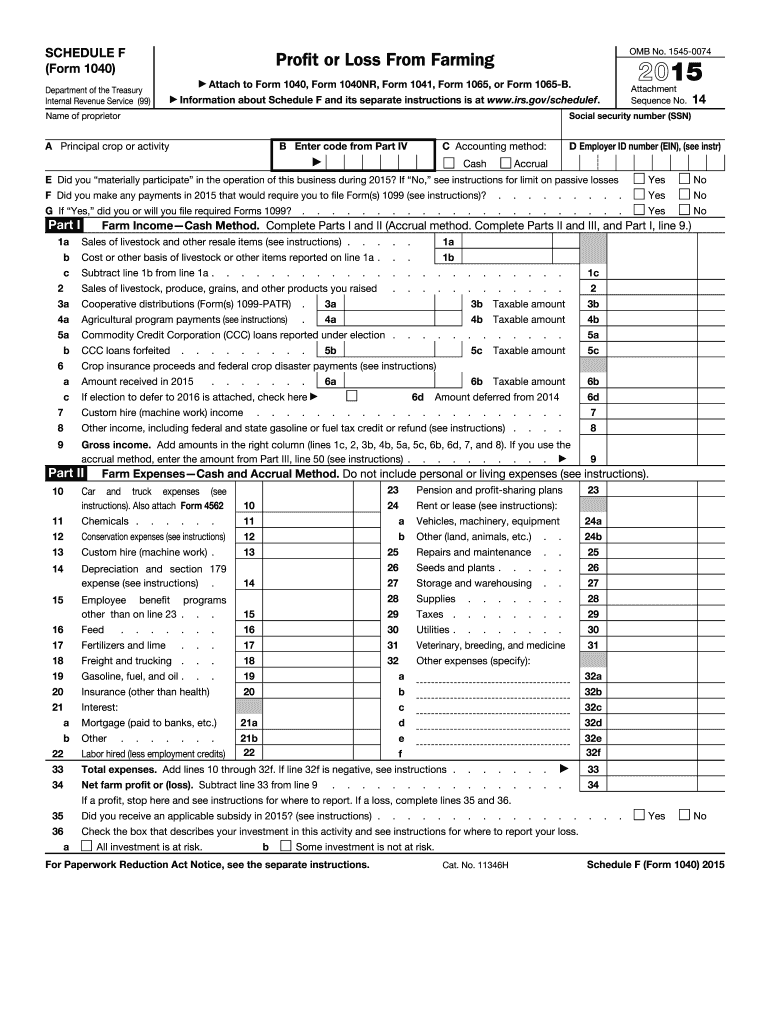

Definition and Meaning of the 2015 F Form

The 2015 F Form, known more formally as Schedule F (Form 1040), is a tax document used by farmers in the United States to report their annual income or loss from farming activities. Its primary purpose is to provide the Internal Revenue Service (IRS) with detailed information on a farmer's income from the sale of livestock, produce, grains, and other farm products. Additionally, it allows farmers to itemize their business expenses, helping to determine their overall taxable profit or loss. Farmers use this form to ensure they comply with federal tax obligations, capturing both income and expenses associated with their agricultural operations.

How to Use the 2015 F Form

Completing the Schedule F involves several important steps:

-

Start with identifying information: Begin by filling in your name, Social Security number, and other personal details.

-

Report farm income: Include income from sales of livestock, produce, and other products, ensuring accuracy by referencing records such as sales invoices or receipts.

-

Itemize expenses: Record expenses associated with farming operations, divided into categories like feed, seeds, fertilizers, and machinery repairs.

-

Calculate net farm profit or loss: Subtract total expenses from total income to determine the net result, which will influence overall tax liability.

By completing these steps, farmers can accurately report their financial activities from farming, ensuring compliance with tax laws and potentially benefiting from deductions through allowed expenses.

Steps to Complete the 2015 F Form

Detailed steps to fill out Schedule F:

-

Gather necessary documents: Collect all relevant documents such as sales receipts, expense invoices, and previous tax returns.

-

Fill out Part I – Farm Income: Record all income generated from farm activities in Part I, ensuring each amount matches your records for accuracy.

-

Complete Part II – Farm Expenses: In Part II, detail every deductible expense related to farming. Cross-reference your entries with your collected expense records for precision.

-

Calculate totals and net profit or loss: Ensure the math checks out by double-checking totals in income and expense sections.

These comprehensive steps will help in accurately completing the 2015 F Form, ensuring full compliance with IRS requirements for farming income and expenses.

Legal Use of the 2015 F Form

Schedule F must be used in compliance with federal tax laws, specifically by those engaged in farming. It's crucial for taxpayers to file this form accurately to avoid legal issues. Legal use means accurately reporting all farming income and claiming only legitimate business expenses. Misreporting can lead to penalties, audits, or other legal implications. Compliance with this requirement ensures farmers maintain good standing with the IRS and can potentially benefit from deductions specific to the agricultural industry.

Key Elements of the 2015 F Form

Some primary components of Schedule F include:

- Income Section: Covers all forms of farm-related revenues.

- Expense Section: Detailed categories for farm expenses are available to itemize costs accurately.

- Net Profit/Loss Calculation: Provides a framework for calculating overall financial outcomes from farming.

Understanding these sections helps ensure precise and complete documentation of agricultural financial activity, aiding both compliance and financial management.

Required Documents for the 2015 F Form

Gathering the right documents is crucial:

- Sales Invoices: For all products sold during the year.

- Expense Receipts: Covering costs like feed, equipment, and services.

- Previous Years’ Tax Returns: For reference and verification.

Having these documents readily available ensures that farmers can complete the Schedule F accurately, reflecting their true financial situation.

How to Obtain the 2015 F Form

Farmers can obtain Schedule F from several sources:

- IRS Website: The IRS provides printable versions of the form for direct access.

- Tax Software Programs: Tools like TurboTax and QuickBooks usually include Form 1040 and related schedules.

- Tax Professionals: An accountant or tax service can provide and help fill out the form.

These resources help ensure farmers have access to the necessary documentation to complete their taxes accurately and timely.

Examples of Using the 2015 F Form

Consider a small farm business that grows and sells corn. In 2015, this farm documented $100,000 in sales revenue. It incurred $60,000 in total expenses, including costs for seeds, fertilizers, and labor. By accurately listing these on Schedule F, the farm recorded a net profit of $40,000, which became part of their overall tax return. This example illustrates important aspects of using Schedule F, primarily the precise recording of revenue and proper categorizing of expenses to determine net gains or losses for the tax year.