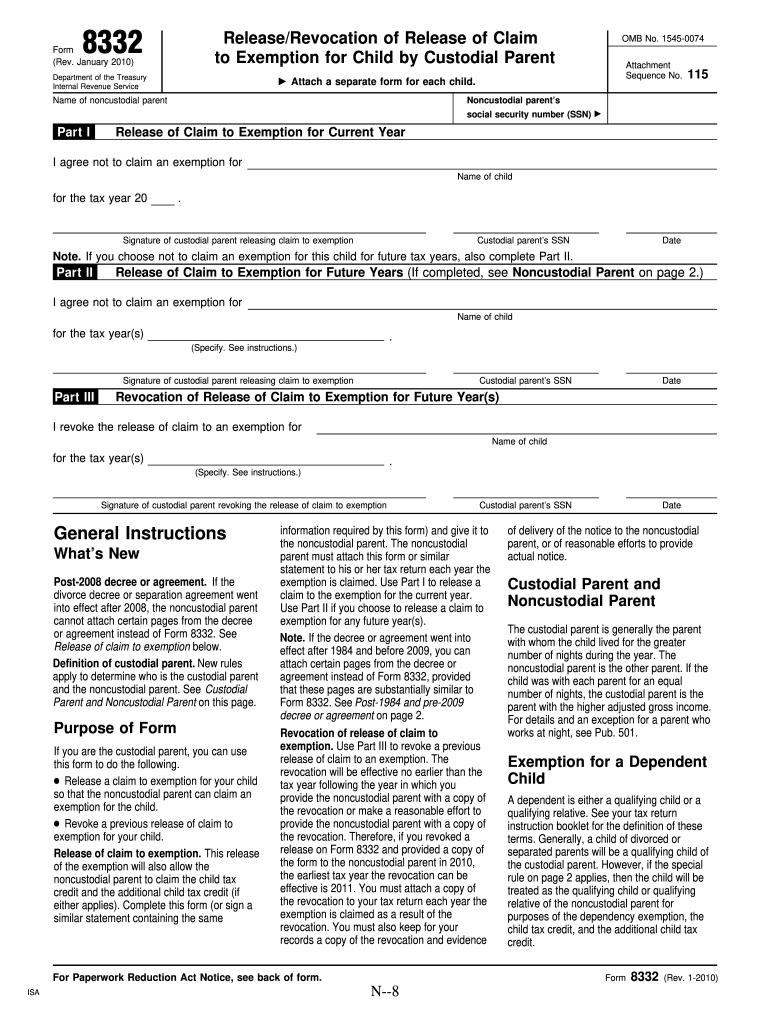

Definition and Purpose of Form 8332

Form 8332 is a tax document used by custodial parents to release or revoke a claim to an exemption for their child. This exemption allows the noncustodial parent to claim the child as a dependent when filing their federal tax return. Specifically, this form is particularly relevant for parents who are divorced or separated, as it formalizes the agreement regarding tax dependency claims between the custodial and noncustodial parents.

The form stipulates that the custodial parent relinquishes their right to claim the child for the current tax year as well as any future years specified in the form. This legal transfer of exemption can significantly impact the tax benefits each parent receives, particularly regarding the Child Tax Credit and Earned Income Tax Credit. The procedure ensures that the noncustodial parent receives appropriate tax relief while keeping the custodial parent's rights in check.

Steps to Complete the Form 8332 Fillable

Completing Form 8332 requires careful attention to detail to ensure accuracy and compliance with IRS regulations. The following are the key steps to properly fill out the form:

-

Download the Form: Access the fillable PDF format of Form 8332 from the IRS website or use DocHub for convenient online editing.

-

Identify the Parents: Clearly state the names and Social Security numbers of both the custodial and noncustodial parents. This identification is crucial for the IRS to track the dependency claim correctly.

-

Specify the Child: Include the child's name and Social Security number. This ensures there is no ambiguity regarding the dependent being claimed.

-

Detail the Release: Indicate the specific tax year(s) for which the claim is being released. This may include current and future years, depending on the agreement between the parents.

-

Sign and Date: The custodial parent must sign and date the form. This signature acts as a formal acknowledgment of the claim release.

-

Distribute the Form: Provide the completed form to the noncustodial parent. It is advisable to keep a copy for your records, as the IRS may require proof of the claim release.

This step-by-step approach ensures the form is completed correctly, reducing the likelihood of complications during tax filing.

Important Terms Related to Form 8332

Understanding the terminology associated with Form 8332 is crucial for navigating its use effectively. Here are some key terms:

-

Custodial Parent: The parent with whom the child lives for the greater part of the year. This parent typically maintains legal custody and is responsible for the child's day-to-day care.

-

Noncustodial Parent: The parent who does not have primary physical custody of the child, yet may be eligible to claim the child as a dependent for tax purposes.

-

Dependency Exemption: A tax benefit that allows a taxpayer to reduce their taxable income based on the number of dependents claimed, resulting in potential tax savings.

-

Child Tax Credit: A tax credit offered for qualifying dependents under the age of 17, which can reduce the taxpayer's liability further.

-

Released Claim: The process by which the custodial parent formally waives their right to claim the child as a dependent, allowing this right to transfer to the noncustodial parent.

Familiarity with these terms aids individuals in understanding the implications and processes surrounding Form 8332.

How to Obtain the Form 8332 Fillable

Acquiring Form 8332 is straightforward. Here are the methods available:

-

IRS Website: The IRS provides the official form in a fillable PDF format on its website. Ensure you download the most current version to comply with updated regulations.

-

Tax Software: Many tax preparation software programs, such as TurboTax or H&R Block, include Form 8332 in their offerings. These programs often facilitate easier completion by guiding users through the required fields.

-

DocHub: For those looking to edit and manage documents online, accessing Form 8332 via DocHub could streamline the process, offering fillable fields and easy document management.

Having multiple options to obtain the form ensures that individuals can choose a method that best fits their preference and technical ability.

Legal Use and Compliance of Form 8332

Understanding the legal implications of Form 8332 is vital for compliance. Utilizing this form serves several purposes:

-

Clarity in Dependency Claims: The form provides legal documentation that clarifies which parent is entitled to claim the child on their tax returns, thereby reducing potential conflicts between parents regarding tax deductions.

-

IRS Guidelines: The completion and submission of Form 8332 must adhere to IRS regulations. Incorrect filing can lead to issues such as denial of claimed exemptions or even penalties for tax evasion.

-

Record Keeping: Form 8332 provides an official record of the custodial parent's consent for the noncustodial parent to claim the child. This documentation can be crucial in case of audits or disputes with the IRS.

Making sure that the form is filled out accurately and submitted in accordance with federal guidelines is essential for maintaining legal compliance.

Examples of Using the Form 8332 Fillable

Consider the following scenarios that illustrate the practical application of Form 8332:

-

Divorced Parents: John and Sarah are divorced and have one child. As the custodial parent, Sarah can complete Form 8332 to allow John to claim their child as a dependent for the current tax year, reducing his taxable income.

-

Separated Parents: Tom and Linda are separated but have not finalized their divorce. Linda decides to release her claim to their child, allowing Tom to claim the dependency exemption in exchange for a verbal agreement regarding child support.

-

Future Claims: Emily, the custodial parent of two children, fills out Form 8332 specifying that the claim is released for the subsequent three tax years, allowing her ex-husband Mark to benefit from the exemptions for those years.

These examples showcase the flexibility and utility of Form 8332 in various familial circumstances, guiding dependency claims effectively.