Definition & Meaning

Form 8050 (Rev December 2025) Direct Deposit of Tax Exempt or Government Entity Tax Refund is a financial document used to streamline the refund process for organizations classified under tax-exempt or government entities. It authorizes the direct deposit of refunds directly into an organization's bank account, thereby eliminating delays and potential errors associated with paper checks. This form is critical for ensuring a secure and efficient transfer of funds as processed by the Internal Revenue Service (IRS).

Purpose and Utility

- Designed to expedite the refund process for eligible entities.

- Reduces administrative burden and speeds up access to funds.

- Enhances security by transferring funds directly to bank accounts.

Who Should Use It

Entities qualifying for tax-exempt status or government-related tax refunds, such as:

- Non-profit organizations

- Government agencies

- Educational institutions

How to Use the Form 8050

Utilizing Form 8050 involves several key steps to ensure the proper and timely receipt of tax refunds. Understanding this process is crucial for eligible entities to effectively benefit from the IRS's direct deposit program.

Detailed Steps

-

Verify Eligibility:

- Confirm the entity qualifies for tax-exempt status or is an applicable government entity.

- Ensure any associated IRS forms, such as Form 990-PF, are correctly filled.

-

Financial Information:

- Collect essential bank details, including routing and bank account numbers.

- Verify monetary limits and conditions applicable to direct deposits.

-

Complete the Form:

- Use accurate and up-to-date financial information.

- Double-check for accuracy to prevent delays.

-

Attach to Required Tax Documents:

- Typically attached to the necessary tax returns like Form 990PF, 990T, etc.

-

Submit to IRS:

- Ensure it accompanies the main tax filing to avoid processing issues.

-

Retain a Copy:

- Keep a record for organizational audits and financial accountability.

Steps to Complete the Form 8050

Filling out the Form 8050 involves following structured steps to ensure compliance and accuracy in the documentation process.

Step-by-Step Process

-

Gather Required Documents:

- Documents reflecting tax-exempt status and relevant IRS forms.

-

Fill Out Entity Information:

- Enter the organization’s name, employer identification number (EIN), and contact details.

-

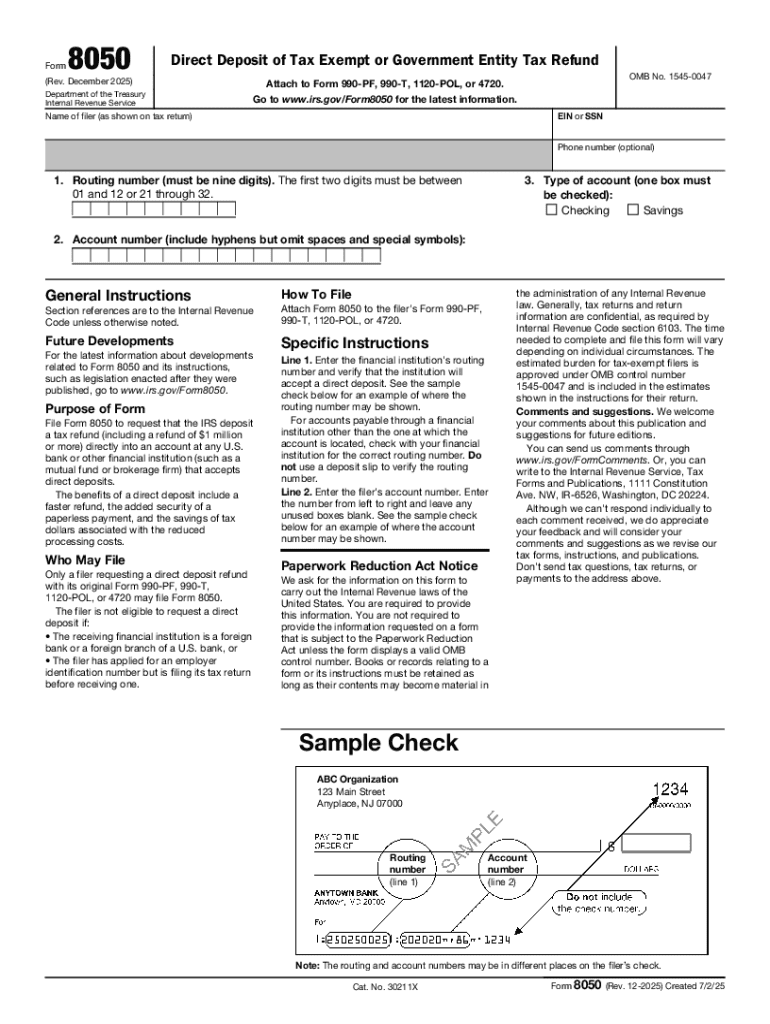

Bank Account Details:

- Input the bank’s routing number, type of account, and account number.

-

Review and Double-Check:

- Check each section for completeness and accuracy.

-

Date and Sign:

- Provide an authorized signature to validate the form submission.

-

File with IRS:

- Submit both electronically and physically, if requested, to ensure completeness.

Important Terms Related to Form 8050

Understanding the terminology associated with Form 8050 is vital for accurate completion and compliance.

Key Terms

- Direct Deposit: Electronic transfer of funds directly to a bank account.

- Tax-Exempt Status: A designation that avoids the imposition of federal income taxes.

- Routing Number: A unique banking code for financial transaction identification.

- EIN (Employer Identification Number): A federal tax identification requisite for organizations.

IRS Guidelines

Form 8050 operates under specific IRS guidelines, which are designed to ensure proper compliance and effective processing of tax refunds.

Essential Guidelines

- The formation of direct deposit requests must be precise and irrefutable.

- Incorrect or inaccurate information can lead to processing errors.

- The IRS may require additional documentation to authenticate eligibility.

Compliance and Verification

- Regular validation of the entity's tax-exempt status is necessary.

- Entitlement reviews performed by IRS for applied refund amounts.

Filing Deadlines / Important Dates

Timeliness in filing Form 8050 is crucial for uninterrupted access to tax refunds.

Key Filing Dates

- Align with the fiscal year's closure or the specific IRS tax calendar relevant to the organization.

- Ensure submissions meet specific IRS deadlines to avoid delays.

Timing Strategy

- Early preparation accommodates unforeseen administrative issues.

- Scheduling aligns with internal financial reviews.

Required Documents

The form mandates several supportive documents to verify and authenticate the direct deposit request.

Document Essentials

- Certified documentation of tax-exempt status.

- A validated bank account statement verifying ownership and account details.

- Corresponding completed IRS forms like Form 990PF or 990T.

Documentation Tips

- Keep digital copies for easier future access.

- Ensure consistency and coherence in documenting details across all forms submitted.

Digital vs. Paper Version

Comparison between electronic and paper submission of Form 8050 reveals advantages and challenges for each method.

Advantages of Digital Submission

- Faster processing times.

- Reduces potential for mailing discrepancies or loss.

- Easier mistake correction and document management.

Considerations for Paper Version

- Useful for entities with less digital infrastructure.

- May entail longer processing duration.

Integration with Tax Software

- Compatibility with platforms like TurboTax or QuickBooks enhances accuracy and efficiency.

- Check software for specific form support and any associated IRS updates.