Definition & Meaning

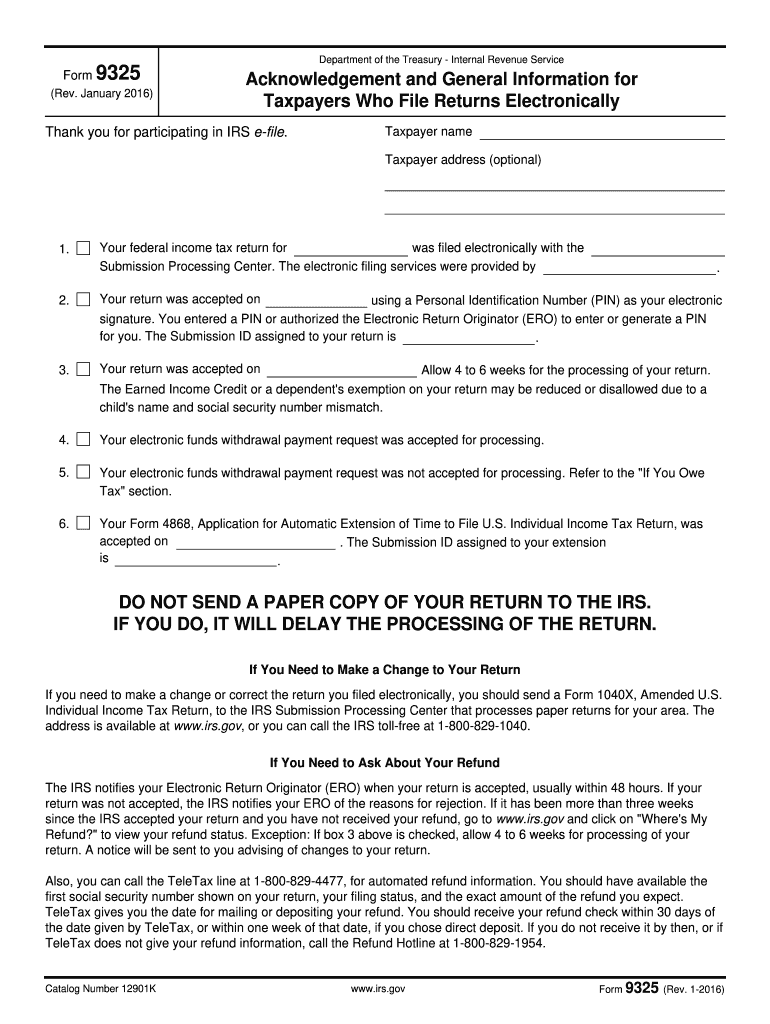

The "2016 Form Acknowledgement" refers to an acknowledgment form issued by the IRS for taxpayers who have filed their federal income tax returns electronically for the tax year 2016. This form provides essential confirmation that your tax return has been successfully received and accepted by the IRS. It includes crucial details regarding the acceptance of your return, any relevant payment processing information, and instructions on how to make changes or inquiries about refunds. Understanding this form is vital as it helps ensure that you have complied with all necessary procedures regarding your electronic tax filing.

Key Information:

- Confirms IRS receipt of your electronic tax return for 2016

- Includes details on tax return acceptance and payment processing

- Provides instructions for refund inquiries or changes to the return

How to Use the 2016 Form Acknowledgement

Utilizing the 2016 Form Acknowledgement involves several steps to ensure your tax submission process is smooth and secure. Upon receiving the form, review the details to confirm that your return has been accepted by the IRS. Use the form to track your payment processing and manage any potential discrepancies.

- Review Confirmation: Ensure that the IRS has accepted your tax return submission.

- Track Payments: Use the information on the form to monitor payment processing.

- Manage Discrepancies: In case of errors, follow the instructions for making corrections or inquiries regarding refunds.

How to Obtain the 2016 Form Acknowledgement

Obtaining the 2016 Form Acknowledgement is an essential step in the electronic tax filing process. When you electronically file your taxes, this acknowledgment form is typically provided through the tax software you are using.

- Via Tax Software: Most electronic filing applications, like TurboTax or TaxAct, will automatically generate the form once the IRS accepts your tax return.

- Directly from IRS: You can also contact the IRS for the acknowledgment if needed.

Steps to Complete the 2016 Form Acknowledgement

The process to complete the understanding and usage of the 2016 Form Acknowledgement involves several actions:

- Receive the Form: Ensure your electronic tax software sends you the form after submission.

- Verify Information: Check that all personal and financial information is correctly listed.

- Store Securely: Keep a digital and/or printed copy for your records as proof of acceptance.

Why You Should Use the 2016 Form Acknowledgement

Using the 2016 Form Acknowledgement is critical because it serves as the official record that the IRS has accepted your tax filing. This can be particularly important if you face any future discrepancies or audits. It verifies your compliance and allows you to avoid late filing penalties.

Important Terms Related to the 2016 Form Acknowledgement

Understanding the terminology associated with the 2016 Form Acknowledgement is crucial:

- Electronic Filing (e-filing): The process of submitting your tax returns to the IRS via the internet.

- Acceptance Status: Indicates whether the IRS has received and accepted your submitted tax return.

- Refund Inquiry Instructions: Guidelines provided for addressing any refund-related questions or issues.

IRS Guidelines

The IRS stipulates guidelines that govern the use and significance of the form:

- The form confirms the receipt and acceptance of electronically submitted tax documents.

- It instructs taxpayers on how to handle refund-related issues while ensuring no paper copies are sent to the IRS to avoid delays.

Filing Deadlines / Important Dates

While dealing with the 2016 Form Acknowledgement, awareness of deadlines is crucial. The typical deadline for filing electronic federal tax returns is usually April 15th of the following year (or the next business day if it falls on a weekend or holiday). Late submissions can lead to penalties or interest fines.