Definition & Meaning of the Creditor Matrix Template

A creditor matrix template, often utilized in bankruptcy proceedings, serves as a systematic list of creditors associated with a debtor. This document is critical within bankruptcy filings, particularly for Chapter 7 and Chapter 11 cases, as it provides the court with an organized record of all entities to whom the debtor owes money. It ensures that all creditors are notified of legal proceedings, thereby protecting their rights and interests.

The creditor matrix typically includes the following key information:

- Creditor Names: The official names of all creditors.

- Mailing Addresses: Complete addresses for service of notices and documents.

- Account Numbers: Reference numbers pertinent to each creditor account, if applicable.

The creditor matrix is crucial for legal accuracy and compliance in bankruptcy filings. It plays a significant role in various bankruptcy laws, ensuring that due process is followed by giving notice to all parties who may have a claim against the debtor.

Key Elements of the Creditor Matrix Template

When creating a creditor matrix template, certain key elements must be included to ensure its validity and comprehensiveness. Understanding these components is essential for anyone involved in bankruptcy or debt management.

- Header Section: Clearly label the document as a "Creditor Matrix" to avoid confusion.

- Creditor Information: Each entry must include the creditor's name, mailing address, and any additional contact details. It is crucial that this information is accurate and up-to-date.

- Debtor Information: The matrix should also contain the name of the debtor and any relevant case numbers, which helps link the creditors to the specific bankruptcy case.

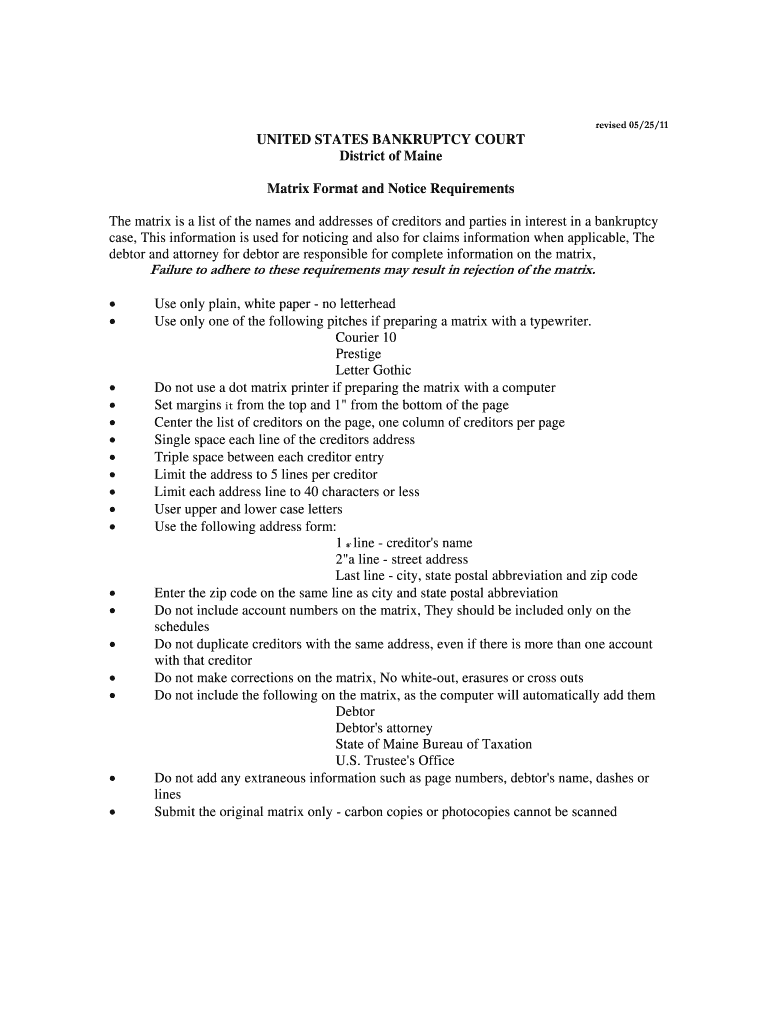

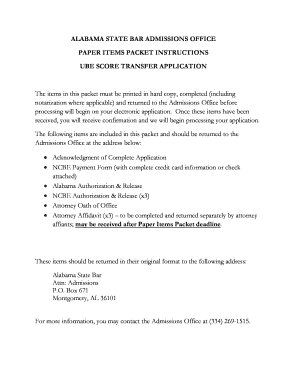

- Format Requirements: Adhere to any court-specific formatting guidelines, which may dictate font size, spacing, and overall layout.

