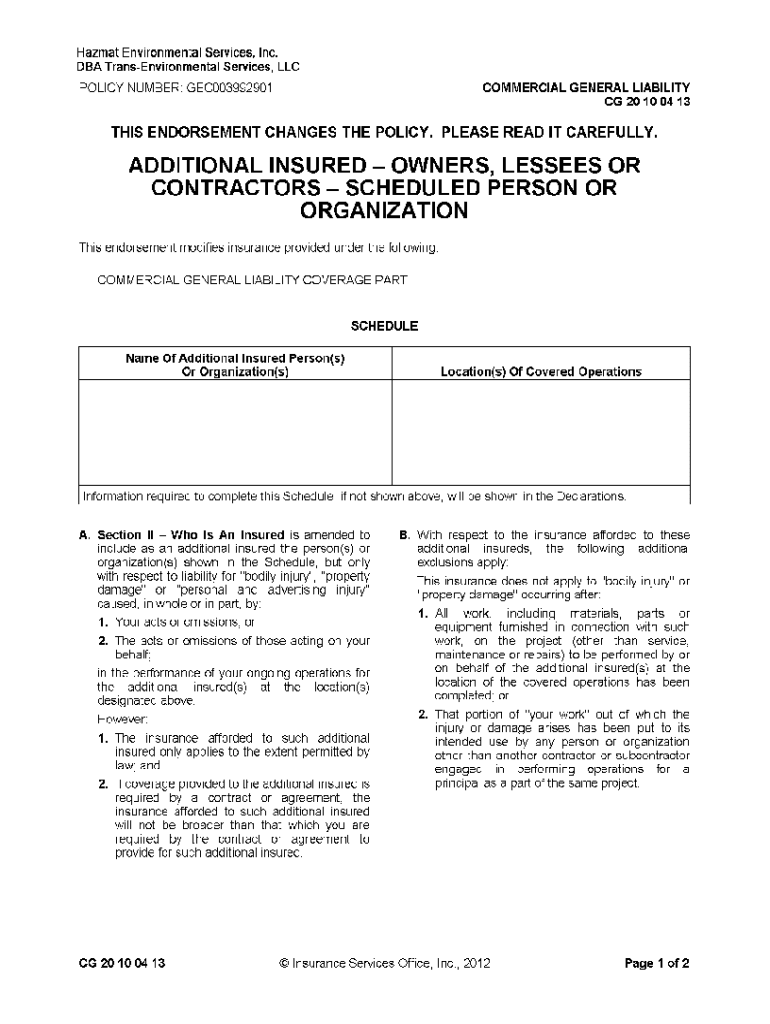

Definition & Meaning of cg20100413

The form cg20100413 refers to a specific document used in the realm of liability insurance, often related to organizations seeking coverage for bodily injury, property damage, or personal and advertising injury. It is essential for ensuring compliance with legal requirements and protecting entities against potential claims that may arise in the course of operations. Understanding this form is crucial for organizations as it outlines liability limits and coverage details that are critical in risk management strategies.

This form is commonly issued by insurance providers and must be accurately completed and submitted to maintain the coverage outlined in liability policies. It acts as an endorsement to insurance contracts, confirming the coverage nuances that apply to the entities named within.

How to Use the cg20100413 Form

Utilizing the cg20100413 form appropriately involves several steps to ensure it meets the legal and organizational requirements. The process typically includes:

- Obtain the Form: The cg20100413 can generally be obtained from your insurance provider or downloaded online, depending on the issuing authority.

- Fill Out Required Information: Complete necessary fields, which usually include the name of the organization, address, and details regarding the specific liability coverage being addressed. It is essential to be accurate as any discrepancies could affect coverage validity.

- Review Coverage Limits: Ensure that the limits specified align with what is required for your organization’s risk level. Understanding the coverage limits is vital for adequate protection.

- Sign the Form: After filling out the form, it must be signed by an authorized representative of the organization, confirming the information is accurate.

- Submit to Appropriate Parties: Once signed, send the form to the relevant stakeholders such as the insurance provider or any regulatory body that requires documentation.

Following these steps carefully ensures that an organization complies with the necessary legal frameworks while maintaining its liability coverage effectively.

