Definition and Meaning of Certificate of Deposit Form

A certificate of deposit (CD) form is a financial document issued by banks or credit unions that evidences the deposit of a certain amount of money for a specific period, typically earning interest at a fixed rate. This form serves as proof of the deposit, detailing the terms such as maturity date, interest rate, and any early withdrawal penalties. It plays a crucial role in personal and business finance by providing a secure way to save money while accruing interest.

Key components of a certificate of deposit form include:

- Principal Amount: The initial sum deposited.

- Interest Rate: The fixed rate of interest that the bank will pay on the deposited funds.

- Maturity Date: The date when the deposit term ends, and the principal amount along with accrued interest can be withdrawn.

- Terms and Conditions: Specific rules related to withdrawals, penalties for early exit, and minimum deposit amounts.

Understanding the nature of the certificate of deposit form is essential for individuals and businesses looking to maximize their savings with minimal risk.

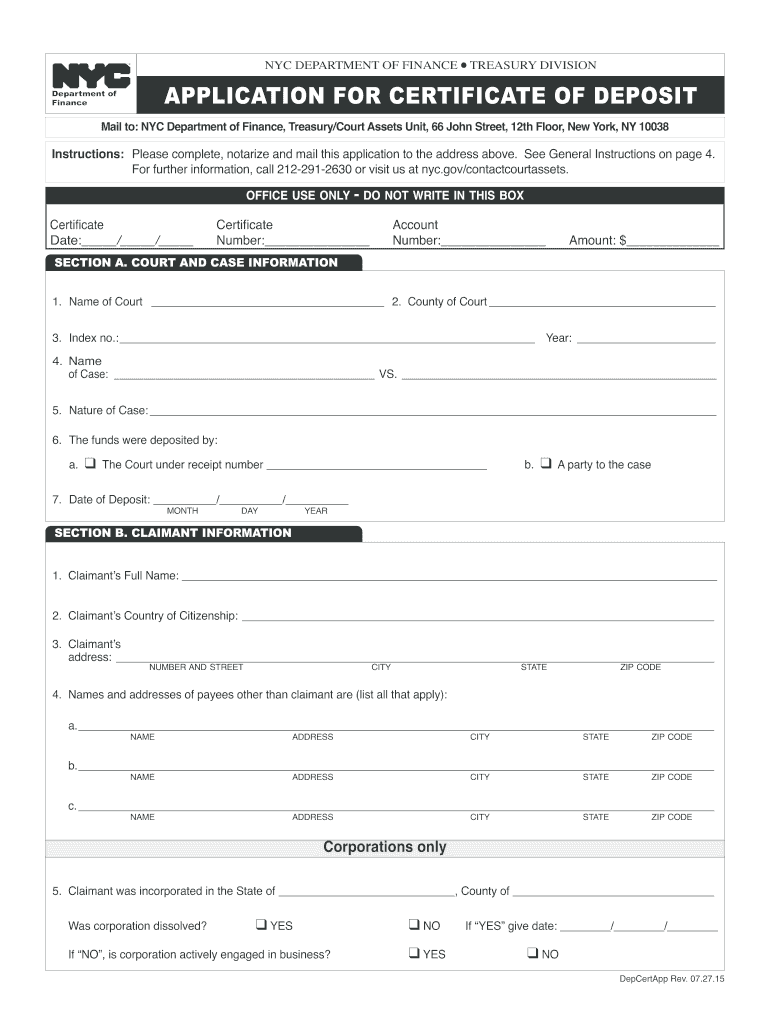

Steps to Complete the Certificate of Deposit Form

Filling out a certificate of deposit form requires careful attention to detail, ensuring that all necessary information is accurately provided. Follow these steps for proper completion:

- Personal Information: Enter your full name, address, contact number, and Social Security number. For businesses, include the entity name, type, and tax identification number.

- Deposit Details: Specify the amount you wish to deposit. Ensure it meets the minimum requirement set by the financial institution.

- Interest Selection: Choose the interest rate option, if applicable, or select a pre-defined rate offered by the bank.

- Select Term Length: Define the duration for which you want to invest your money, typically ranging from a few months to several years.

- Review Terms and Conditions: Carefully read the terms associated with the certificate, including penalties for early withdrawal and the process for account management.

- Sign and Date: Finally, sign the form and add the date, indicating your consent and understanding of the terms outlined.

Completing this form accurately is crucial as it directly impacts the management of your funds and the interest you can earn.

