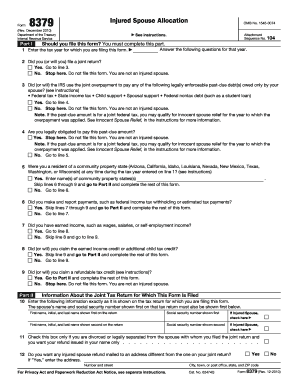

Definition and Meaning

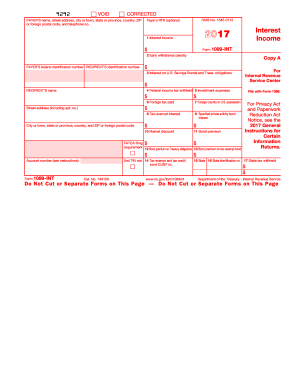

The " printable" refers to the printable version of the IRS Form 1099 used for reporting various types of income other than wages, salaries, and tips. It's particularly important for independent contractors, freelancers, and other non-employee service providers, as it reports nonemployee compensation. The form must be filled out accurately to ensure the correct reporting of income for tax purposes.

How to Use the Printable

Using the printable version of Form 1099 involves a few straightforward steps to ensure accurate reporting. Begin by gathering all necessary information for the form, including the payer's and recipient's details. Fill out each section carefully, ensuring that all dollar amounts are correct. Use the form to report any nonemployee compensation of $600 or more. After completing the form, retain a copy for your records and distribute copies to the IRS and the recipient.

How to Obtain the Printable

To obtain the printable form, you can visit the IRS website and download the available version. It's essential to ensure you have the latest version to meet IRS requirements. While digital versions can be viewed and printed easily, ensure you use high-quality print settings to make the form legible for filing. You may also order official pre-printed forms from the IRS if needed.

Steps to Complete the Printable

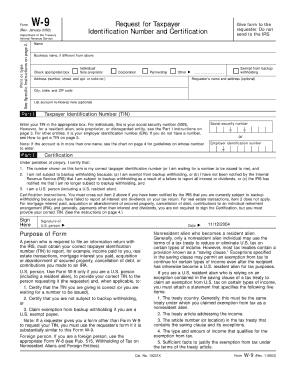

- Gather Information: Collect the payer's and recipient's personal information, such as names, addresses, and taxpayer identification numbers.

- Enter Compensation Amounts: Carefully enter the dollar amounts related to nonemployee compensation in the appropriate boxes.

- Check for Accuracy: Review each section of the form for accuracy and completeness.

- Distribute Copies: Send Copy A to the IRS, Copy B to the recipient, and retain Copy C for your records.

- File on Time: Ensure all copies are distributed and submitted before the IRS deadline to avoid penalties.

Key Elements of the Printable

The form includes several key components that must be filled out correctly:

- Payer Information: Details of the individual or entity paying for services.

- Recipient Information: Information about the individual or business receiving the payment.

- Nonemployee Compensation Amount: The total amount paid for the services provided.

- Security Features: Note that specific fields are necessary for ensuring the scannability of the form by the IRS.

Filing Deadlines and Important Dates

It's crucial to adhere to the IRS deadlines to avoid penalties:

- January 31: Deadline to provide Copy B to the recipient.

- February 28: Deadline to send Copy A to the IRS if filed on paper.

- March 31: Deadline if filing electronically. Ensure records are maintained, and deadlines are met in a timely fashion.

Penalties for Non-Compliance

Failing to file the 1099 form correctly and on time can result in penalties from the IRS:

- Late Filings: Penalties increase based on the lateness of filing, ranging from $50 to $270 per form.

- Intentional Disregard: Higher penalties apply if failure to file is done intentionally.

- Inaccurate Information: Even if filed on time, any inaccuracies can result in penalties.

Software Compatibility

Many tax software programs, such as TurboTax and QuickBooks, can ease the completion of Form 1099. They provide step-by-step guidance and e-filing options, which can streamline the process:

- TurboTax: Guides users through entering the necessary information for each 1099 form.

- QuickBooks: Offers integration and e-filing directly from the software.

Who Typically Uses the Printable

Independent contractors, freelancers, and small business owners frequently use Form 1099. It's essential for anyone who conducts business or services where they are paid directly from clients rather than as an employee. Understanding its use is crucial for accurate taxation.

IRS Guidelines

IRS guidelines specify how the 1099 form can be used and filed. They provide detailed instructions for each section of the form and outline the expected use cases. Compliance with these guidelines ensures that income is correctly reported and taxes are filed properly.

Required Documents

When completing the 1099 form, you may need additional documents, such as:

- Contract Agreements: For verifying payment amounts.

- Bank Statements: To confirm received payments.

- Previous Year's Returns: For consistency in reporting.