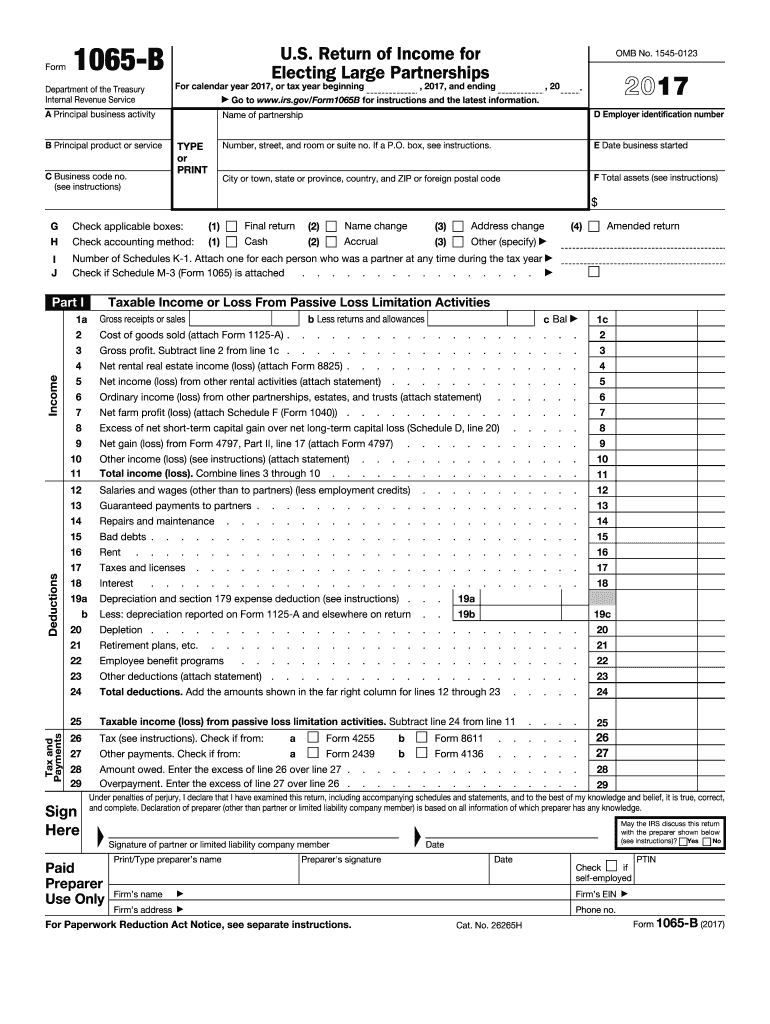

Definition and Purpose of the IRS 1065 Return Income Form

The IRS 1065 return income form, also known as the "U.S. Return of Partnership Income," is pivotal for partnerships in the United States. It serves as an information return used to report the income, deductions, gains, losses, and other relevant financial details of a partnership. Unlike traditional corporate tax returns, the IRS Form 1065 does not directly result in tax payments. Instead, it informs the IRS of the partnership's financial activities, which are then distributed to individual partners based on their shareholdings. Each partner reports their portion of the income or loss on their tax return.

Key Components of IRS Form 1065

- Identification Information: Includes the partnership's name, address, and Employer Identification Number (EIN).

- Income Reporting: Lists total income, including sales or receipts minus returns and allowances.

- Deductions: Covers all allowable deductions such as salaries, wages, and operating expenses.

- Distributive Shares: Details how income or loss is allocated among partners.

- Partner Information: Lists all partners and their respective shares, including changes in partnership interests.

Steps to Complete the IRS 1065 Return Income Form

- Gather Necessary Information: Collect all financial records, including receipts, invoices, and bank statements, from the tax year.

- Start with Basic Information: Begin filling the form by entering the partnership's basic details such as name and EIN.

- Report Income and Deductions: Input all sources of income and list allowable deductions to calculate the partnership's taxable income.

- Complete Partner’s Information: Fill out Schedule K-1 to report each partner’s share of income, credits, and deductions.

- Review and Adjust: Carefully review the completed form for discrepancies, ensuring all figures align with documented records.

- Submission: File the completed form with the IRS by mail or electronically before the designated deadline.

Common Mistakes to Avoid

- Incorrect Partner Details: Ensure all partner information is accurate and up to date.

- Omitting Income: Double-check that no sources of income have been missed.

- Misreporting Deductions: Verify that all deductions are proper and accurately recorded.

Who Typically Uses the IRS 1065 Return Income Form

The IRS 1065 form is predominantly used by businesses organized as partnerships within the United States. This includes:

- General Partnerships: Where all partners are equally liable for business debts and decisions.

- Limited Partnerships (LP): Involving at least one general partner and limited partners with restricted liability.

- Limited Liability Partnerships (LLP): These offer personal liability protection to all partners.

- Limited Liability Companies (LLC) treated as partnerships: Certain LLCs opt to be taxed as partnerships rather than corporations.

Importance for Partnership Entities

Using Form 1065 allows these entities to remain compliant with tax statutes, ensuring all income is appropriately reported and processed according to each partner’s tax obligations.

Key Considerations and IRS Guidelines

- Filing Deadline: The form must be filed by March 15th of each year, or the 15th day of the third month after the end of the partnership's fiscal year.

- Penalties for Late Filing: Penalties apply if the form is late without an extension or correct information.

- Amendments: Correction of any errors in the originally filed IRS Form 1065 can be made by submitting an amended return using Form 1065-X.

Document Submission and Resources

- Form Variations: Standard IRS 1065 for regular partnerships; however, depending on specific partnership agreements and structures, additional schedules or variations might be needed.

- Support and Assistance: IRS guidelines recommend consulting with a tax professional for complex partnership structures to ensure compliance and accuracy in submissions.

IRS 1065 Form Submission Methods

Partnerships have several options for submitting the IRS 1065 form:

- Online Filing: Through IRS-approved tax software, which can simplify the process of calculating appropriate figures and reduce errors.

- Mail: Traditional postal submission is available, though electronic filing is encouraged for quicker processing.

- In-Person: Direct submission at IRS service centers; however, this is less common due to digital conveniences.

Choosing the Right Method

Selection between these methods often depends on the partnership’s size, resources, and advisor recommendations. Electronic filing is generally favored for its speed and efficiency.

Penalties for Non-Compliance

Failure to comply with IRS 1065 filing requirements can lead to substantial penalties:

- Late Submission Penalties: Partnerships face fines for each month the return remains unfiled past the deadline.

- Inaccuracy Penalties: Incorrect information can lead to additional charges on corrections or audits.

- Failure to Furnish K-1s: Partners must receive their Schedule K-1 by the due date to file their returns properly. Lack of compliance can result in monetary penalties for the partnership.

Understanding and adhering to these guidelines helps partnerships prevent legal complications and maintains smooth operations in line with IRS expectations.