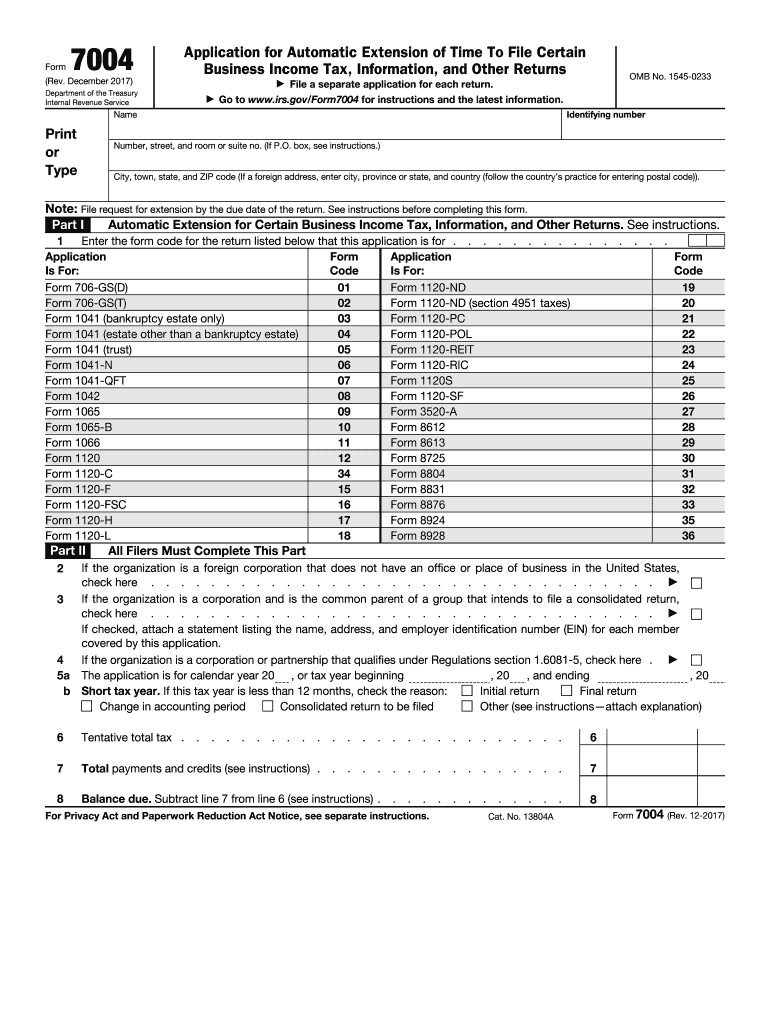

Definition & Meaning of Form 7004

Form 7004 is an application to request an automatic extension of time to file specific business income tax returns, information returns, and other returns required by the Internal Revenue Service (IRS). This form is essential for businesses that need additional time beyond the normal due date to prepare their tax filings. It applies to various business entities, including corporations, partnerships, and certain other organizations.

Purpose of Form 7004

The primary purpose of Form 7004 is to prevent late filing penalties. By filing this form, business owners can extend the deadline for submitting their tax returns without incurring additional fines, provided the form is submitted on time. However, it's crucial to understand that while this extension gives extra time to file the return, it does not extend the time to pay any taxes owed.

How to Use the 7 Form

Using Form 7004 involves several straightforward steps, ensuring that you adhere to IRS requirements for automatic extensions.

-

Determine Eligibility: Before using Form 7004, confirm that your business type is eligible. This form is typically used by corporations and partnerships.

-

Fill Out the Form: On Form 7004, enter your business name, address, and employer identification number (EIN). Additionally, indicate the type of return you are requesting to extend.

-

File the Form: Submit the completed form to the IRS by the original due date of your return. This can be done electronically or by mail. Ensure that you choose the correct filing method based on your preference and technical capability.

-

Await Confirmation: After submitting the form, you should receive confirmation from the IRS that your extension request has been accepted. This confirmation is essential for record-keeping purposes.

Filing Methods

- E-filing: Many tax preparation software programs support e-filing for Form 7004, allowing for instantaneous submission and confirmation.

- Mailing: If you choose to file by mail, send the form to the appropriate address listed on the IRS instructions for Form 7004.

Steps to Complete the 7 Form

Completing Form 7004 requires careful attention to detail to ensure compliance with IRS regulations.

-

Gather Required Information: Collect all necessary details about your business, including its legal name, address, and EIN.

-

Select the Appropriate Tax Return: Identify the specific tax return for which you are requesting an extension. This could include forms for C corporations, S corporations, or partnerships.

-

Complete the Form Fields: Fill in the required fields accurately. Each section has clear instructions indicating what information is necessary.

-

Review for Accuracy: Double-check all entries to ensure they reflect current and correct information.

-

Submit the Form on Time: Ensure Form 7004 is submitted on its due date to avoid penalties. Extensions must generally be filed by the original due date of the tax return.

Key Sections to Complete

- Business identification details

- Type of return for which the extension is requested

- Signature and date of the person authorized to sign on behalf of the business

Important Terms Related to Form 7004

Understanding specific terms related to Form 7004 is crucial for effective use:

- Automatic Extension: A period granted by the IRS allowing businesses additional time to file their tax returns without penalty.

- Employer Identification Number (EIN): A unique identifier assigned by the IRS for tax reporting purposes.

- Tax Return: The formal financial reports filed with the IRS to disclose income, expenses, and tax liability.

IRS Guidelines for Form 7004

The IRS provides specific guidelines that detail how to properly utilize Form 7004.

- Submission Deadline: Form 7004 should be submitted by the original due date of the return being extended. Late submissions may incur penalties.

- Filing Frequency: Businesses must file a Form 7004 each year they require an extension on their tax returns.

- Prohibited Behaviors: Misuse of the form, such as using it for more than one extension per tax year, can result in penalties.

Additional IRS Instructions

- The IRS emphasizes that the extension allows for additional time to file, not to pay any taxes owed. Pre-estimation of tax payments is still necessary to avoid penalties.

- Businesses are encouraged to keep a copy of the submitted form and any confirmations received from the IRS for their records.

Filing Deadlines for Form 7004

Timely submission of Form 7004 is critical to avoid penalties related to late filing.

-

Normal Filing Deadline: Form 7004 must be filed by the original due date of the tax return. For most corporations, this falls on the 15th day of the third month following the close of the taxable year.

-

Extended Filing Period: Upon successful submission, businesses may receive an extension of up to six months to file their tax returns, allowing for more comprehensive financial preparation.

Examples of Filing Situations

- A C corporation with a tax year ending on December 31 would need to file Form 7004 by March 15 of the following year to obtain a six-month extension.

- A partnership with a tax year ending on March 31 must submit Form 7004 by June 15 to request an extension.

These examples illustrate the need for businesses to keep track of their specific tax deadlines and maintain compliance with IRS regulations regarding filing and payment obligations.