Definition & Meaning

The beneficial ownership declaration format in Word serves as a formal document that enterprises use to disclose the identity of individuals who exercise significant control over the entity. This declaration is designed to enhance transparency regarding ownership structures and help financial institutions and regulatory bodies in evaluating risks related to money laundering or illicit financial activities. In this context, a beneficial owner is typically defined as a natural person who ultimately owns or controls more than twenty-five percent of the company or exercises significant influence over its management.

This declaration format is essential for ensuring compliance with various legal obligations, including the Bank Secrecy Act and the anti-money laundering regulations, which require entities to identify and verify the beneficial owners of their businesses. Utilizing this format helps maintain trust and integrity in financial transactions by making ownership information accessible to relevant stakeholders.

Key Elements of the Beneficial Ownership Declaration Format

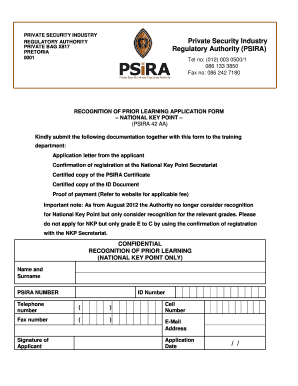

A beneficial ownership declaration format typically contains several critical components:

- Company Information: This section includes the legal name, registered address, and contact details of the entity submitting the declaration.

- Beneficial Owner Information: Details about each beneficial owner must be provided, including full name, date of birth, nationality, and details of ownership stake.

- Control Information: If applicable, this section will specify any individuals who exercise significant control over the company, even if they do not meet the ownership threshold.

- Declaration Statements: The entity must make legally binding statements affirming the accuracy of the information provided and the commitment to promptly inform changes in ownership.

- Signature and Verification: The declaration must be signed by an authorized official, often requiring verification by banking institutions.

These elements collectively ensure the document serves its purpose effectively by providing a clear and accurate account of the ownership structure within the organization.

Steps to Complete the Beneficial Ownership Declaration Format in Word

Following a structured methodology is crucial to ensure that the beneficial ownership declaration is completed accurately. Here’s a breakdown of the steps:

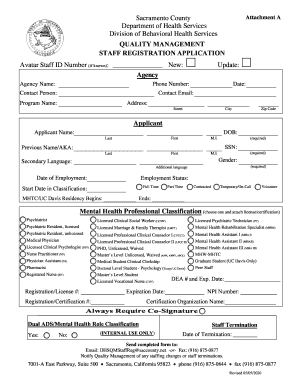

- Prepare Company Information: Gather essential details about the company, including its registered name, address, and registration number.

- Identify Beneficial Owners: Compile a list of individuals who own over twenty-five percent of the company, along with necessary personal details like their names and birthdates.

- Document Control Information: Note any other individuals with significant control even if they do not directly own a large percentage. This can include directors or senior officials.

- Complete Declaration Statements: Write clear statements affirming the truthfulness of the information and the obligation to provide updates if ownership changes.

- Signature: Ensure that the document is signed by an authorized representative of the company, which may need to be in accordance with specific corporate governance protocols.

- Review and Store Safely: Before submission, double-check all information for accuracy. Ensure that the finalized document is stored securely for future reference and compliance checks.

Each of these steps outlines an important aspect of the completion process and ensures that the necessary information is accurately represented in the declaration format.

Legal Use of the Beneficial Ownership Declaration Format

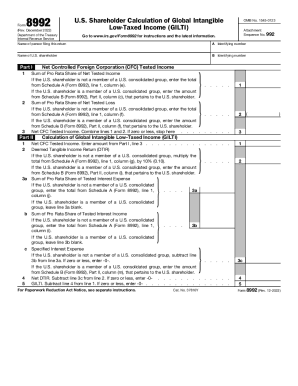

The legal implications surrounding the beneficial ownership declaration format are significant. By utilizing this document, companies can demonstrate compliance with various regulatory frameworks governing corporate transparency. Such frameworks include:

- The Bank Secrecy Act: Mandates the identification of beneficial owners for financial institutions, enhancing the detection of suspicious transactions.

- Anti-Money Laundering (AML) Laws: Require firms to establish and maintain procedures for the identification of beneficial owners to combat money laundering activities.

- State-Level Regulations: Various states may have their specific beneficial ownership disclosure requirements that necessitate the use of this format.

Failure to utilize this declaration properly can lead to severe legal consequences, including hefty fines and restrictions on business operations. Thus, it plays a pivotal role in ensuring legal compliance and fostering accountability within business practices.

Who Typically Uses the Beneficial Ownership Declaration Format in Word

The beneficial ownership declaration format is commonly utilized by:

- Corporations and LLCs: These entities often need to declare ownership and control structures to comply with state and federal requirements.

- Financial Institutions: Banks and lenders use this format to vet clients and assess risks as part of their due diligence processes.

- Regulatory Bodies: Government agencies use ownership declarations to monitor compliance with financial regulations and anti-money laundering laws.

- Accountants and Legal Professionals: These individuals assist businesses in preparing and filing the necessary forms, ensuring compliance with relevant regulations.

Understanding the primary users of this format underscores its importance in various sectors, particularly among entities involved in financial transactions and regulatory compliance.

Important Terms Related to Beneficial Ownership Declaration

Several essential terms are associated with the beneficial ownership declaration that may provide clarity and context:

- Beneficial Owner: A person who enjoys the benefits of ownership even though the title to the property or asset may be in another name.

- Ultimate Beneficial Owner (UBO): Refers to the individual who ultimately owns or controls an entity, which is crucial for transparency.

- Ownership Stake: The percentage of ownership held by a beneficial owner, often exceeding twenty-five percent to qualify for disclosure.

- Significant Control: This encompasses either a direct stake in ownership or indirect control through other means such as voting rights.

Acquainting oneself with these terms facilitates better comprehension of the declarations and their legal and regulatory implications.

Examples of Using the Beneficial Ownership Declaration Format in Word

Practical examples illustrate how the beneficial ownership declaration works in real-world applications:

- Bank Compliance: A financial institution may require this declaration from a new corporate client to assess risks and fulfill regulatory guidelines.

- Mergers and Acquisitions: During the due diligence process, companies involved in mergers may request beneficial ownership declarations from each party to understand potential conflicts of interest.

- Franchise Applications: Potential franchisees may be asked to complete this declaration to disclose control information as part of the franchise agreement process.

- Partnership Agreements: Partners in a joint venture may utilize this format to clarify ownership stakes and control dynamics, aiding in dispute resolution and maintaining transparency.

These examples highlight the versatility and necessity of the beneficial ownership declaration format in diverse business contexts.