Definition & Meaning

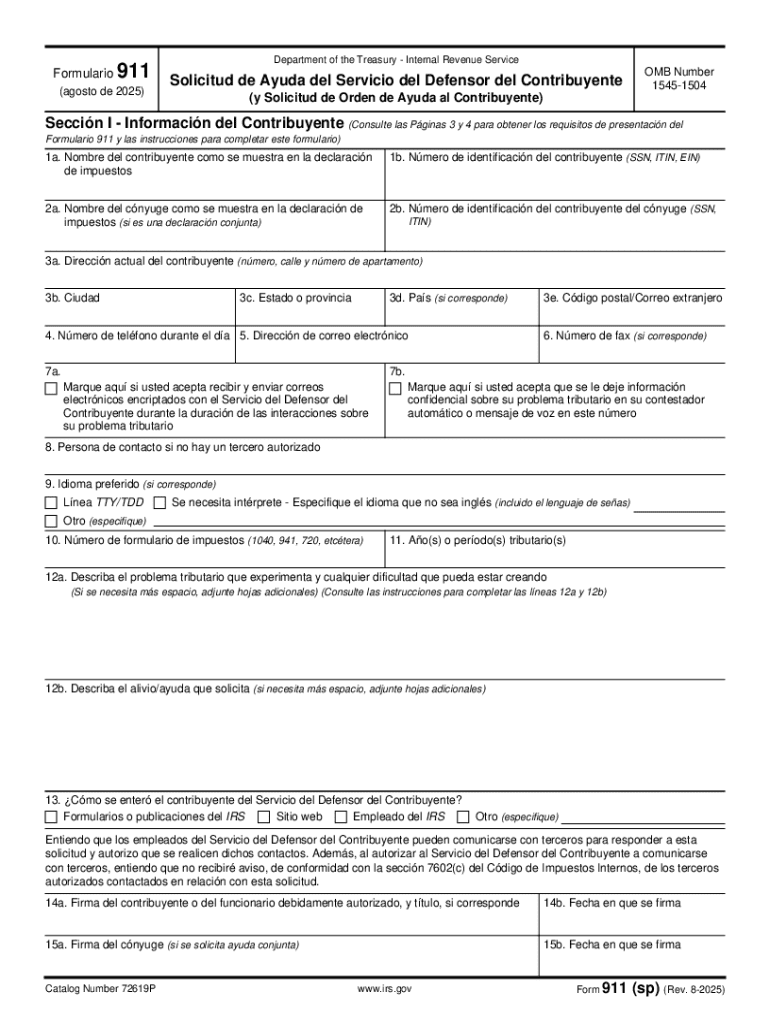

Form 911 (sp) (Rev 8-2025) is a crucial document used by taxpayers to request assistance from the Taxpayer Advocate Service (TAS). This form is designed to address situations where taxpayers face financial difficulties, unfair treatment, or delays from the IRS. The Taxpayer Advocate Service aims to help individuals resolve persistent IRS problems efficiently. This document is also applicable as an application for tax-related assistance, providing a dual function that makes it vital for those encountering IRS-related issues.

How to Use the Form 911 (sp) (Rev 8-2025)

To effectively use Form 911 (sp), taxpayers must thoroughly understand the process and the purpose behind it. The form assists in receiving advocacy for unresolved tax issues. Here are some practical steps:

- Identify the Problem: Clearly define your unresolved IRS issue or financial difficulty that necessitates TAS assistance.

- Fill Out Personal Information: Complete sections requiring details like name, address, Social Security Number, and tax identification numbers.

- Describe the Case: Elaborate on the nature of your problem with the IRS, including previous attempts to resolve it and any adverse effects due to delays or mismanagement.

- Submit the Form: Depending on your preference, submission can be through mail, fax, or directly via an online TAS case assistance portal.

Steps to Complete the Form 911 (sp) (Rev 8-2025)

Filling out the Form 911 (sp) accurately is imperative to ensure prompt assistance:

- Personal Information: Start with your complete name, address, telephone number, and email address. Verify these details before proceeding.

- Identification Numbers: Include your Social Security Number or Employer Identification Number, as applicable.

- Tax Periods Involved: Specify the tax years or periods related to your issue.

- Description of Problem: Provide a detailed account of the issue, including any previous communication with the IRS and how it has affected you financially or otherwise.

- Signature and Date: Ensure the form is signed and dated to authenticate your request.

Eligibility Criteria

Knowing whether you qualify for TAS assistance is important before submitting Form 911 (sp):

- Financial Hardship: If IRS actions or inaction creates a financial difficulty, you are eligible.

- Process or Procedure Issues: Eligibility extends to those experiencing long-standing issues caused by IRS systems or processes.

- Fair Treatment: Any taxpayer who feels mistreated by IRS personnel may apply.

- Inefficiency Concerns: If IRS processes delay your tax resolution without reason, TAS can intervene.

IRS Guidelines

IRS guidelines dictate how the Form 911 (sp) should be used and processed:

- TAS Authority: The TAS acts independently within the IRS, providing impartial dispute resolution services.

- Confidentiality Assurance: Communications with TAS are confidential, protecting sensitive information.

- Prompt Action Rule: TAS is required to act quickly, often within 30 days, to resolve taxpayer concerns.

Legal Use of the Form 911 (sp) (Rev 8-2025)

Using Form 911 (sp) has legal implications and benefits:

- Binding Cooperation: Submitting this form mandates IRS cooperation with TAS to resolve your issues.

- Legal Protection: Ensures that taxpayers are protected against unwarranted IRS actions during the resolution process.

- Audit Safeguard: Requesting TAS intervention does not increase your likelihood of being audited.

Important Terms Related to Form 911 (sp) (Rev 8-2025)

Understanding pertinent terminology assists in correct form utilization:

- TAS: Taxpayer Advocate Service, an independent organization within IRS for resolving taxpayer issues.

- Systemic Burden: Refers to obstacles impacting numerous taxpayers due to IRS system flaws.

- Economic Harm: Financial hardship faced by the taxpayer as a result of tax-related issues.

Submission Methods (Online / Mail / In-Person)

Different submission methods cater to convenience and preference:

- Online Submission: Use the new online platform for quicker processing and confirmation.

- Mail: Traditional mailing to an IRS office provides a physical record of submission.

- Fax: Offers a balance between speed and documentation.

Required Documents

Gathering the right paperwork enhances the application process:

- Proof of Identity: Submit with government-issued identification.

- Previous Correspondence: Include anything relevant from the IRS outlining issues or interactions.

- Financial Documentation: Evidence supporting claims of economic harm may be required for eligibility determination.