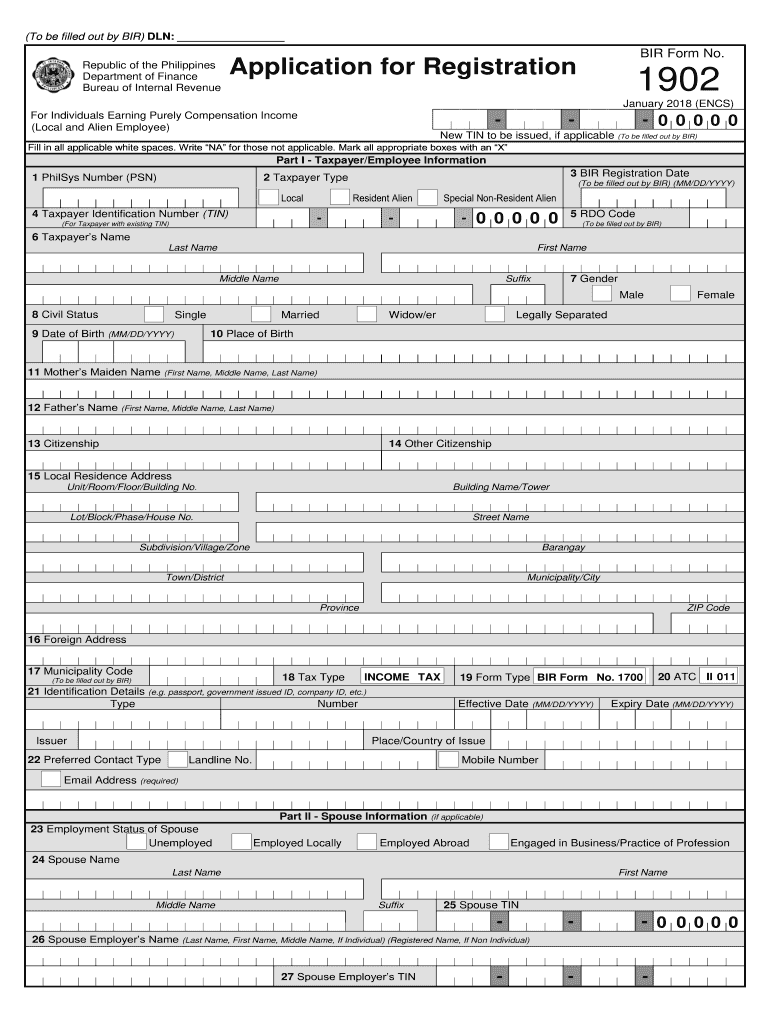

Overview of BIR Form 1902

BIR Form 1902 is an essential document for individuals earning purely compensation income in the Philippines. This form facilitates the registration process with the Bureau of Internal Revenue (BIR) and captures necessary personal and employment information for both local and alien employees.

Purpose of BIR Form 1902

BIR Form 1902 is primarily used for registering taxpayers, specifically those earning purely compensation income. It serves several purposes, including:

- Tax Identification: Assigning a Taxpayer Identification Number (TIN) to the individual.

- Employment Information: Collecting data regarding the taxpayer's employment status and income.

- Compliance with Tax Laws: Ensuring that all registered individuals comply with tax regulations as mandated by the BIR.

Required Information on BIR Form 1902

When filling out BIR Form 1902, the following details are typically required:

-

Personal Information:

- Full name

- Address

- Contact information

-

Employment Details:

- Employer’s name

- Employer’s address

- Position held

-

Tax Details:

- TIN (if applicable)

- Spousal information if married

Steps to Fill Out BIR Form 1902 Online

-

Access the Form: Download BIR Form 1902 in PDF format or fill it out directly online if available. Ensure you have access to all the necessary information before beginning.

-

Complete Personal Information: Enter your name, address, and other personal details accurately.

-

Input Employment Information: Provide information regarding your employer and your position.

-

Include Spousal Information: If applicable, fill out the spouse’s details and provide consent for data processing as required by the Data Privacy Act of 2012.

-

Review and Submit: Double-check all entries for accuracy. Submit the completed form through the online portal or print it for mailing.

Important Documentary Requirements

To successfully register using BIR Form 1902, recipients should prepare the following documents:

- A valid identification card (e.g., passport, driver's license)

- Any employment contracts or related documents that substantiate employment status

- Previous tax returns, if applicable

Who Should Use BIR Form 1902?

BIR Form 1902 is primarily utilized by the following individuals:

- New Employees: Individuals who are starting new employment and need to register with the BIR.

- Aliens Working in the Philippines: Foreign nationals earning a purely compensation income and require a TIN.

- Returning Overseas Filipino Workers (OFWs): Those coming back to the Philippines and taking up employment.

Potential Issues and Penalties for Non-Compliance

Failure to fill out or submit BIR Form 1902 can lead to several negative consequences:

- Legal Penalties: Taxpayers may incur fines or penalties for failing to register properly.

- Delayed Tax Processing: Incomplete or incorrect forms may lead to delays in processing tax obligations.

Variants and Alternatives to BIR Form 1902

Alternative forms may be necessary depending on employment status:

- BIR Form 1904: Used for self-employed individuals or professionals.

- BIR Form 1905: Employed for reporting changes to taxpayer registrations, such as address changes or changes in tax status.

How to Obtain a Copy of BIR Form 1902

BIR Form 1902 can typically be obtained through several methods:

- Download from Official Website: The authoritative BIR website provides downloadable versions of the form.

- Visit BIR Offices: Individuals can also physically visit a local BIR office to acquire a copy.

- Through Authorized Agents: Some third-party services may offer forms for convenience.

By understanding the significance and requirements of BIR Form 1902, individuals may ensure they meet regulatory demands efficiently while facilitating a smooth registration process.