Definition and Meaning of Overtime Pay Worksheet Answers

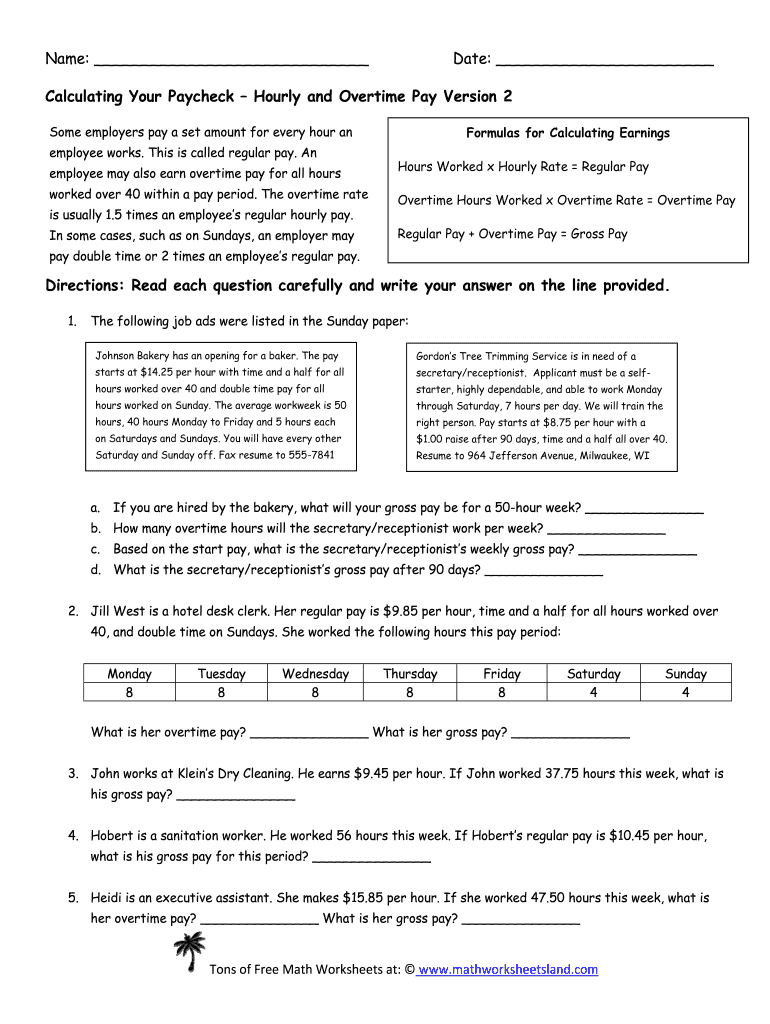

The overtime pay worksheet is a crucial document designed to help employers and employees understand how to calculate overtime compensation properly. Typically, it outlines the formulas used for determining both regular pay and overtime pay for hourly employees. The answers provided in the worksheet stem from specific computations based on the employee’s standard pay rate, the number of hours worked, and applicable overtime regulations.

- Regular pay: The standard wage an employee earns for their typical hours of work.

- Overtime pay: Compensation earned for hours worked beyond the standard 40 hours per week, usually calculated at one and a half times the regular hourly rate, also known as "time and a half."

- Gross pay: The total earnings before any deductions, which includes regular pay and any overtime pay.

Understanding these terms is fundamental to accurately completing a calculating overtime pay worksheet. The worksheet helps in clarifying how to apply the correct formulas based on the federal and state laws governing overtime pay.

How to Use the Calculating Overtime Pay Worksheet

Using the calculating overtime pay worksheet involves several key steps that guide users through the process of calculating both regular and overtime pay accurately.

-

Gather employee information:

- Collect details such as the employee’s hourly rate, total hours worked in a week, and specific overtime policies of the business.

-

Identify standard and overtime hours:

- Determine how many hours fall into regular time (usually up to 40 hours).

- Identify any hours worked beyond this threshold, which counts as overtime.

-

Apply relevant overtime rules:

- Use the worksheet to input the aforementioned data along with any necessary formulas to calculate the overtime pay, which is typically 1.5 times the regular hourly rate.

-

Document calculations:

- Ensure all calculations are recorded in the worksheet. This not only aids in payroll processing but also serves as a record in case of disputes or audits.

-

Review and verify:

- Double-check all entries to ensure accuracy before finalizing the payroll process.

Providing this structured approach helps users navigate complex calculations and ensures compliance with labor laws.

Steps to Complete the Calculating Overtime Pay Worksheet

Completing the calculating overtime pay worksheet involves systematic steps that ensure correct overtime calculations. Follow these steps for accurate results:

-

Input basic information:

- Begin by filling out basic employee details, such as their name, position, and hourly wage.

-

Log total hours worked:

- Accurately record the total hours worked for the week, distinguishing between regular and overtime hours.

-

Calculate regular pay:

- For the hours considered regular, simply multiply the total regular hours by the employee's hourly wage.

- Example: If an employee works 40 hours at $15 per hour, their regular pay is 40 x $15 = $600.

-

Calculate overtime pay:

- For overtime hours, multiply the number of overtime hours worked by one and a half times the regular hourly rate.

- Example: If the same employee worked 5 hours of overtime, their overtime pay would be 5 x ($15 x 1.5) = $112.50.

-

Sum gross earnings:

- Add the regular pay and overtime pay to calculate the gross pay for the week.

- Example: Regular pay ($600) + Overtime pay ($112.50) = Gross pay of $712.50.

Following these steps ensures that the calculations are thorough, compliant with labor regulations, and straightforward to process.

Important Terms Related to Calculating Overtime Pay Worksheet

Several essential terms must be understood for effective use of the calculating overtime pay worksheet. Key terms include:

- Fair Labor Standards Act (FLSA): The law that sets the standard for overtime pay, which requires employers to pay eligible employees time and a half for hours worked over 40 in a week.

- Exempt Employees: Certain employees exempted from overtime pay requirements, generally including salaried positions in specific industries or roles.

- Non-exempt Employees: Employees entitled to receive overtime pay as stipulated by the FLSA.

- Workweek: A fixed and regularly recurring period of 168 hours, which is equivalent to seven consecutive 24-hour periods.

Understanding these terms ensures clarity while filling out the overtime pay worksheet and helps maintain compliance with employment laws.

Examples of Using the Calculating Overtime Pay Worksheet

Practical examples can illuminate how the calculating overtime pay worksheet is applied in real-world situations. Consider the following scenarios:

-

Example One: An employee who works 45 hours in a week:

- Hourly rate: $20

- Regular hours: 40

- Overtime hours: 5

- Regular pay: 40 x $20 = $800

- Overtime pay: 5 x ($20 x 1.5) = $150

- Gross pay: $800 + $150 = $950

-

Example Two: An employee who works 50 hours in a week but is classified as an exempt employee:

- Hourly rate typically does not apply since they are not entitled to overtime based on the exemption classification.

These examples highlight the utility of the overtime pay worksheet in determining compensation based on varying hours worked and employment classifications, illustrating necessary calculations for accurate payroll practices.