Failure to include any of these elements can result in delays or issues during the bankruptcy process. Courts are stringent regarding the completeness and accuracy of files submitted.

Steps to Complete the Creditor Matrix Template

Filling out a creditor matrix template requires careful attention to detail. Below are prioritized steps to guide you through the process efficiently:

- Collect Creditor Information:

- Gather all necessary information for each creditor, including names, addresses, and account numbers. Cross-check with financial statements or previous correspondence.

- Utilize the Template:

- Download a standard creditor matrix template or create your own from a blank document, ensuring it follows the required format.

- Input Information:

- Using a spreadsheet application or word processor, input the gathered creditor data into the template systematically. Be accurate in spelling and formatting.

- Review for Completeness:

- Once filled, review the document carefully for any omissions or errors. Ensure that each creditor has been included and that the information is correct.

- Consult Legal Guidelines:

- If necessary, consult local bankruptcy court rules or guidelines for any specific requirements that may apply. Adjust the matrix accordingly.

Completing the creditor matrix correctly can significantly streamline the bankruptcy filing process, allowing for timely notifications to all creditors involved.

Legal Use of the Creditor Matrix Template

The legal implications of the creditor matrix template are paramount in bankruptcy proceedings. It acts as an official record filed with the court and ensures compliance with the requirements laid out under bankruptcy law, including the United States Bankruptcy Code.

- Filing Requirements: The creditor matrix must be filed with the bankruptcy petition to ensure that all parties are duly notified of the actions being taken.

- Legal Compliance: Adhering to local regulations regarding the format and content of the matrix is crucial, as failure to comply can result in penalties or delays in the case.

- Protecting Creditor Rights: Proper use of the creditor matrix safeguards the rights of creditors by ensuring they receive proper notice of bankruptcy proceedings, allowing them to file claims or take necessary legal action.

Understanding the legal foundations of the creditor matrix template is essential for debters and their legal counsel to ensure compliance and protection of all parties' rights.

Examples of Using the Creditor Matrix Template

Practical use cases illustrate how the creditor matrix template functions in real-life scenarios. Here are a few examples:

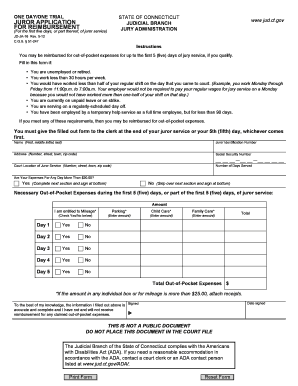

- Individual Bankruptcy Filing: An individual filing for Chapter 7 bankruptcy might list various personal creditors such as credit card companies, medical providers, and personal loan institutions. Each creditor's details must be carefully documented to ensure proper representation.

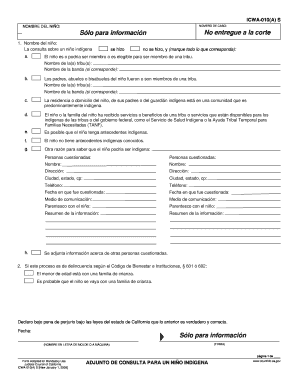

- Business Bankruptcy Case: A corporation may use a creditor matrix to highlight multiple vendors, suppliers, and lenders. This would include pertinent associations and their contact details, allowing all creditors to be informed about the bankruptcy proceedings.

- Contractor or Freelance Issues: A freelance contractor going through bankruptcy might use the matrix to file claims related to unpaid invoices from different clients. Each client would be listed with their specific address and outstanding contract details.

These examples demonstrate the flexibility and necessity of a well-constructed creditor matrix for various types of bankruptcy scenarios, ensuring that all creditors are adequately informed.

Important Terms Related to the Creditor Matrix Template

Familiarizing oneself with essential terminology related to the creditor matrix template can enhance understanding and compliance in bankruptcy scenarios:

- Debtor: An individual or entity that owes money to creditors and is filing for bankruptcy.

- Creditor: An individual or institution that is owed money by the debtor.

- Bankruptcy Filing: The legal process a debtor undergoes to seek relief from debts.

- Mailing Matrix: A term often used interchangeably with the creditor matrix; it emphasizes the role of the document in ensuring correct notifications.

- Chapter 7: A type of bankruptcy that allows for liquidation of assets to pay off creditors.

- Chapter 11: A bankruptcy option for businesses to restructure debts while continuing to operate.

Understanding these terms clarifies the roles and processes involved, making it easier to navigate the complexities of bankruptcy filings correctly.