Definition & Meaning

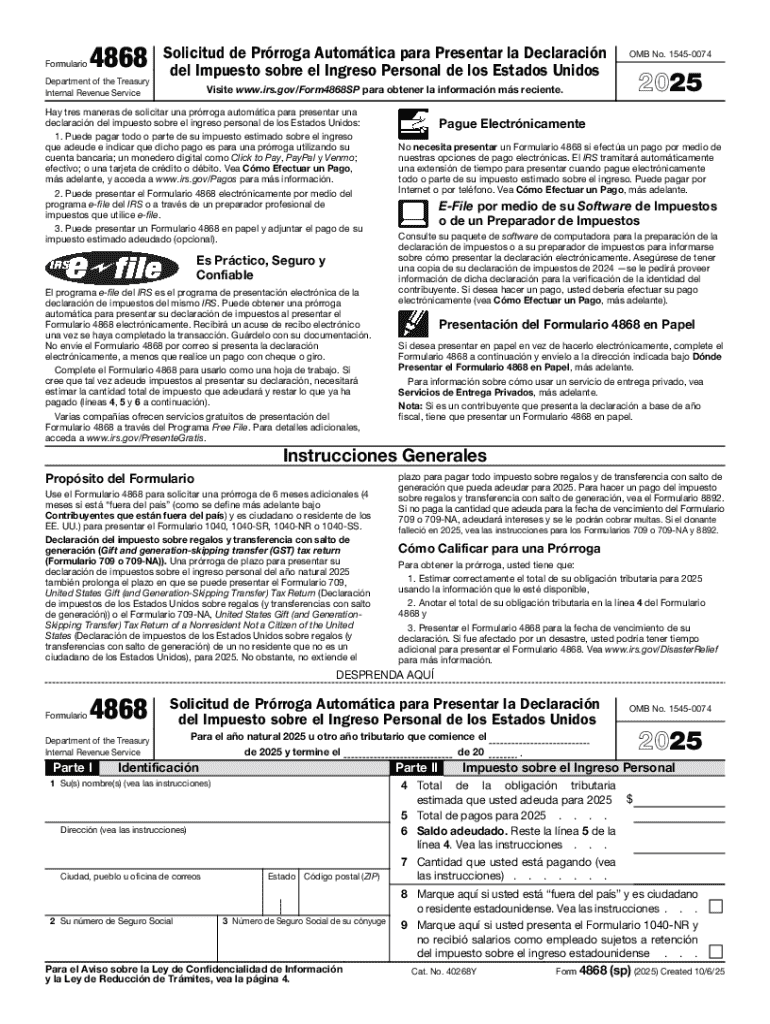

The 2025 Form 4868 (sp), formally known as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Re, is an official document provided by the Internal Revenue Service (IRS). This form allows taxpayers to request an extension for filing their individual income tax returns. It's crucial to understand that while this form extends the time to file taxes, it does not extend the time to pay any taxes owed. The standard extension period granted by Form 4868 is six months.

- Purpose: Primarily, Form 4868 provides taxpayers with additional time to accurately complete their tax returns without incurring any late filing penalties.

- Benefit: This form can be particularly helpful for those who require extra time to gather documentation or need an accountant’s assistance.

How to Use the 2025 Form 4868 (sp)

Using Form 4868 is a straightforward process designed to cater to the needs of individual taxpayers. To effectively utilize this tool, follow these steps:

- Estimate Your Tax Liability: Before filing the extension, you must estimate your total tax liability for the year. Subtract any estimated payments or credits to determine what is owed.

- Complete the Form: Fill out the form with your name, address, Social Security Number (SSN), and the calculated tax owed.

- Submit Payment: Pay any estimated taxes due by the original filing deadline, typically April 15.

- Online Submission: Use the IRS e-file service for a quick and secure submission.

- Mailing the Form: If opting for a paper submission, mail it to the appropriate IRS address for your state.

Steps to Complete the 2025 Form 4868 (sp)

Filing Form 4868 involves a few steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect details like your Social Security Number and estimated tax liability.

- Download the Form: Obtain the form from the IRS website or through a tax software platform like TurboTax.

- Fill Out the Form: Enter all required information accurately, including your estimated tax obligation.

- Review for Accuracy: Double-check your entries to prevent errors that could delay processing.

- Submit the Form: Choose either electronic filing or mailing based on your preference.

Key Considerations

- Accuracy: Ensure all information is current and accurate to avoid rejection or penalties.

- Confirmation: If filing electronically, retain an electronic confirmation receipt for your records.

Filing Deadlines / Important Dates

Understanding the timeline associated with Form 4868 is fundamental for timely submission.

- Initial Filing Deadline: Generally, the deadline aligns with the original tax filing date, typically April 15.

- Extended Filing Deadline: The extension grants a six-month period, moving the deadline to October 15.

- Estimated Tax Payment Due: Regardless of the extension, any owed taxes must be paid by the April deadline to avoid interest and penalties.

Variations in Deadlines

- Weekends and Holidays: If the deadline falls on a weekend or legal holiday, it is moved to the next business day.

- State Extensions: Some states automatically grant an extension when a federal extension is filed.

IRS Guidelines

The IRS provides specific guidelines for utilizing Form 4868, ensuring consistency and compliance across the taxpayer community.

- Eligibility: Available to all U.S. taxpayers who require more time to prepare their tax returns.

- Accuracy in Estimation: Taxpayers must make a reasonable estimate of their tax liability for the year.

- Penalty Avoidance: Ensuring that taxes are paid by the original deadline helps avoid interest and penalties.

Additional IRS Recommendations

- Electronic Filing: Strongly encouraged for ease and a higher chance of acceptance.

- Contact Information: Verify and update any contact details, such as a change of address.

Legal Use of the 2025 Form 4868 (sp)

When utilizing Form 4868, adherence to legal guidelines and requirements is mandatory.

- Tax Obligation: Form 4868 does not provide an extension for payment of taxes due.

- Validity: Only valid if an honest attempt is made to properly estimate the tax liability.

- Protection: Helps mitigate the risk of penalties associated with late filing, but not late payment.

Compliance Measures

- Record-Keeping: Maintain meticulous records of filings and related correspondence.

- Verification: Confirm receipt and processing status with the IRS if filing electronically.

Key Elements of the 2025 Form 4868 (sp)

Several critical components comprise Form 4868, each serving a distinct function.

- Personal Information: SSN, name, and address.

- Estimated Tax Liability: Estimations to evaluate any payment owed.

- Transferred Payments: Payments already made during the year which affect the estimated liability.

Form Fields and Instructions

- Signature Not Required: As an extension request, it does not require a taxpayer's signature.

- Instructions: Detailed instructions are available on the IRS website to guide taxpayers in accurately completing the form.

Penalties for Non-Compliance

Failing to comply with the guidelines associated with Form 4868 can lead to penalties that affect a taxpayer's financial standing.

- Late Payment Penalty: Charged on any taxes not paid by the original due date.

- Interest: Accrued daily on unpaid taxes and any late payment penalty assessed.

- Failure to File Penalty: If the extension is not filed and the return is late, this penalty is charged in addition to interest.

Avoiding Penalties

- Timely Payment: Ensuring the estimated tax is paid by April 15 avoids additional costs.

- Proper Estimation: Accurate estimation of tax liability is crucial to prevent underpayment penalties.