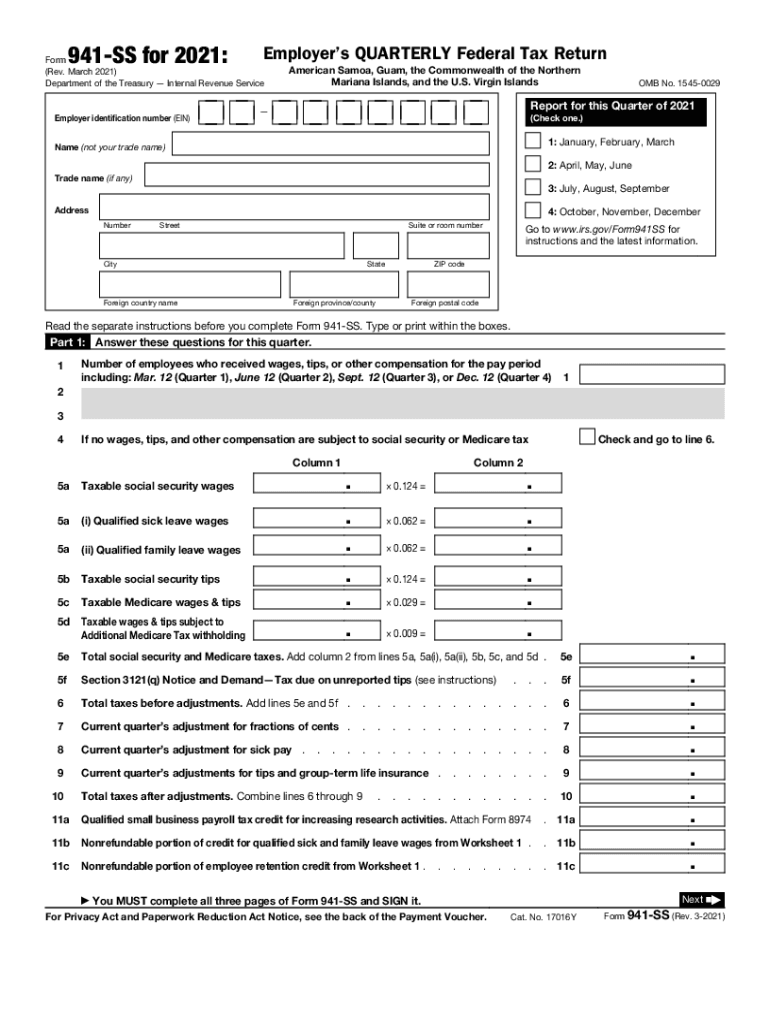

Definition and Meaning

Form 941 is the Employer's Quarterly Federal Tax Return used by businesses in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employees’ paychecks. It also documents the employer's portion of Social Security and Medicare. This form is crucial for tracking the taxes withheld from employees and ensuring that businesses comply with the federal tax requirements.

Form 941 covers several critical aspects, including reporting on wages paid, tips received, and the number of employees. It allows the IRS to reconcile the taxes reported with the actual amount paid by the employer throughout the year. Accurate completion of this form helps avoid complications during tax assessments or audits.

How to Use the 941 Form

Using Form 941 involves several steps. Employers must first identify the correct reporting period, as the form must be filed quarterly. Accurate record-keeping of wages paid, taxes withheld, and tips is essential for preparing this document. Employers need to ensure they have accurately calculated the amounts for Social Security, Medicare taxes, and income tax withholding.

- Identify the reporting period: Understand the quarterly deadlines to avoid late penalties.

- Complete each section: Fill in wages, taxes withheld, and other relevant fields.

- Verification: Double-check calculations for accuracy and completeness.

Each section of Form 941 should be meticulously completed to avoid any errors that could result in penalties or additional scrutiny from the IRS.

Steps to Complete the 941 Form

Completing Form 941 requires attention to detail to ensure accurate reporting. Follow these steps to complete the process efficiently:

- Gather Payroll Records: Ensure all payroll information for the quarter is organized and accurate.

- Calculate Tax Amounts: Compute the correct amounts for federal income tax withheld, Social Security, and Medicare taxes.

- Fill Out Required Sections: Enter employer identification number (EIN), total wages paid, and any applicable adjustments.

- Verify Details: Review each data entry to ensure it aligns with your payroll records.

- Submit Form: File the form either electronically or via mail by the specified due dates.

Employer adherence to these steps ensures compliance with IRS requirements, mitigating the risk of incurring penalties.

Key Elements of the 941 Form

Form 941 encompasses several essential components that employers must accurately fill out:

- Employer Information: Includes employer identification number (EIN), name, and address.

- Wages and Tax Calculations: Detailed sections for reporting total wages, tips, and specific tax amounts withheld.

- Tax Deposits and Credits: Information on deposits made during the quarter and any credits applied.

Understanding these components is vital for completing Form 941 accurately and ensuring thorough compliance with federal regulations.

Important Terms Related to the 941 Form

To fully comprehend Form 941, familiarity with specific terminology is beneficial:

- Federal Income Tax Withholding: The portion of income taxes withheld from employee earnings.

- Social Security and Medicare Taxes: Contributions made by both the employee and the employer to fund Social Security and Medicare programs.

- Quarterly Reporting: The requirement that Form 941 be filed every three months to report on income and taxes withheld.

Grasping these terms aids employers in ensuring accurate reporting and compliance with IRS guidelines.

Filing Deadlines and Important Dates

Compliance with filing deadlines is essential for avoiding penalties. Form 941 deadlines are consistent each quarter:

- First Quarter: January 1 to March 31, due by April 30.

- Second Quarter: April 1 to June 30, due by July 31.

- Third Quarter: July 1 to September 30, due by October 31.

- Fourth Quarter: October 1 to December 31, due by January 31 of the following year.

Marking these dates in advance ensures timely filing and compliance with IRS regulations. Late submissions may lead to penalties and interest charges.

Penalties for Non-Compliance

Failing to file Form 941 or submitting incorrect information can result in significant penalties. The IRS imposes these penalties to encourage compliance and timely reporting:

- Late Filing Penalties: Typically start at 5% of the tax due for each month or part of a month the return is late, with a maximum penalty of 25%.

- Inaccurate Information: Providing incorrect data can lead to additional fines and possibly an audit.

- Failure to Deposit Penalty: Applied if deposits are not made timely, calculated based on the numbers of days late.

Understanding these penalties helps emphasize the importance of accurate and punctual filing, reducing the risk of financial repercussions for businesses.

Examples of Using the 941 Form

Practical scenarios help clarify the application of Form 941:

- Small Business Example: A small retail shop with five employees uses Form 941 to report wages and taxes quarterly, ensuring compliance with federal requirements.

- Corporate Scenario: A medium-sized corporation with multiple locations calculates consolidated taxes across branches and accurately fills a single Form 941.

- Adjustment Situations: If an error is found in previous filings, businesses can use corrections on subsequent forms to adjust the records.

These examples illustrate how various types of businesses rely on Form 941 to maintain compliance and accurately report federal tax obligations.