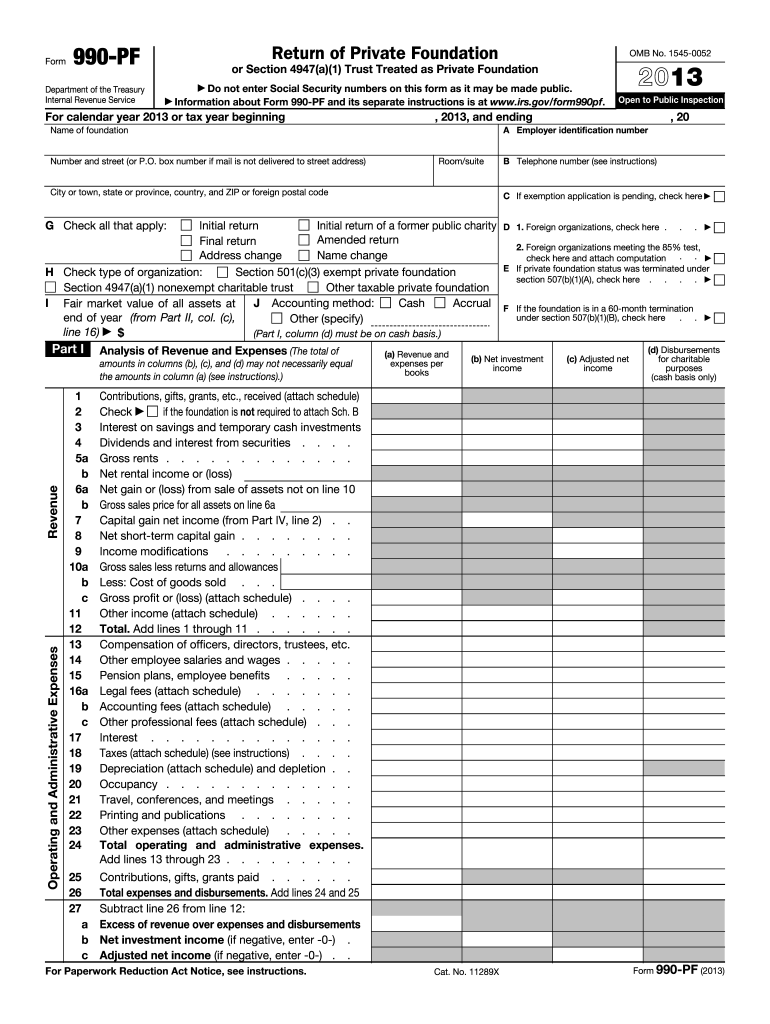

Definition & Purpose of Form 990-PF

Form 990-PF, often referred to as the Private Foundation Tax Form, is a critical document mandated by the IRS for private foundations operating within the United States. This form is employed to report a foundation's financial standing, including revenue, expenses, assets, liabilities, and information about charitable distributions. Its principal aim is to promote transparency and accountability, ensuring these entities comply with federal tax regulations. Private foundations are required to annually file Form 990-PF to maintain their tax-exempt status and provide public access to vital information about their operations.

Charitable Activities and Compliance

Private foundations use Form 990-PF to detail their charitable activities, including grants and contributions made throughout the fiscal year. This section of the form ensures that organizations adhere to their stated philanthropic missions. Accurate documentation of each grant, recipient, and amount distributed is necessary. Foundations must demonstrate that their funds are used to support charitable purposes rather than for personal gain, aligning with IRS compliance regulations.

How to Use the 2013 990-PF Form

Foundations must pay close attention when preparing the 2013 990-PF form, as accuracy is crucial to compliance. Tax professionals typically advise using this form to meticulously document all financial transactions and charitable involvements for the designated year. It involves listing financial data that reflects the foundation’s fiscal health and integrity transparently.

Navigating the Form Sections

The form contains several sections that must be completed:

- Part I: Summary of revenue and expenses during the fiscal year.

- Part II: Balance sheet with detailed assets and liabilities.

- Part IX-A: Analysis of income-producing activities and unrelated business income.

- Part XIII: Description of the foundation’s charitable purpose and activities.

Every section is essential for covering specific aspects of the foundation's tax obligations and operational transparency.

How to Obtain the 2013 990-PF Form

Private foundations can acquire the 2013 edition of Form 990-PF through several methods:

- IRS Website: Download the form directly from the IRS website. Ensure the correct year is selected to avoid filing errors.

- Tax Software: Use software compatible with tax forms, such as TurboTax or QuickBooks, which often includes the latest and historical forms in their packages.

- Professional Tax Services: Employing the services of a tax professional or firm can assist in obtaining and completing the correct version of the form efficiently.

Steps to Complete the 2013 990-PF Form

Completing the 2013 Form 990-PF involves a methodical approach:

- Gather Financial Records: Collect all necessary financial documents, such as bank statements, prior-year tax returns, and charitable contribution receipts.

- Complete Revenue and Expenses Sections: Accurately record all revenue sources and itemize foundation expenses.

- Report Assets and Liabilities: Provide a detailed balance sheet including end-of-year asset and liability figures.

- Detail Charitable Activities: Include comprehensive descriptions of all charitable activities, ensuring compliance with IRS guidelines.

- Review and Sign: Before final submission, review the entire form for accuracy, and ensure an authorized individual signs it.

Important Considerations

Apart from precise data entry, it’s paramount that foundations verify compliance with IRS regulations concerning the calculation of taxes and allowable deductions. Errors may lead to audits or penalties.

Who Typically Uses the 2013 990-PF Form

The form is predominantly used by private foundations, which are categorized into two main types:

- Family Foundations: Often established by a family to oversee their charitable contributions and maintain a family philanthropic legacy.

- Corporate Foundations: Businesses or corporations establish these to engage in philanthropic endeavors aligned with corporate social responsibility goals.

Both entities must use this form to report their annual financial activities and demonstrate their adherence to organizational missions.

Key Elements of the 2013 990-PF Form

The 2013 Form 990-PF contains several critical elements necessary for IRS compliance:

- Section on Officers and Directors: A detailed enumeration of the foundation's officers and directors, including compensation received.

- Detailed Financial Statements: Comprehensive sections reflect all revenue sources, expense distributions, and asset values.

- Charitable Distribution Details: Description and allocation of funds disbursed for charitable purposes during the year.

Each element directly impacts the foundation's tax eligibility and public transparency.

Legal Use of the 2013 990-PF Form

Form 990-PF serves several legal purposes, including:

- Maintaining Tax-Exempt Status: Foundations must file this form annually to retain their tax-exempt status under IRS rules.

- Public Accountability: As a public document, it allows stakeholders to monitor foundation activities and ensures transparency to donors and the public.

- Regulatory Compliance: Correctly filing the form demonstrates adherence to federal tax laws and charitable activity regulations.

Non-compliance could result in penalties and jeopardize the foundation’s tax-exempt status.

Filing Deadlines and Important Dates

Understanding the timeline is vital for compliance:

- General Deadline: Form 990-PF is generally due on the 15th day of the 5th month following the end of the organization's fiscal year.

- Extension Options: Organizations can file for an automatic six-month extension using Form 8868, giving additional time to file without incurring penalties.

It's crucial for foundations to adhere to these deadlines to avoid late fees and potential scrutiny from the IRS.