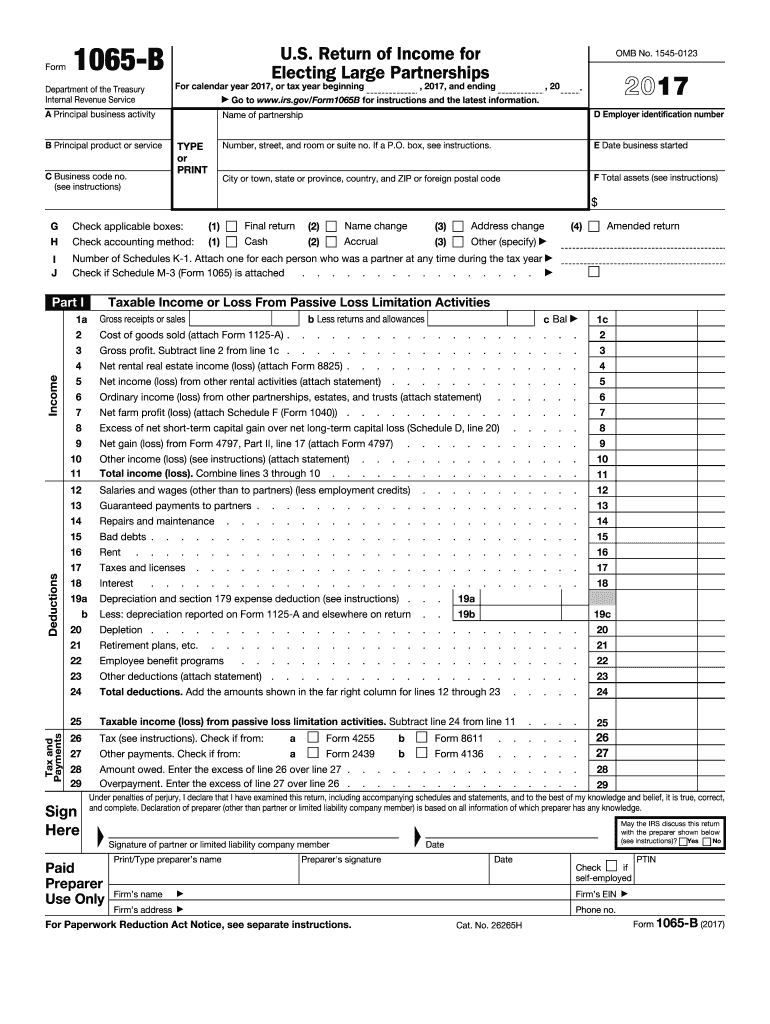

Definition & Meaning of the IRS 1065 Return Income Form

The IRS Form 1065 is a U.S. tax document specifically designed for use by partnerships to report income, deductions, gains, losses, and other relevant tax information for the partnership as a whole. Partnerships are entities where two or more individuals or groups manage and operate a business together. The form provides a comprehensive overview of the partnership's financial activities during the tax year, detailing how profits and losses are allocated among partners.

By filing this form, partnerships fulfill their tax obligations, ensuring that the Internal Revenue Service (IRS) receives accurate information regarding earnings that will eventually be taxed at the personal income level of each partner. Unlike traditional corporations, partnerships themselves are not taxed directly; rather, income is passed through to partners who report it on their individual tax returns.

Purpose and Significance

- Income Reporting: Form 1065 captures all sources of income earned by the partnership, including sales revenue and other forms of income.

- Deductions: Partnerships can deduct business expenses, which reduces the overall taxable income reported.

- Partner Information: The form includes sections that detail each partner's share of income or loss, facilitating proper tax reporting across multiple individuals.

This form is critical for compliance with tax laws and ensures transparency in the reporting of partnership income.

Important Terms Related to the IRS 1065 Return Income Form

Understanding the terminology associated with the IRS 1065 return income form is essential for proper completion and compliance. Here are several key terms that frequently appear in conjunction with this form:

- Partnership: A business entity formed by two or more individuals or entities sharing profits and management responsibilities.

- Pass-Through Entity: A type of business structure where income is passed directly to the owners and taxed on their individual tax returns rather than at the entity level.

- K-1 Form: A schedule that details each partner's share of income, deductions, and credits, issued to each partner to facilitate their personal tax filings.

Familiarity with these terms not only aids in accurately filling out Form 1065 but also helps partners grasp their responsibilities regarding their individual tax liabilities.

Steps to Complete the IRS 1065 Return Income Form

Completing the IRS Form 1065 involves several methodical steps that ensure all necessary information is accurately reported.

- Gather Financial Records: Collect all income, expenses, deductions, and stakeholder information relevant to the partnership's activities over the tax year.

- Complete the Basic Information Section: Fill out the partnership’s name, address, and federal employer identification number (EIN).

- Report Income: Use the relevant lines on the form to report total income, including ordinary business income, capital gains, and other sources of revenue.

- Deduct Expenses: Document all allowable business deductions, including salaries, rent, and any other costs incurred during operations.

- Allocate Income/Loss to Partners: Prepare Schedule K, which summarizes the total income, deductions, and losses, and prepare individual K-1 forms for distribution to each partner.

- Review and Sign: Ensure the form is complete, accurate, and signed by a partner or an authorized representative.

Following these steps minimizes errors and ensures compliance with IRS regulations.

Filing Deadlines / Important Dates for Form 1065

Adhering to the filing deadlines for IRS Form 1065 is crucial for maintaining compliance and avoiding penalties. Key deadlines include:

- March 15: The annual due date for filing Form 1065 for partnerships operating on a calendar year. If March 15 falls on a weekend or holiday, the due date is observed on the next business day.

- Extension Requests: Partnerships may request a six-month extension by filing Form 7004, pushing the due date to September 15.

It is essential for partnerships to meet these deadlines to ensure timely processing and avoid potential penalties or interest charges.

Examples of Using the IRS 1065 Return Income Form

The application of IRS Form 1065 can vary based on the specific circumstances and structures of partnerships. Here are practical examples illustrating its usage:

- General Partnership: A group of three friends who run a successful catering business share profits and losses according to their initial agreement. They file Form 1065, reporting total earnings and distributing the K-1s to reflect each person’s share.

- Limited Liability Partnership (LLP): Two lawyers practicing together as an LLP utilize Form 1065 to report their income, detailing expenses like office rent and professional fees to lower taxable profits.

- Multi-Entity Partnership: A real estate development company structured as a partnership with multiple investment partners might file Form 1065, allocating rental income and expenses for properties owned collectively.

These scenarios demonstrate how partnerships effectively manage tax obligations through detailed reporting using Form 1065.