Definition and Meaning

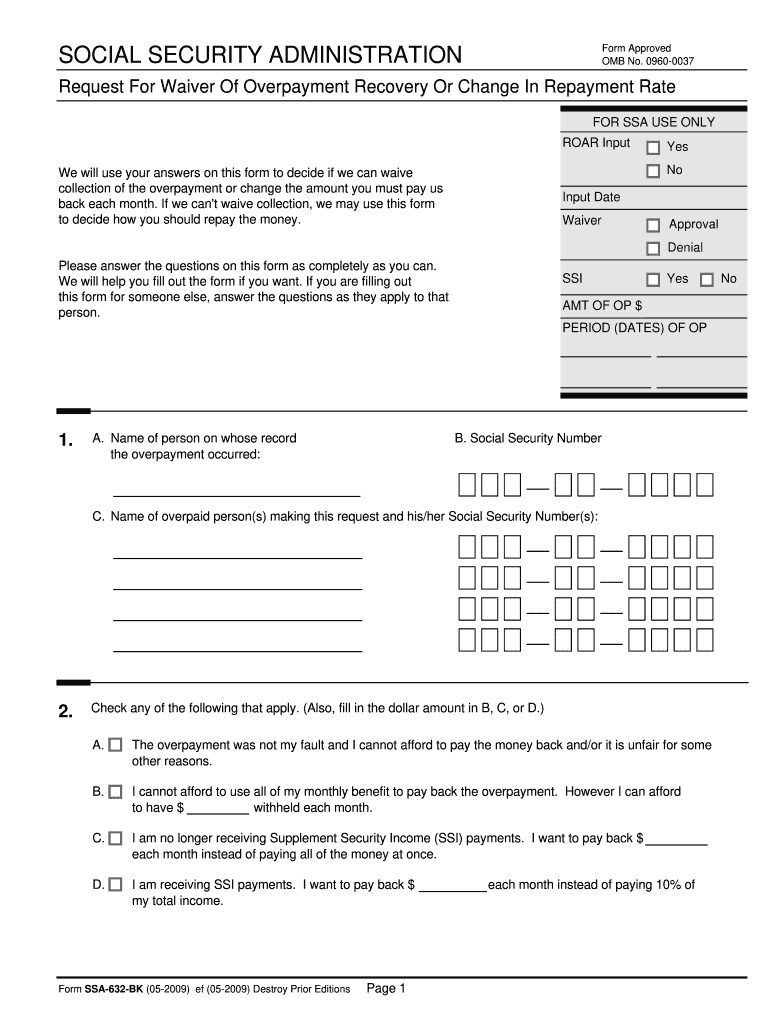

The "Form SSA-632-BK 05-2009" is officially titled the "Request for Waiver of Overpayment Recovery or Change in Repayment Rate." Issued by the Social Security Administration (SSA), the form serves a specific function—it allows individuals to request relief from repayment of overpaid Social Security benefits or to alter the repayment terms. This form is critical for beneficiaries who have received excess payments due to changes in income, misunderstanding of eligibility, or administrative errors. For example, a beneficiary who unknowingly received overpayments due to fluctuating income may use this form to request a waiver based on their inability to repay due to financial hardship.

How to Use the Form SSA-632-BK 05-2009

To effectively use Form SSA-632-BK 05-2009, individuals must carefully fill out each section, providing detailed and accurate information. This form requires personal, financial, and income-related details to make a compelling case for waiving the overpayment or adjusting repayment terms. Begin by supplying your Social Security Number, full name, and contact information. Follow this by detailing the reasons for overpayment, your current income, and monthly household expenses.

Examples of how this form might be utilized include:

- A retired individual on a fixed income who experiences an unexpected financial burden can request a waiver or reduction in monthly repayments.

- An individual whose financial situation has changed since the overpayment can detail their new circumstances for consideration.

How to Obtain the Form SSA-632-BK 05-2009

Obtaining Form SSA-632-BK 05-2009 is straightforward and can be done via multiple channels. The form is available for download on the official Social Security Administration website. Alternatively, you can request a physical copy by visiting your local SSA office or by calling the SSA’s toll-free number.

Once acquired, it is important to thoroughly understand the form's requirements before filling it out. For convenience, ensure Adobe Reader or another compatible PDF viewer is installed on your device, as the form is often provided in a PDF format suitable for digital completion or printing.

Steps to Complete the Form SSA-632-BK 05-2009

- Personal Information: Enter your Social Security Number, name, and contact details.

- Reason for Overpayment: Explain why the overpayment occurred and provide any supporting documentation.

- Financial Information: Include comprehensive details about your current financial situation, including income, expenses, assets, and liabilities.

- Household Contribution: List all household members and detail their financial contributions, as applicable.

- Request Detail: Clearly state whether you’re requesting a waiver, a repayment schedule modification, or both.

- Sign and Date: Ensure the form is signed and dated to confirm the information provided is accurate and truthful.

Who Typically Uses the Form SSA-632-BK 05-2009

This form is predominantly used by Social Security beneficiaries who have been notified of an overpayment. Typically, these individuals are retirees, people with disabilities, or survivors of deceased workers relying on Social Security benefits. For example, a retiree who receives notification of excess benefit payments will employ this form to address the situation, particularly if repaying the amount would cause financial difficulty.

Important Terms Related to Form SSA-632-BK 05-2009

Terms important to understanding this process include:

- Overpayment: The excess benefit amount received beyond what is owed.

- Waiver: A request to forgo repayment of the overpaid amount.

- Repayment Rate: The schedule or terms under which repayment is expected.

- Financial Hardship: A condition affecting one's ability to repay due to limited financial resources.

Legal Use of the Form SSA-632-BK 05-2009

The legal use of Form SSA-632-BK 05-2009 involves formally requesting relief from financial repayments legally owed to the Social Security Administration. The process is backed by SSA policies and regulations allowing beneficiaries to contest overpayment claims under specific circumstances, often including financial incapacity or administrative errors. Legal recourse may follow if the form is completed dishonestly or is misused, highlighting the need for truthful and accurate submission.

Key Elements of the Form SSA-632-BK 05-2009

Key elements comprise:

- Personal and Financial Sections: Where key details of personal and financial status are documented.

- Explanation of Overpayment: Where you provide a narrative on how the overpayment occurred.

- Signature: Legal declaration of truthfulness and intent.

- Documentation Attachments: Supporting evidence or documents to substantiate your claims.

Eligibility Criteria for Form SSA-632-BK 05-2009

Individuals eligible to use Form SSA-632-BK 05-2009 include Social Security beneficiaries who have received notice of overpayment. Eligibility generally requires showing that the overpayment wasn’t due to your fault and that repayment would cause financial hardship. Circumstances considered reasonable include significant changes in income, catastrophic health events, or unanticipated expenses that affect financial stability.