the format to manage payroll for multiple employees, ensuring that all withholdings are accurately reported to the BIR.

- Small Businesses: Small business owners use the Excel format to streamline payroll processes, making tax computation manageable without employing extensive resources.

- Freelancers: Freelancers or contractors may use this format when they hire individuals and need to remit withheld taxes.

- Non-Profits: Non-profit organizations, which also employ staff, must comply with tax regulations similarly to for-profit entities.

These varied applications underscore the utility of the 1601 C Excel format across different employment scenarios.

IRS Guidelines Related to the 1601 C Excel Format

While the 1601 C Excel format is specific to BIR in the Philippines, there are parallels to IRS guidelines that govern similar forms in the United States. Key guidelines often include:

- Timely Filing: Adherence to deadlines for submitting the form to avoid penalties. Employers must track the specific due dates for submissions.

- Accurate Reporting: Employers are required to accurately report withholding amounts as per employees’ compensation, following the IRS tax tables.

- Record-Keeping: For tax purposes, maintaining a complete record of submitted forms is essential in case of audits or disputes.

While the 1601 C is specific to the Philippine context, understanding these aspects helps guide compliance and improve filing practices for similar forms in other jurisdictions.