Important Terms Related to Certificate of Deposit Form

Being familiar with the terminology associated with certificates of deposit is vital for understanding the nuances of the form and the underlying product. Here are some key terms:

- Interest Accrual: The process by which interest is added to the principal amount, usually calculated on a daily basis.

- Withdrawal Penalty: Fees imposed for removing funds from a certificate of deposit before the maturity date.

- CD Laddering: A strategy of investing in multiple CDs with varying maturity dates to maintain liquidity while maximally earning interest.

- Renewal Option: The choice to reinvest the funds in a new CD upon maturity, often at the current market interest rate.

These terms are crucial for potential investors to understand the impact of their decisions surrounding certificates of deposit.

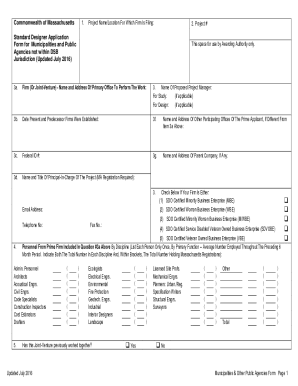

How to Obtain the Certificate of Deposit Form

Acquiring a certificate of deposit form can be accomplished through various means, depending on the financial institution's policies and your preferences. Here are methods to obtain the form:

- Online Download: Many banks provide downloadable forms directly from their websites. Look for a "Forms" or "Resources" section to find the appropriate certificate of deposit form in PDF format.

- In-Person Request: Visit your local bank branch where you have an account. Bank representatives can assist you in obtaining the form and provide guidance on how to complete it.

- Customer Service: Reach out to the customer service department of your bank or credit union via phone. They can email or mail the necessary documentation to you.

- Financial Advisor: If you work with a financial planner, they can facilitate the process by providing the form and discussing the best strategies for your investment.

Accessibility is typically straightforward, allowing individuals and businesses to initiate the process of investing in a CD easily.

Key Elements of the Certificate of Deposit Form

When reviewing the certificate of deposit form, specific elements must be highlighted to ensure you fully comprehend the financial product. Notable sections include:

- Account Holder Information: Details of the individual or entity opening the CD, including identification data that verifies status.

- Deposit Amount and Terms: Clear documentation of the amount invested and selected term length, critical for understanding investment maturity.

- Interest Rate Explanation: A detailed breakdown of how the interest will be calculated and paid out, ensuring transparency.

- Withdrawal Conditions: Insight into penalties related to early withdrawals, crucial for those considering accessing their funds prematurely.

- Signature Section: Places for the account holder's signatures and dates affirming the agreement and confirming the terms understood.

Each of these elements provides a foundation for making informed decisions about savings and investments in CDs.

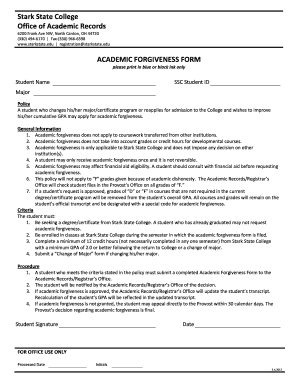

State-Specific Rules for the Certificate of Deposit Form

When dealing with certificates of deposit, it is essential to understand that rules and regulations can vary by state, potentially impacting your investment. Specific considerations include:

- Deposit Insurance: Different states may have various insurance requirements under the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA) for deposits.

- Tax Implications: States may have unique taxation policies related to interest earned from CDs, influencing overall return on investment.

- Penalties for Non-compliance: Variances in how penalties for early withdrawals are structured can affect investor choices.

- Consumer Protection Laws: Certain states may offer additional consumer protections related to financial products, which can clarify how to manage your investment safely.

Understanding these state-specific rules is beneficial for both personal and business finances regarding CDs.

Examples of Using the Certificate of Deposit Form

Practical applications of the certificate of deposit form illustrate its versatility and advantages in different contexts. Here are some scenarios:

- Personal Savings: An individual might utilize a CD to save for a goal, such as buying a home or funding education. A fixed-rate CD can provide a predictable return and help in budgeting for future expenses.

- Business Investments: A small business owner looking to accumulate savings for future projects might open a CD to earn interest on reserves not needed for immediate operational expenses. This allows for capital growth without taking excessive risks.

- Retirement Planning: Individuals nearing retirement may choose CDs to protect their savings, locking in interest rates to ensure capital preservation while still growing their funds.

- Emergency Fund Strategy: Investors might implement a CD laddering strategy, with multiple CDs maturing at different times, ensuring liquidity while still benefiting from higher interest rates compared to traditional savings accounts.

These scenarios demonstrate the effectiveness of the certificate of deposit form in various aspects of financial planning.