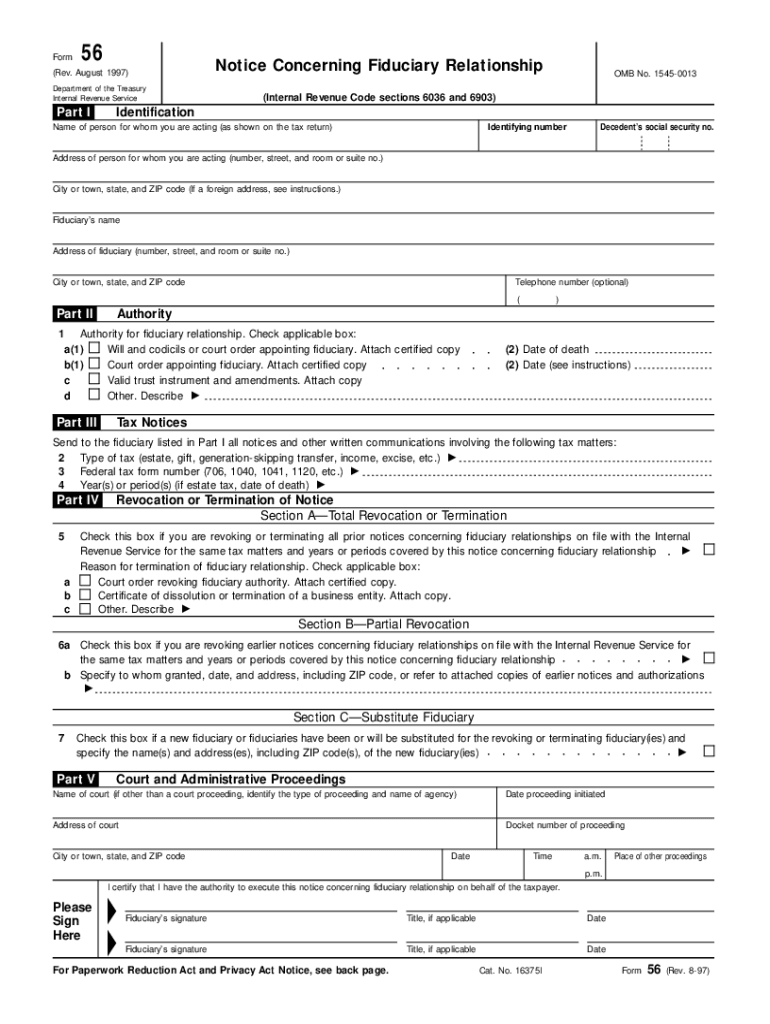

Definition and Purpose of IRS Form 56

IRS Form 56 is a document used to notify the Internal Revenue Service of the creation or termination of a fiduciary relationship. This form is critical when a fiduciary, such as a guardian or a trustee, takes on or relinquishes the responsibility of managing another party's tax matters. The creation of a fiduciary relationship involves scenarios where one party is granted authority to act on behalf of another, typically in financial or tax-related manners, under specific sections of the Internal Revenue Code. Understanding the comprehensive details of this form is essential for ensuring compliance with IRS regulations and avoiding potential legal pitfalls.

Steps to Complete IRS Form 56

- Personal Information: Fill in your name, title, and address along with the taxpayer's information, such as their name, identification number, and address.

- Fiduciary Details: Clarify the type of fiduciary you are acting as and describe the fiduciary relationship established or terminated.

- Section Information: Indicate the relevant sections of the Internal Revenue Code that apply to the fiduciary relationship being reported.

- Signatures and Dating: Ensure that the form is signed and dated by the fiduciary. It's critical for legal authentication and validation by the IRS.

- Additional Documentation: Attach any necessary legal documents that verify the fiduciary's authority, like court orders or power of attorney forms.

How to Use IRS Form 56

IRS Form 56 is used mainly during scenarios where a fiduciary act is required. This could be at the initiation of a fiduciary relationship, such as when a trust is established or when a guardian is appointed for an incapacitated individual. It is equally important when terminating such relationships to ensure that the IRS is informed of the end of the fiduciary's capacity, thereby preventing future liabilities or mismatches in tax filings.

Who Typically Uses IRS Form 56

Individuals or entities that often use IRS Form 56 include:

- Trustees managing trusts on behalf of beneficiaries.

- Guardians handling tax responsibilities for minors or incapacitated individuals.

- Estate Executors handling the estate affairs and final taxes of a deceased individual.

- Legal Representatives who are taking on or giving up fiduciary duty involving tax matters.

Important Terminology Related to IRS Form 56

- Fiduciary: A person or organization that acts on behalf of another person, managing assets or rights.

- Beneficiary: The individual for whom the fiduciary holds assets or benefits.

- Trustee: A fiduciary who manages a trust on behalf of the beneficiary.

Understanding these terms is crucial for correctly filling the form and ensuring proper adherence to fiduciary responsibilities as outlined by the IRS.

Filing Methods for IRS Form 56

Form 56 can be submitted through various channels:

- Mail: You can post the completed form to the appropriate IRS service center address, which depends on the location of the taxpayer.

- Electronic Submission: While not directly submitable online, components of fiduciary documentation can be managed through IRS electronic systems such as CAF.

- In-Person: For those who prefer personal interaction or have queries, submissions can be made at IRS Taxpayer Assistance Centers.

IRS Guidelines for IRS Form 56

The IRS provides detailed guidelines to comply with when filing Form 56. These include instructions on accurately reporting the fiduciary relationship, understanding pertinent sections of the Internal Revenue Code, and legal obligations involved therein. It’s advisable to consult these guidelines to ensure that all parts of the form are duly completed and submitted correctly.

Consequences of Non-Compliance with IRS Form 56

Failure to file or incorrect filing of IRS Form 56 can lead to complications such as delayed processing of tax matters, potential legal liability for the fiduciary, and even penalties. Ensuring the proper and timely submission of this form is vital for the smooth handling of the fiduciary responsibilities and avoiding unnecessary interactions with the IRS.

Examples of Using IRS Form 56

Consider a scenario where an individual is incapacitated, and a family member is appointed as their legal guardian. Filing Form 56 informs the IRS of the new fiduciary responsibility, ensuring the guardian can manage the individual's taxes. Conversely, when the ward reaches the age of majority, the guardian would file to terminate this fiduciary relationship.

Business Entities and IRS Form 56

Business entities like corporations or partnerships might use IRS Form 56 when appointing a fiduciary over tax matters. For example, if a corporation places its financial affairs in the hands of a trustee due to reorganization, Form 56 would illustrate this relationship to the IRS.

Digital vs. Paper Version of IRS Form 56

While the form can still be completed on paper, digital handling of associated documentation is increasingly preferred due to efficiency and enhanced tracking capabilities. Utilizing digital tools allows for better management of fiduciary documentation and efficient communication with entities like the IRS, particularly in collaborative environments involving multiple fiduciaries.