Important Terms Related to cg20100413

Understanding the terminology associated with the cg20100413 form is crucial for effective communication and comprehension within the context of liability insurance. Important terms include:

- Bodily Injury: Refers to physical harm, illness, or impairment sustained by individuals due to negligence or mishaps.

- Property Damage: Encompasses damage to tangible property, which can occur as a result of the organization’s operations or actions.

- Personal and Advertising Injury: Refers to non-physical injuries that might occur from services, including defamation or invasion of privacy claims.

- Liability Limits: The maximum amount an insurance provider will pay for a covered loss. Knowing these limits aids organizations in understanding their coverage scope.

- Coverage Endorsement: A formal amendment to an insurance policy that modifies its terms or coverage. The cg20100413 serves as such an endorsement, affirming specific coverages.

Familiarity with these terms supports informed decision-making regarding liability insurance and the use of the cg20100413 form.

Key Elements of the cg20100413

The cg20100413 form consists of several critical components which define its functionality and purpose. Key elements include:

- Organizational Details: Section for entering specific information about the insured organization, which helps in identifying the coverage recipient.

- Coverage Description: This part details the nature of the coverage being purchased, including limits, conditions, and endorsements.

- Effective Dates: It specifies the date when the coverage begins and ends, ensuring clarity on the period of protection.

- Signature Area: This area is designated for the signing authority of the organization which validates the document's authenticity and acceptance of the terms outlined.

- Amendment Clauses: Provisions that may allow the form to be modified based on either party's agreement, ensuring flexibility within the insurance terms.

Each of these elements plays a vital role in establishing a comprehensive understanding of the insurance coverages in place, which is necessary for effective risk management.

Legal Use of the cg20100413

The legal implications surrounding the cg20100413 form mandate careful consideration during its completion and submission. Compliance with the guidelines set forth in this form is essential for maintaining valid insurance coverage. Key legal aspects include:

- Adherence to State Laws: The form must comply with relevant state legislation regarding liability coverage, which can vary significantly across jurisdictions.

- Contractual Obligations: Signing the cg20100413 signifies an acknowledgment of the liabilities covered and may have legal ramifications if misrepresented.

- Regulatory Compliance: Submission of the form to the appropriate entities is necessary for meeting any regulatory requirements associated with business operations.

Understanding these legalities reinforces the importance of the cg20100413 form within the broader context of liability insurance and risk management. Organizations must navigate these legal landscapes diligently to mitigate risks associated with their operations.

Examples of Using the cg20100413

Practical examples of utilizing the cg20100413 form can illustrate its application in various contexts:

- Example 1: A non-profit organization, while holding a fundraising event, fills out the cg20100413 form to secure liability coverage against potential injuries that may occur on the event premises.

- Example 2: A construction company completes the cg20100413 to ensure that their operations are covered against property damage claims arising from their work on client sites.

- Example 3: A marketing firm utilizes the form to protect against potential personal and advertising injury claims related to their promotional materials.

These examples showcase the versatility of the cg20100413 form across different industries and scenarios, emphasizing its significance in ensuring comprehensive liability protection.

Filing Deadlines / Important Dates

Being aware of critical deadlines is paramount to the effective use of the cg20100413 form. Typical timelines may include:

- Annual Submission: Organizations often need to submit the cg20100413 form annually or at policy renewal times to maintain up-to-date coverage.

- Event-Specific Deadlines: For organizations that engage in special events, filing the form well in advance (at least thirty days prior) is advisable to ensure coverage during the event.

- Change of Operations Notices: If there are significant changes in operations, such as expanding services or geographical reach, the cg20100413 should be filed immediately to reflect updated coverage needs.

Awareness of these timelines is crucial for sustaining legal compliance and ensuring ongoing protection against liabilities.

Form Submission Methods (Online / Mail / In-Person)

Submitting the cg20100413 form may vary based on the insurance provider and organizational preferences. The most common methods include:

- Online Submission: Many insurance companies offer digital portals that allow for the electronic completion and submission of the cg20100413 form, which enhances efficiency and tracking capabilities.

- Mail Submission: After completing the form, organizations can choose to send it via postal services directly to their insurer. It’s critical to verify mailing addresses to avoid misdirection.

- In-Person Submission: Some may prefer submitting the form in person, especially if there are questions or clarifications needed. This method allows for direct interaction with the insurer's representatives.

Choosing the appropriate submission method can help facilitate timely processing and ensure the form serves its intended purpose effectively.